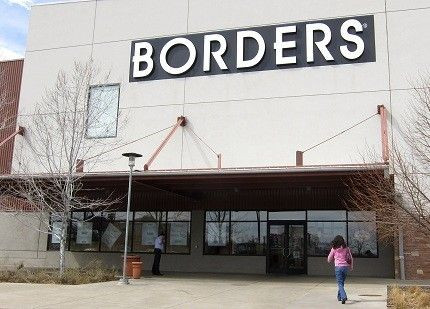

As Borders Moves Ahead With Sale, Premature To Say Whether More Stores Could Close

If a bankruptcy court approves, Borders Group Inc., the nation's second-largest bookstore chain, will be owned by a direct marketer before the end of the month.

Borders Group announced that it has agreed to sell itself to Direct Brands -- whose properties include the Book of the Month Club, Doubleday Book Club, and BMG Music Service -- for $215.1 million, plus the assumption of about $220 million worth of liabilities.

Borders, which entered bankruptcy in February, said the sale provides the best path forward to reposition the business for a successful future. It expects the tentative purchase agreement with Direct Brands -- a portfolio company of the Phoenix investment firm Najafi Companies -- to take place before a hearing in bankruptcy court in New York July 21.

Meantime, more of Borders' stores could be headed for the books, as the retailer bleeds cash and works to restructure and reorient itself for the digital, e-book age.

Borders said that Direct Brands would purchase substantially all of its assets -- and that under their agreement two other companies, Hilco and Gordon Brothers, have agreed to acquire any store locations that are ultimately not included in the sale and will close those stores in an orderly manner.

It's premature to speculate about which stores may or may not be impacted by the sale process, Borders spokeswoman Mary Davis told the International Business Times when asked how many stores would be closed.

She said in an email that Borders operates just over 400 stores. It had 642 when it went into bankruptcy Feb. 16.

The company reported recently that it lost $18.1 million in its business operations for a period covering nearly all of May, and told the U.S. Bankruptcy Court for the Southern District of New York that it has $714.3 million in assets and liabilities.

Borders said it chose Direct Brands' stalking horse bid. The term refers to a bidder selected by a bankrupt company from a pool of potential buyers to make the first bid for its assets. Private equity investor Alec Gores was also seeking to buy Borders.

The company had until today to secure an opening bid for its assets before an auction scheduled for July 19, and any sale must be wrapped up by July 29, according to Reuters.

Borders said its day-to-day operations will continue as usual during the sale process, including its rewards program and its gift cards.

Borders Group President Mike Edwards portrayed the deal with Direct Brands as another important step forward as we position Borders for a vibrant future and sustainable earnings growth.

Since its bankruptcy filing, the company has made significant progress in reducing our cost structure, refocusing our merchandise offering, and building our e-book business, he emphasized in a press release. We look forward to working with a supportive partner as we continue to execute on our turnaround strategy.

Borders has revamped its kids offering and its Borders Cafe, and says it is capturing a larger share of the e-book market through an expanded partnership with Kobo.

Davis said the new Kobo eReader Touch Edition is now available in most of Borders' stores.

Reuters and the IBTimes staff contributed to this report.

Edward B. Colby is the Books editor of the International Business Times. He can be reached at e.colby@ibtimes.com.

© Copyright IBTimes 2025. All rights reserved.