Coronavirus Economy: Americans Spent More Last Month -- Even Though They Earned Less

KEY POINTS

- Overall personal consumption expenditures were up 8.2% while personal savings fell 10 points to 23.2%

- Spending for goods increased $590.4 billion while spending for services increased $363.8 billion

- Personal income fell $874.2 billion or 4.2%

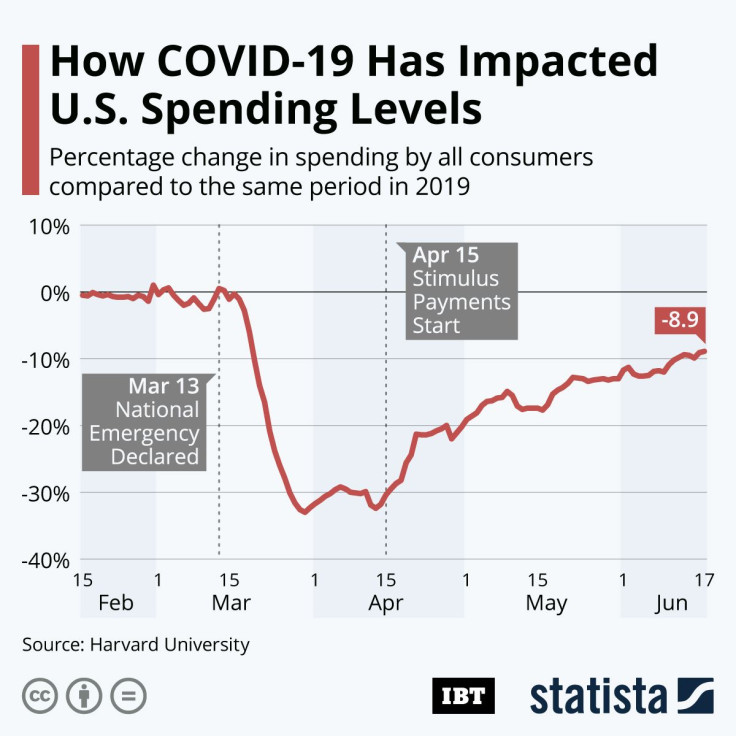

Americans had less income last month but they spent more amid the coronavirus pandemic, the Bureau of Economic Analysis reported Friday. BEA said income fell 4.2% while personal consumption expenditures rose 8.2% and personal savings fell 10 points from April’s record to 23.2%.

Real consumer spending was up 8.1% from April.

“While 8.1% rebound in real consumer spending was largest ever, level of spending is 11% below February with major shortfalls [in] spending on clothing, healthcare, recreation, food services and accommodation, and autos,” Gregory Daco, chief U.S. economist at Oxford Economics, said in a tweet. He said consumers, however, still are fearful of spending.

“Spending rebounded as lockdowns were lifted but at a price: a resurgence in infections. That has already blunted the economic rebound in June, with people pulling back from spending in hotspots,” Grant Thornton chief economist Diane Swonk said in an analysis.

“Gains in consumer spending will likely remain much more regionalized and stronger in places where health officials were able to bend the curve on infections. The outlook is contingent upon the places that are doing better staying that way.”

BEA said personal income fell $874.2 billion while disposable income fell $911.1 billion or 4.9%. At the same time, spending increased $994.5 billion. Spending for goods increased $590.4 billion while spending for services increased $363.8 billion. Spending on motor vehicles and parts as well as recreational goods and vehicles led the way in goods purchases while healthcare, food services and accommodations led services spending.

BEA said a decrease in direct payments from the federal government to taxpayers was partially offset by increased unemployment insurance benefits.

“While the rebound in employment in May led to a moderate $260 billion (annualized) bounce-back in compensation, the fact that the one-time stimulus checks weren't renewed meant a loss of $2 trillion in transfers partially offset by $825 in UI [unemployment] benefits,” Daco said.

© Copyright IBTimes 2025. All rights reserved.