Cryptocurrency Lending Seeing Growth, Fueled By Shadow Banks: Analyst

KEY POINTS

- Analyst Ryan Anderson: Crypto lending appears to be at least a $5bn market today

- The transformation of modern lending markets has contributed to the entrance of new lenders

- The business of crypto lending is a mix of transaction patterns that could not be combined earlie

Crypto lending is growing at a fast clip as modern lending markets get transformed with the spread of “shadow banks” in the East and the evolution of “direct lenders” in the West.

Credmark, a cryptocurrency credit bureau in Singapore, said that the crypto-lending market was at $8 billion in total lifetime loan originations as of the last quarter of 2019. The market size is reported to have increased considerably thereafter, and now exceeds $10 billion in total loan originations.

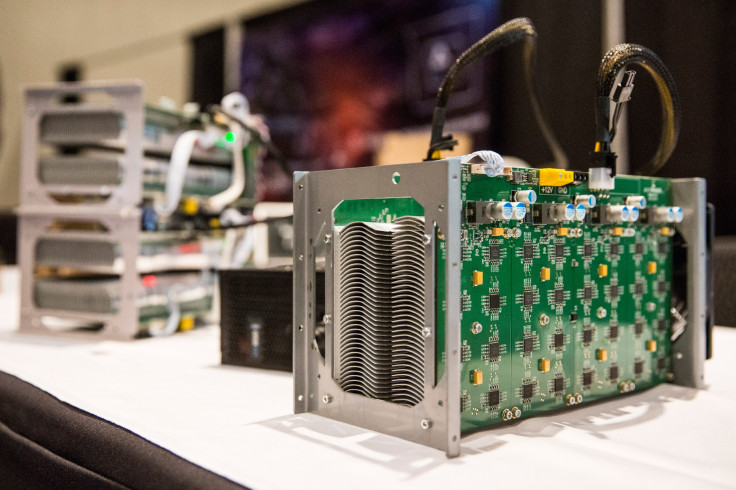

Crypto-lending refers to lending digital assets through cryptocurrency exchanges or lending sites.

Speaking to International Business Times, Ryan Anderson, Head of Trading at investment management firm Wave Financial Group, said, “The evolution of shadow banking and direct lending paved the way, intellectually at least, for all sorts of banking transactions to be moved out of the traditional banking house.”

Shadow banks refer to lenders that operate outside the domain of the regulated banking space, unlike traditional banks and other financial institutions. These are non-depository banks and generally serve as intermediaries between investors and borrowers. The U.S. is the largest shadow banking market, followed by the U.K. and China.

People’s Bank of China (PBC) and Insurance Regulatory Commission (CIRC) in China are shadow banks. Bear Stearns and Lehman Brothers, whose bankruptcy precipitated the global financial crisis in 2008, were also shadow banks.

Shadow banking is expected to fill the lending gap created by the troubles faced by traditional lenders following the COVID-19 pandemic, says a report in the Wall Street Journal.

In a note titled "The Brave New World of Generating Yield Returns from Crypto Lending," Anderson said that the shift out of the traditional lending realm has triggered the growth of crypto-lending. “When direct lenders started to offer businesses more expansive terms of credit in the recovery following 2008 and banking houses stayed on the side lines, it opened up the possibilities for how lending and borrowing could evolve, going forward,” he told the International Business Times.

Speaking about the size of the cypto-lending market today, Anderson said. "Combining figures from the largest players like Genesis, Celsius and BlockFi, as well as considering contributions from decentralized finance apps, crypto-lending appears to be at least a $5 billion market today. To compare, the volume of Bitcoin futures —financial instruments that allow investors to gain exposure to Bitcoin without having to hold the underlying cryptocurrency traded across the biggest exchanges totals about $5 billion daily.”

Transactions vary from those involving the borrowing of cash with crypto-collateral, the lending of both cash and crypto-currencies as an investment, and borrowing crypto-currencies against other crypto-currencies.

“Cryptocurrency lenders who saw the path of evolution early on attempted to do largely the same thing—cryptocurrency lending—and with great success,” said Anderson. New York-based Genesis Capital, one of the biggest bitcoin lenders serving institutional clients, said that in the first quarter of 2020, active loans were up ~20% from the previous quarter, reported Forbes.

Coinbase, one of the largest cryptocurrency exchanges in the U.S., has announced its intention to get into the lending business. It plans to allow U.S. retail customers to borrow fiat loans up to 30% of their bitcoin holdings in the fall. “Customers may use bitcoin-backed loans in different ways depending on their financial needs,” said Max Branzburg, head of product at Coinbase, in an article on the Nasdaq website.

Anderson is upbeat about the future prospects of crypto-lending, and believes it is sure to expand going forward. “As long as people want to trade cryptocurrencies, lending will be around. The existence of a deep and liquid lending market is intimately connected to the smooth operation of derivatives markets like those for futures and options, and as those gain in popularity, lending will grow as well,” he said.

He added that even if trading somehow becomes less popular, crypto-rich players will look to find alternative investments for their capital, which will spur creative development in lending and other areas.

In the U.S., cryptocurrencies are not considered legal tender. However, cryptocurrency exchanges are legal, though regulations vary in different states. Data from the Law Library—the world’s largest law library in Washington, D.C..—shows that the legalities or restrictions regarding cryptocurrencies vary across geographies.

© Copyright IBTimes 2025. All rights reserved.