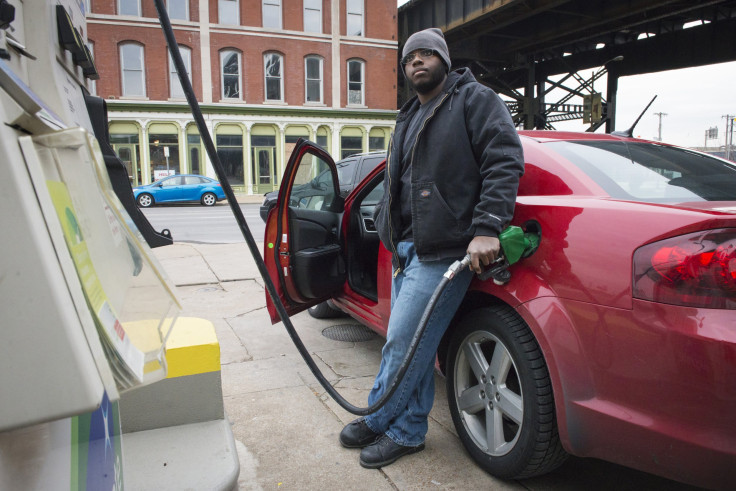

Falling Gas Prices Put Pressure On Congress To Hike Federal Fuel Tax

As U.S. gasoline prices slip below $2 a gallon this month, one cost is holding flat: the federal motor fuel tax, which hasn’t budged in more than two decades. But now that Americans are saving big at the pump, transportation analysts say the time is right to raise the tax to help repair crumbling roads and bridges.

“We have that [political] luxury now,” says Carl Larry, a director for Frost & Sullivan’s oil and gas consulting arm in Houston. He says raising federal fuel taxes “is going to be an enormous boost to every state and obviously America.”

Debate over the gas tax is picking up in Washington as policymakers prepare to hammer out a federal transportation bill before May 31, when funding will run out. Tax-hike proponents say that raising gas and diesel fees could help cover some of the $100 billion in additional revenues needed to fund the six-year transportation plan shortfall. They add that lower fuel prices should give lawmakers political cover to lift the tax above 18.4 cents per gallon of gasoline and 24.4 cents for diesel — the prices set by Congress in 1993.

“Given the recent huge drop in the price of gasoline, this is an opportune time to increase this tax without undue burden to the users,” says Michael Sivak of the University of Michigan’s Transportation Research Institute.

Since the federal tax is a flat per-gallon fee — not a percentage of total sales — the drop in gas prices won’t reduce the amount of money the government earns from fuel taxes. In fact, tax revenues could rise in 2015 as Americans guzzle more gallons of cheap gas. Gas consumption will likely rise by 1.1 percent this year over 2014 figures due to increased highway travel, the U.S. Energy Information Administration projected this week.

However, any boost in gas tax income would be tiny compared to the shortfall in federal transportation funding. Fuel fees bring in about $35 billion a year for the federal Highway Trust Fund, which helps states repair roads and bridges and develop mass transit networks. But the government spends about $50 billion each year through the highway fund, forcing legislators to shuffle money from other parts of the budget. If the taxes aren’t raised, the fund’s costs could outpace revenues by more than $160 billion in the next decade, by some estimates.

Proponents say gas taxes should be around 10 to 15 cents higher today to reflect the rise in inflation in the 22 years since the policy was first adopted.

“We have a crumbling infrastructure system, we have roads that are becoming increasingly congested,” says Avery Ash, director of federal affairs for AAA, a national auto club. “Let’s put the Highway Trust Fund back on firm footing and ensure that states and municipalities who rely on federal funding have a stable funding source.”

AAA and other transportation groups have pushed for years to increase taxes on motor fuels as a means of raising federal infrastructure funding. Governors in cash-strapped states also have called on Congress to tax more at the pump, and they’re pushing for higher state taxes as well. Leaders in nearly a dozen states are mulling tax proposals, while Pennsylvania, Maryland, New Hampshire and Wyoming all adopted measures in the last two years, NPR reported in December.

Michigan Gov. Rick Snyder, a Republican, is urging state legislators to roughly double Michigan’s gas tax over time to raise more than $1 billion. “The money I’m talking about is to get us fair to good roads. They’re not even going to be great roads, folks. We can’t afford to have great roads in this state given what we need to invest,” Snyder said after touring a crumbling retaining wall in Detroit, NPR reported.

Yet Congressional policymakers have so far resisted efforts to raise taxes on gas and diesel. The U.S. House and Senate are floating two gas-tax bills, but neither is likely to pass. “I don’t know of any support for a gas tax increase in Congress,” Sen. John Cornyn, R-Texas, told the Associated Press. Sen. John McCain, R-Ariz., explained: “They don’t want to vote for a tax increase.”

U.S. President Barack Obama’s own transportation spending plan avoids the gas-tax hike. Instead, the president proposes to close corporate tax loopholes and use the increased revenue to pay for infrastructure projects. The plan would raise highway spending by 22 percent and transit spending by 70 percent over four years. The loophole plan is still Obama’s preferred option, Transportation Secretary Anthony Foxx told a conference this week, though he said the administration remains open “to ideas that emerge from Congress,” the AP noted.

Larry of Frost & Sullivan says he believes the gas tax "will probably be inevitable" given the massive gap in federal transportation spending. "Not only is a sales tax a benefit, it's a necessity," he says. "Raising the [fuel] tax is something that could be done, should be done and will be done."

© Copyright IBTimes 2025. All rights reserved.