Gold Miners Face High Hurdle As Production Costs Top Spot Prices For Many

This story was updated on September 30, 2013 at 5:17pm.

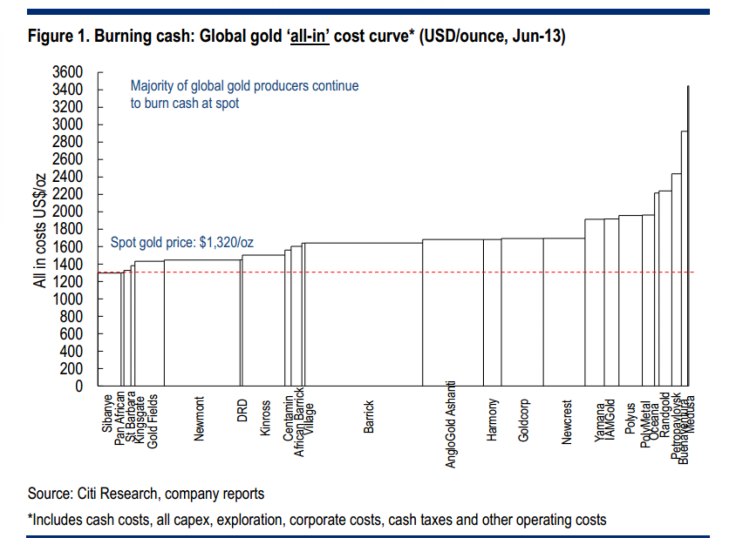

Gold mining companies worldwide haven’t made ends meet after gold prices plunged dramatically this year, meaning that 98 percent of the industry bear production costs matching or exceeding gold’s sale price.

The conclusion that the industry is “burning cash” at spot gold prices of $1320/oz comes from a Citigroup Inc. research note, emailed out on Monday.

“Gold companies have continued to cut capex, exploration, and corporate costs in order to make ends meet in a lower gold price environment,” wrote the Citi analysts. “Despite these cuts, we estimate that most of the global gold cost curve is burning cash at spot levels.”

“We think further cuts are likely over the next 6-12 months as companies try to adjust to a lower gold price environment.”

Gold companies spent hugely on new capital projects and exploration over the past decade, as gold prices rose reliably each year, reaching an all-time high in April 2011. But that strategy is no longer sustainable, Citi argued in an earlier industry update.

Even though gold miners will sell assets, slash capital budgets and explore less, these corrective actions don’t necessarily mean they’ll be free and clear in the near future, wrote the analysts.

That’s because cutting costs is a “double-edged sword”, they said.

Gold companies actually need to spend more on capital costs – dubbed ‘capex’ in the jargon – to fight faltering production. Cutting capex will result in a fall in production, which will mean per unit costs, the cost of producing one ounce of gold, will rise.

Citi data showed that even though global gold capex rose tenfold in the past 12 years, production still fell by five percent, with unit costs rising 16 percent annually. Per unit costs would have risen dramatically faster if capital spending were less, too, they noted.

“Whether or not capex is cut, we see both scenarios as bad for shareholders,” read the note. “There seems to be no easy way out.”

The world’s biggest gold miner, Barrick Gold Corp. (TSE:ABX) has sold several gold mines this year and slimmed its asset portfolio, to beat back cost overruns and poor gold markets.

In a recent investor presentation at the Denver Gold Forum, however, Barrick pegged its all-in sustaining costs at $900 -$975/oz for 2013, much lower than Citi’s estimate of all-in costs of about $1600/oz for the company.

That’s because all-in sustaining costs, which Barrick discloses, are a significantly lower measure than all-in costs, which include irregular one-off costs, according to standards promoted by the World Gold Council earlier this summer.

With the council’s new ‘all-in’ cost metric, many gold companies are expected to show losses at current spot gold prices, according to industry executives.

Citi analyst Johann Steyn, who co-wrote the report, told International Business Times in an email that their breakdown for Barrick included $3 billion in capitalised interest and $1 billiion in cash taxes, which Barrick's analysis may not have included. Representatives for Barrick didn't return a request for comment. He put Barrick's total capex alone at $810/oz.

The gold mining industry also faces heavy impairment charges, debt burdens and uncertainty over U.S. monetary policy.

Citi has been consistently bearish on the gold mining sector in the past few months.

© Copyright IBTimes 2025. All rights reserved.