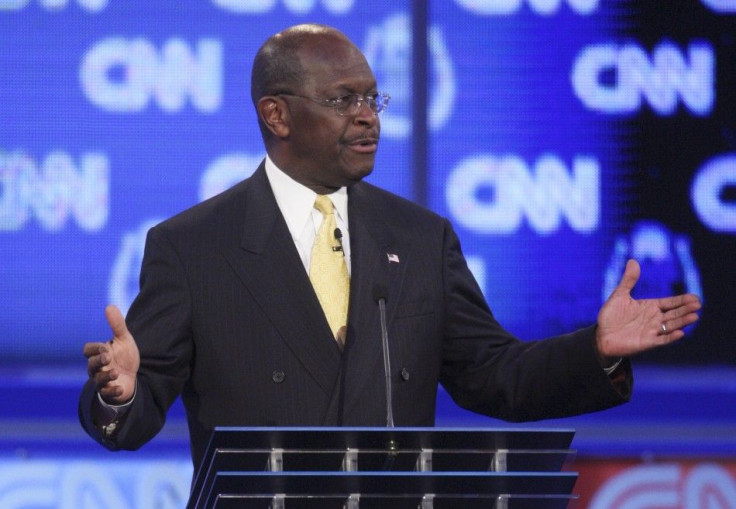

Herman Cain Says '9-9-9' Plan Is 'Misrepresented' - but How?

Opinion

Herman Cain's 9-9-9 plan has encountered a relentless volley of criticism from Democrats and Republicans alike since he surged ahead in the polls last month, and his rebuttal is always the same: the critics are misrepresenting his proposals.

What he doesn't say is how.

At the Republican candidates' debate in Las Vegas, Nev. on Tuesday, for example, several of Cain's opponents cited a study by the nonpartisan Tax Policy Center that found that 84 percent of Americans would pay higher taxes under the 9-9-9 plan than they do under the current tax code.

In response, Cain directed viewers to his Web site, where he said they would find a PDF of an analysis from Fiscal Associates detailing how the 9-9-9 plan would work. The claims that the plan would decrease overall tax revenue and increase taxes on the poorest Americans are simply not true, he said. The reason that my plan is being attacked so much is because lobbyists, accountants, politicians, they don't want to throw out the current tax code and put in something that's simple and fair.

9-9-9 Tax Plan Comprehensive Analysis: Where Is It? And Where Are Cain's Analysts?

When moderator Anderson Cooper pressed him on the 84 percent statistic, Cain repeated that it was simply not true. I invite people to look at our analysis, which we make available... and I invite every American to do their own math, because most of these are knee-jerk reactions.

But the facts of the 9-9-9 plan are not nearly as transparent as Cain claims. The Fiscal Associates report he referenced was not actually available on his Web site until midway through the debate, so his critics couldn't have looked at it beforehand.

Cain is fond of saying that the media should contact my people before printing criticisms of the 9-9-9 plan -- but that, too, is rather easier said than done, as the press contact form on his Web site does not work. Reporters get an error notice that says, Failed to send your message. Please try later or contact administrator by other way, and there is no e-mail address or phone number listed anywhere on the Web site. A general contact form does work, but his campaign did not respond to a request for comment sent that way.

Revenue Neutral Does Not Mean no Tax Hike for Lower-Income Americans

More substantively, the Fiscal Associates report only shows that the 9-9-9 plan is revenue-neutral -- it doesn't look at whether it would increase taxes for the average American, which is what the Tax Policy Center concluded. Calling the 84 percent statistic simply not true does not qualify as addressing the criticism -- that's just a denial with no proof.

(Funnily enough, the experts at the Tax Policy Center actually tried to contact Cain's economic adviser for confirmation that we were interpreting their plan correctly, but they received no response. If that is true, Cain really has no right to complain that his plan is being misinterpreted.)

For all his talk about transparent methodologies, Cain does not seem to be providing his own when it comes to the key issue of whether the 9-9-9 plan will increase taxes. He can deny the Tax Policy Center's numbers until the the cows come home, but it is all obfuscation until he provides numbers of his own.

Contact Maggie Astor at m.astor@ibtimes.com.

© Copyright IBTimes 2025. All rights reserved.