IBM's Mainframe Sales Crashed. That’s Normal.

One reason IBM (NYSE:IBM) suffered a revenue decline in the first quarter was slumping demand for its mainframe computers. Revenue from mainframes tumbled 38% year over year, dragging sales in the systems segment down 9% on a currency-adjusted basis.

While mainframes aren't as important to IBM today as they were in the past, the hulking systems, with a large install base and monstrous switching costs, are a key component of the company's competitive advantages. That makes the steep decline in sales seem all the more concerning.

This is normal

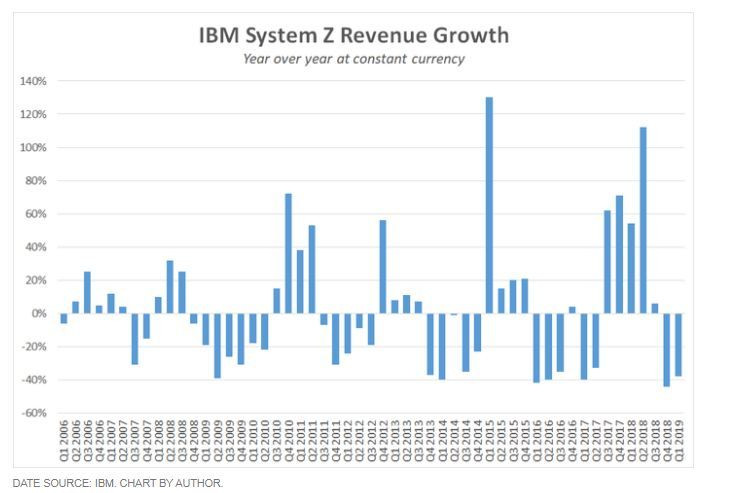

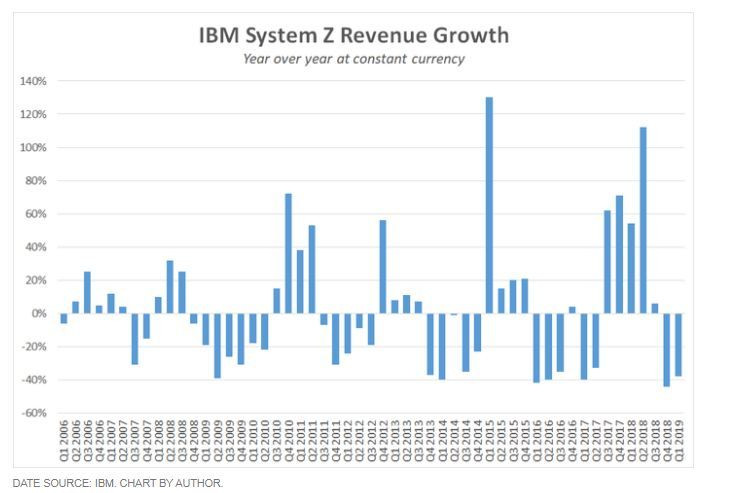

There's no reason to worry about the precipitous decline in mainframe sales. IBM's mainframe sales spike each time the company launches a new model -- the third quarter of 2017 marked the start of the latest surge in sales with the z14 system. After four or five quarters of strong year-over-year growth, driven by customers upgrading from older models, that growth is lapped, and sales begin to decline.

This cycle has played out multiple times over the past decade as IBM refreshed its mainframe systems every few years. And despite the steep sales declines IBM is now seeing, the current cycle is the strongest in many years.

"We are seven quarters into the z14 cycle and the program continues to track ahead of the prior program. We had strong growth in volumes or shipped MIPS, and new workload MIPS continue to outpace our standard MIPS," said IBM CFO James Kavanaugh during the first-quarter earnings call. (MIPS stands for million instructions per second, a measure of processing power.)

Kavanaugh added that the single-frame version of the z14, launched last year and designed to fit into standard data centers, is a growth driver for the mainframe business.

IBM more than doubled mainframe sales on a year-over-year basis in the second quarter of 2018, so another big decline in sales in the second quarter of this year is inevitable. The company will then begin to lap these declines in th

e second half of this year.

Given the typical gap between mainframe launches, IBM's next-gen mainframe system probably won't arrive until sometime in 2020. That means three or four more quarters of weak mainframe performance before another year-long surge in sales.

2020 is shaping up to be a big year

Not only will IBM likely get a revenue boost in 2020 thanks to the next mainframe launch, but the company will also add a few billion dollars of revenue from its acquisition of Red Hat. That deal is scheduled to close before the end of this year.

Red Hat is growing at a double-digit rate, and its software strengthens IBM's hand as it goes after the hybrid cloud computing market. There's a mainframe connection here, too -- Red Hat offers a version of its Enterprise Linux operating system for IBM's mainframes. Kavanaugh pointed out during the earnings call that Linux is a key growth driver for the mainframe business.

IBM's total revenue will likely decline this year, mostly because of a significant currency headwind, but also because of slumping mainframe sales. But next year will look a whole lot better.

This article originally appeared in The Motley Fool.