Impact of public companies on the blockchain industry

In 2020, institutional investors have had the biggest impact on the entire cryptocurrency market. Back in late February, when the world was engulfed in a pandemic and economic crisis, analysts and experts from large companies began to look for alternative assets. Thus, many companies approached Bitcoin, which performed well during the crisis. Despite the collapse in the value of BTC in March 2020, which occurred synchronously with all quotes, the cryptocurrency very quickly regained its position, proving its independence from traditional markets.

In the summer, analysts at Fidelity Investments, which has more than $ 7 trillion in capital under management, surveyed 774 European and American companies. More than ⅓ confirmed investment in cryptocurrencies. Over the past year, another 5% of American companies have added cryptocurrencies to their portfolio, and now their share exceeds 27%. These include pension funds, hedge funds, family investment companies, and insurance companies. In Europe, almost half of the business representatives surveyed have already invested in cryptocurrency assets. Most of them choose Bitcoin as their main asset.

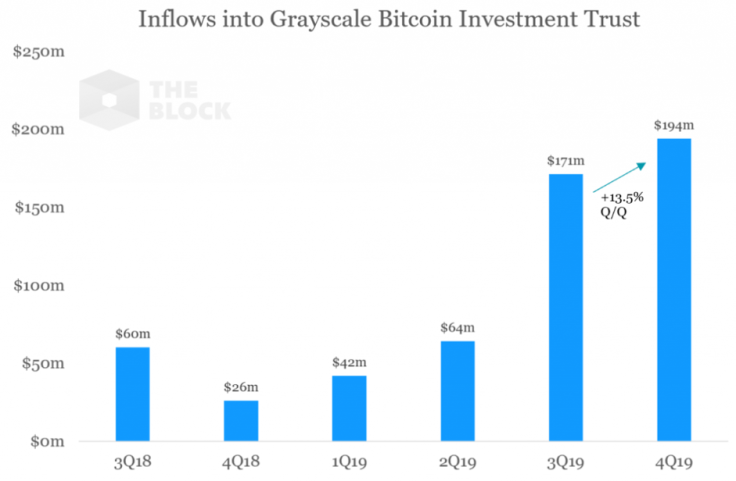

A good confirmation of the growing interest of big business in cryptocurrencies is the statistics of Grayscale investments in bitcoin over the past few years.

As a reminder, only 22% of Grayscale clients are private investors, and 78% are institutional investors and funds. Such dynamics show the constant growth of companies' interest in bitcoin and other cryptocurrencies.

Impact of public companies

Comparing Bitcoin's growth in 2020 and 2017, there is a huge difference. Differences in the reasons for such active growth. If three years ago the main fuel for the price growth was hype and the interest of private investors, now Bitcoin is bought by major market players. In September, the purchase of more than 28,000 BTC was announced by the CEO of MicroStrategy, registered on Nasdaq. The company believes Bitcoin is an attractive asset that is safer than cash in the long run. MicroStrategy plans to use BTC as its “main treasury reserve asset”. And in October, Square announced the purchase of bitcoins worth $ 50 million.

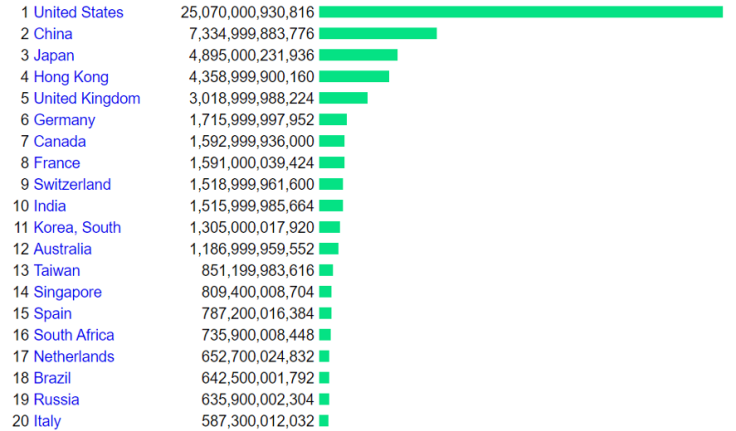

According to Google Trends statistics, interest in Bitcoin is now several times lower than it was in 2017. And this only confirms the fact that the main volumes are provided by the companies. It is not surprising that their influence on the market is so great. If we talk about business, and especially about public companies, then they are the basis of the economy of developed countries, reaching a capitalization of trillions of US dollars. Among the largest public companies are Apple Inc., Alphabet (the parent company of Google), Microsoft Corporation, Amazon, Facebook Inc., and many others.

Back in the summer, JPMorgan analysts noted that the cryptocurrency market, and especially Bitcoin, is under the huge influence of institutional investors. Nikolaos Panigirtzoglu drew attention to the fact that it was in 2017 that institutional investors came to the cryptocurrency market. And since then, this trend has increased significantly.

“The structure of the market is likely to have undergone significant changes since the previous jump in the price of Bitcoin at the end of 2017; institutional investors are now more influential, ” — says Panigirtzoglu.

Large companies in the cryptocurrency industry are closely monitoring these changes, and are even contributing to it. For example, Huobi Group has launched an OTC platform for large market players. At the same time, BitGo created a similar clearing system.

Thus, the growing interest of multimillion-dollar corporations in bitcoin was one of the main reasons for the active growth of cryptocurrencies in 2020. But not all institutional investors look at the cryptocurrency market as “bitcoin and everything else”. Some look broader, not ignoring the phenomenon of recent times, which is decentralized finance. It was recently revealed that xSigma has become the first publicly-traded company to enter the DeFi industry.

Despite the huge impact of decentralized finance on the entire blockchain industry this year, this technology has many weaknesses. The DeFi market is still very young, which means it contains many weak and dubious projects on which developers are simply trying to speculate. In addition, their implementation is very often technically weak due to the inexperience of the development teams. These disadvantages hold back the development of the market. Despite the fact that the capitalization of decentralized finance has grown almost 20 times over the year, the real potential of this idea is much higher. The main growth was driven by enthusiasts and private investors, as was the case with ICOs in 2016 and 2017.

Taking the DeFi market to the next level requires large investments and experienced teams. That is why xSigma public company decided to launch its own products in this industry.

XSigma's first task will be to launch an exchange for decentralized trading of stablecoins. Anyone who has followed the industry this year knows that the DEX's biggest problem at the moment is liquidity. It is the low liquidity that causes the most negative emotions among the users of decentralized trading platforms. Therefore, when creating a DEX, xSigma pays most attention to the development of market-making mechanisms. The main goal is to make it as stable as on centralized exchanges. But a year after the launch of the exchange, the xSigma team is going to release its own stablecoin, which will become the basis for the future decentralized ecosystem. The company is going to continue to develop ideas that promote decentralized finance.

xSigma's product team is led by Alex Lebed, a software engineer with career stops at Facebook, Amazon, 1Inch, and also the founder of Stableunit.org. The team also features Harvard graduate and former Google engineer Kamal Obbad, and Daniel Garay, a project manager formerly of Ripple Labs and Google.