The Importance Of Transparency In Blockchain

A review of successes in transparent blockchain technology

From monumental success stories like the Bitcoin protocol to the advancements within Decentralized Finance (DeFi), we've seen how total transparency can be an inherent strength of blockchain technology. With the advent of smart contract-based applications, developers have the opportunity to build transparency within their protocols.

Simultaneously, we've seen a fair share of projects that lacked the focus or care of creating transparent applications. These ranged from pump-and-dumps schemes like SAFEMOON to colossal failures like FTX, Terra and Celsius who were, in some form or another, actively working against creating transparent systems.

What is clear is how important it is to understand the distinctions between projects that consider transparency vital to their design, and vice versa. So, we'll go through the most important historical applications.

Exist Without Permission, Be Transparent for All

Some like to think that everything began with the Bitcoin protocol, but Satoshi Nakamoto cryptically hinted that motivations for Bitcoin began because of the Great Financial Crisis in 2008 when the first block mined had the inscription "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks."

Bitcoin is, by the principles of its design, a permissionless and transparent cryptocurrency network. The network records its transactions through a distributed ledger, viewable to all nodes of its blockchain. To transact on Bitcoin does not require permission, and the ledger is available for anyone to view the transaction history across all Bitcoin. This was the blueprint for future projects and existed as the first alternative to the global financial system.

Ethereum: Programmatic Blockchains

Vitalik Buterin would announce Ethereum at Bitcoin Miami in 2014 and later launch it alongside the Ethereum Foundation in 2015. Ethereum is like Bitcoin in that it's permissionless and transparent by design, but instead of being a blockchain for one digital currency, Ethereum was also a decentralized system to build applications on top of.

Ethereum, also known by its alias the "world computer," included a new programmatic language, Solidity, that enabled developers to build smart contracts. Smart contracts are programs that are stored on a blockchain, so anyone is able to view a smart contract's transaction history and the wallets that interact with it.

The Rise of Digital Art and NFTs

One sector was beginning to flourish in 2017. Non-fungible tokens (NFTs) were beginning to see their first real applications, with Cryptopunks emerging in June of 2017. Shortly thereafter, Crypto Kitties, a game where users could breed unique digital cats by pairing two NFTs, began in October of the same year.

The ICO Bull Runs

Users began to flock to cryptocurrency projects, and as retail investors started to invest in different tokens during a growing ICO era, prices began to rise across the board. Bitcoin initially started 2017 at $964 and grew to almost $20,000 by the peak of the bull run.

Projects like MobileGo set tremendous goals and visions for their investors, only to spend the raised funds largely on salaries for their own developers. The actual development of a working project never came to fruition.

It would later be discovered that the first meteoric rise was in part thanks to the manipulation of one whale investor. A subsequent fall would ensue shortly after, and crypto would experience its first winter.

Ethereum's First Evolution: DeFi

As early as 2018, DeFi began to sprout its roots, with protocols like Uniswap, Compound and Aave demonstrating the power of permissionless and transparent decentralized finance applications. Uniswap pioneered the decentralized exchange, while Compound and Aave built and innovated on the decentralized capital markets applications. Things grew slowly, then all at once a DeFi summer raged through 2020.

DeFi Speculation and Scams

Unfortunately, as capital interest began to grow in cryptocurrency and NFTs during the pandemic, so did the number of grifters and scammers who were interested solely in turning a profit on this new technology. Thousands of pump-and-dump projects and NFTs emerged, doing little to nothing to build or showcase their work in any transparent way.

Successful DeFi applications saw their projects forked across other alternative chains, such as the OlympusDAO model. In reality, these copies were on chains that lacked the real permission-less or transparent attributes that made Bitcoin, Ethereum and DeFi successful in the first place.

DeFi became the Wild West and anyone who was not savvy enough or did not do their homework about their investments would find themselves caught in the crossfire of scams or failed projects.

The Rise of Hacks

DeFi also had a new enemy emerge through its bull run: black hat hackers. These were sophisticated players who would target projects that had one or several points of failure in their security measures. Sometimes hacks were simple, like the governance hack of Beanstalk, which stole $80 million in funds. Other times they were more sophisticated, like the social engineering hack of the Ronin Bridge, which stole $650 million.

Projects that lacked transparency, and/or had systems where funds were controlled by the core team were perfect targets for hackers.

At the same time that hacks were increasing, several decentralized applications (DApps) stood out as champions from the rest. DApps like Aave, Uniswap and Maker proved their core applications were standing the test of time.

The Fall of Goliath

During the first quarter of 2022, Terra was hailed as one of the greatest projects to come out of DeFi, and Do Kwon was loved by LUNA holders. With a valuation near $50 billion that was wiped out in sheer days during its crash, it's important to pay attention to what was different with Terra versus other DeFi projects.

The Terra team had one of the worst bank runs in crypto history, while simultaneously funneling capital out of Terra reserves for their own purposes when UST was crashing.

Terra is a reminder to not trust idols that only claim to have built transparent and permissionless technology without having definitive proof. If it were otherwise, Terra would have been designed exactly to protect itself from actors like Do Kwon.

And Goliath's Big Brother

In the same year, FTX would experience the largest bank run in all of crypto history, a monumental disaster for the blockchain space. With yet another talking head at the helm of the ship, Sam Bankman-Fried (SBF) outright scammed nearly anyone who stored funds on the FTX trading platform.

Since FTX was a centralized exchange, almost all of the capital was not properly recorded on any publicly known source. Unlike the Bitcoin or Ethereum blockchains, which have distributed public ledgers, FTX did not even have an accounting department. Financial statements were impossible to rely on for any ounce of truth.

The FTX bank run solidified the bear market, simultaneously wiping out billions in value across all blockchain ecosystems and any remaining grifters in the space. It was once again a reminder of the importance of understanding how transparent a crypto company or project is with user funds.

What Has History Taught Us

The successes and failures in blockchain technology have taught us much over the last decade when it comes to transparency. They can be boiled down to these criteria:

- Transactions must be fully viewable on the blockchain. If you cannot view a program's transactions on any decentralized blockchain, be wary.

- Protocols must not manage funds within wallets. They must be managed via a permissionless smart contract or application. There are several points of failure to having developers.

- If there are projects or icons claiming they have built permissionless and transparent systems, it is most important to research further. Do not take grand claims at face value.

When the Dust Settles, Search for Builders

After the crypto market crash at the end of 2022, many projects and developers left the blockchain sphere. It's no surprise, especially with the advent of the super-evolution in AI technologies over the past several months.

However, blockchain building continues. Developers in the space continue to follow the mission to build novel applications for the global citizen in the name of economic freedom. Blockchain is a gateway to a permissionless and transparent monetary system, free of the control of private institutions or their governments. With blockchain, everyone can be their own bank.

As the dust settles from the crash, we're slowly seeing new forms of progress emerge. One project that has been carving a name for itself in the crypto winter is GoMining.

From Bitcoin Mining to Empowering Investors

GoMining originally began in 2016 as a Bitcoin mining hosting service for clients interested in large-scale Bitcoin mining. As it continued working, expanding its data centers in different countries, GoMining made a keen observation about the crypto marketplace: The barrier of entry to Bitcoin mining is incredibly high and continues to only get higher. There was no easy investment vehicle for retail investors to get into Bitcoin mining.

That all changed in the summer of 2023 when it introduced the novel concept "Liquid Bitcoin Hashrate" (LBH). LBH is a protocol that tokenizes Bitcoin mining computing power on the Ethereum and BNB blockchains.

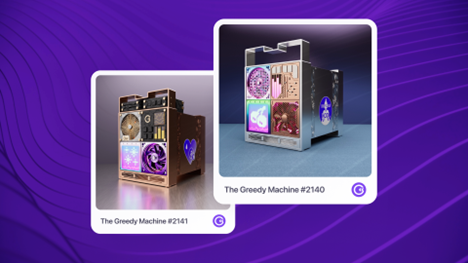

This took the form of the GoMining NFT, which is backed by actual computational power housed in GoMining's data centers. LBH has seen major success for investors, with GoMining distributing over 2,000 BTC across over 20,000 NFTs to holders.

Each NFT sports artwork of a unique mining rig, as well as two attributes that directly affect a GoMining NFT's earning potential.

They are hash power valued in terahashes per second (TH/s) and electrical efficiency measured in watts per terahash (W/TH). The more hash power, the more potential Bitcoin is earned. The higher the energy efficiency, the cheaper the cost of electricity is to mine.

The Ecosystem Token, GOMINING

GoMining also updated its token, GOMINING. The token has three functions within the ecosystem:

- Discount Token for NFT Holders: When NFT holders pay mining fees, they can choose to save 10% by paying with GOMINING instead of their BTC rewards.

- Burn and Mint: To control supply over time, the GOMINING smart contract will burn all GOMINING used to pay for mining fees across NFTs. A new smaller amount of GOMINING is minted and redistributed to mining service providers (65%), veGOMINING tokenholders (20%), NFT rewards (10%) and the GoMining team (5%).

- NFT Rewards: veGOMINING holders can vote on how the 10% of GOMINING will be distributed. They have three options: Upgrade The Greedy Machines NFT collection, increase multipliers in pool mining or give discounts to solo mining NFT holders.

Learn more about veGOMINING here and GOMINING reward distribution details here.

GoMining in the Context of History's Lessons

GoMining, while not being completely permissionless, focuses deeply on building transparent systems across its ecosystem. We can apply the three lessons from history and see how GoMining fares.

Transactions Are Fully Viewable on the Blockchain

Yes, GoMining has its NFTs, and the pooled earnings from Bitcoin mining are distributed via the Ethereum and BNB blockchains. They are viewable on each respective block explorer. GoMining also takes it a step further and discloses the distribution of rewards on both its website and various public channels.

GoMining Does Not Actively Manage Protocol Funds

GoMining did build the on-ramp that moves mined Bitcoin from their data centers to decentralized blockchains. So while they manage the on-ramping process for Bitcoin, they do not actively manage user funds.

GoMining Leadership Focuses on Results, Not Bold Statements

Compared to Do Kwon and SBF, GoMining CEO Mark Zalan is a much more focused and calculated executive. The GoMining team has been working since 2016 to get to this point, so there is a low probability they are here for any other reason than to make Bitcoin mining easy and accessible.

Conclusions

Despite its growing pains throughout history, blockchain technology has opened a new path for the global financial system. Keep the lessons of its history in mind as more blockchain innovations continue to emerge. Projects like GoMining are exemplary and can be examples of what to look for in the context of transparency.