Bitcoin Can Hit $200K By Year-End 2025 Amid Continuing US Asset Reallocation: Standard Chartered

KEY POINTS

- $BTC may hit $120,000 this quarter and trade as high as $200,000 by the end of 2025: Kendrick

- US investors are reallocating their assets, including reallocations from gold to Bitcoin, he said

- Bitcoin plunged below $75,000 earlier this month, but has since recovered above $90,000

Bitcoin is on track to hit new all-time highs this year and potentially this quarter as investors continue to pull their money out of U.S. assets and reallocate them to the world's largest cryptocurrency by market cap, an analyst with multinational bank Standard Chartered said in a note Monday.

Standard Chartered Global Head of Digital Assets Research Geoffrey Kendrick said it's possible for BTC prices to surge to $120,000 this quarter and $200,000 by the end of the year.

Investors are Reallocating Their US Assets, And It Could be Good for $BTC

According to Kendrick, recent activity around the world's first decentralized crypto asset, which includes whale accumulation and massive flows around BTC exchange-traded funds (ETFs), all signal "safe-haven reallocation from gold to BTC."

In the past week, spot Bitcoin ETFs hauled in over $1.7 billion. At one point in the week, the funds took in a staggering $912 million in single-day flows.

Such activity suggests that American investors are pulling out their home-based assets and may be considering other assets overseas, which could lead them to cryptocurrency and naturally, Bitcoin will be in the conversation.

"We expect a strategic asset reallocation away from U.S. assets to trigger the next sharp upswing in Bitcoin in the coming months," he said.

He further noted that Bitcoin's past price action, wherein there have been sharp spikes after months of sideways price movements, suggests that timing such upswings is crucial – even for an asset that has risen dramatically in the past few years.

Things could even be better throughout the summer, Kendrick projected. "We see gains continuing through the summer, taking BTC-USD towards our year-end forecast of 200,000."

Bitcoin Makes Steady Gains in the Month

Kendrick's projections came as BTC has logged steady gains in the past month despite some low points earlier in the month due to fears around the impact of President Donald Trump's global trade war.

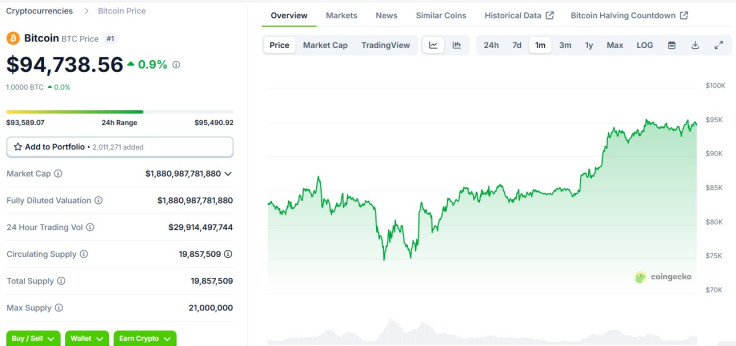

Still, the digital coin has been steadily rising and in the last 24 hours alone, it climbed by nearly 1%, as per data from CoinGecko.

From lows before $75,000 earlier this month, as fueled by Trump's China tariffs, Bitcoin has recovered dramatically, trading in the $94,000 highs late Monday.

It remains to be seen whether BTC prices will tread the same path as Kendrick predicted, but at least based on its latest movement, the world's most valuable digital asset may be on track to shocking the world yet again.

© Copyright IBTimes 2025. All rights reserved.