India Central Bank To Test CBDC On Nov. 1

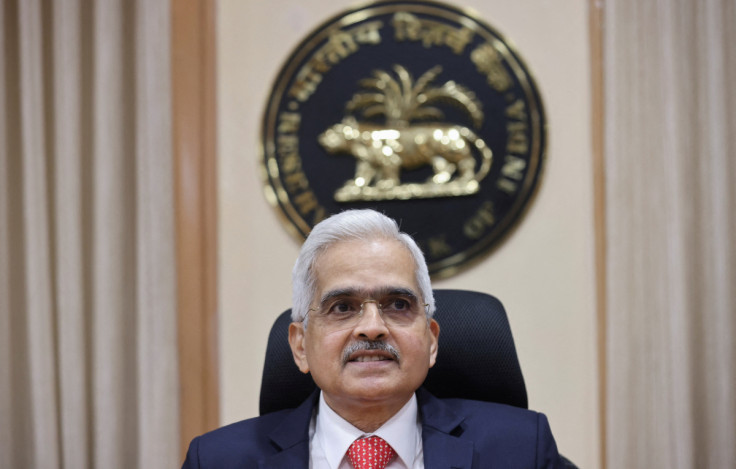

The Reserve Bank of India (RBI) is ready to test its central bank digital currency (CBDC), dubbed the Digital Rupee (e₹), starting Tuesday for "specific use cases."

According to the announcement Monday, the first pilot in the Digital Rupee - Wholesale segment (e₹-W) shall commence Tuesday, and its focus would be the "settlement of secondary market transactions in government securities."

"Use of e₹-W is expected to make the inter-bank market more efficient. Settlement in central bank money would reduce transaction costs by pre-empting the need for settlement guarantee infrastructure or for collateral to mitigate settlement risk," read the announcement. "Going forward, other wholesale transactions, and cross-border payments will be the focus of future pilots, based on the learnings from this pilot."

Furthermore, nine major banks operating in India, including the State Bank of India, Bank of Baroda, Union Bank of India, HDFC Bank, ICICI Bank, Kotak Mahindra Bank, Yes Bank, IDFC First Bank and HSBC, will participate in the pilot.

Being the largest democracy and the fifth-largest economy by nominal GDP and the third-largest by purchasing power parity (PPP), the testing of a CBDC in India might be an industry-leading move.

The central bank will debut two types of CBDCs - wholesale and retail. The first pilot in Digital Rupee - Retail segment (e₹-R) is set to take place within a month in select locations across the country.

The retail version will be available to closed user groups comprising merchants and customers.

"The details regarding operationalization of e₹-R pilot shall be communicated in due course," said the RBI.

The crypto adoption rate in India is rising, and as per earlier reports, crypto investors in the world's biggest democracy have put their faith in Shiba Inu (SHIB), the world's second-biggest meme coin which is also the most-traded cryptocurrency in the region.

However, the central bank has been highly vocal about its stance against crypto, stressing on the economic instability it would bring. The bank published a 50-page concept note on CBDC in October, which noted that "in the tail-risk event of economic instability or a system-wide bank run, CBDC could be viewed as a safer substitute of bank deposits."

© Copyright IBTimes 2025. All rights reserved.