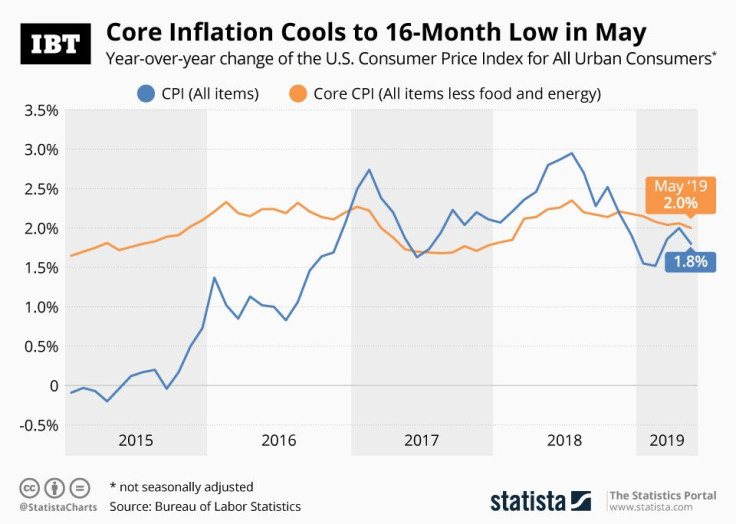

Infographic: US Core Inflation Drops To 16-Month Low In May

The Consumer Price Index for All Urban Consumer (CPI-U), a closely watched measure of inflation in the United States, came in below estimations in the May reading, with both the broad CPI for all items and the core CPI excluding food and energy prices up just 0.1 percent on a seasonally adjusted month-over-month basis. Compared to May 2018, consumer prices rose 1.8 percent and 2.0 percent excl. food and energy items, respectively, versus expectations of 1.9 and 2.1 percent.

The soft inflation reading, the lowest since February 2018 for the core CPI, will likely add fuel to speculations of an imminent Fed rate cut amid fears of a broader economic downturn. Over the past few weeks, President Trump has repeatedly called for the Fed to cut interest rates, arguing that the U.S. economy could “go up like a rocket if we did some lowering of rates”.

The current target range for the federal funds rate, i.e. the interest rate at which depository institutions such as banks trade federal funds (balances held at Federal Reserve Banks) with each other overnight, is 2.25 to 2.50 percent. It has been increased nine times since tightening began in December 2015. The European Central Bank in comparison has maintained a refinancing rate of 0.00 percent since March 2016.