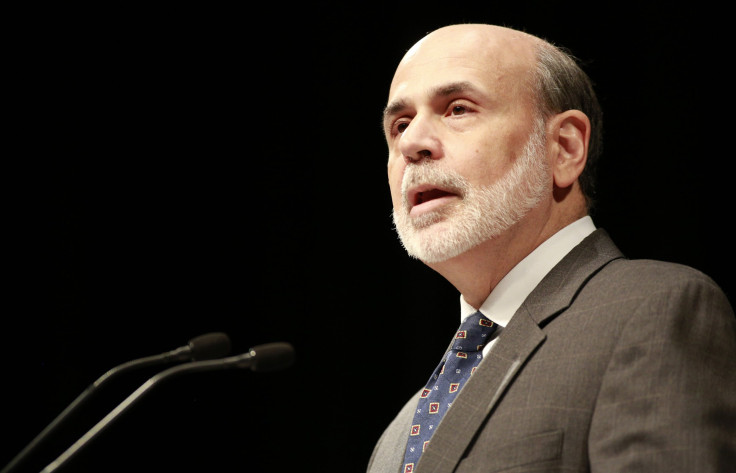

June FOMC Preview: Fed To Taper QE Soon, Bernanke Press Conference Eyed

The Federal Reserve is unlikely to taper the pace of its asset purchases during this week’s meeting, but Fed Chairman Ben Bernanke will have the opportunity to explain what might trigger that change, and when.

The two-day Fed meeting ends Wednesday with a statement, economic forecast and press conference by Bernanke. It also follows a rough several weeks for markets.

Investors believe they heard the end of quantitative easing, or QE, when Bernanke indicated in May during his congressional testimony that the Federal Open Market Committee might scale back the pace of bond buying “in the next few [FOMC] meetings” if the economy improves.

Interpreting Bernanke's words and recent signs about the economy has roiled markets since then, and the Fed chief might want to do some damage control. The rally in stocks stumbled and Treasury bond yields rose to 14-month highs.

As part of its ultra-easy monetary policy, adopted more than four years ago, the Fed has been buying Treasury and other bonds each month to keep interest rates low and promote growth. According to a Reuters poll, most economists expect the central bank to pare back its debt purchases by the end of this year, and a sizeable number expect reduced buying as early as September.

Of 49 economists who responded to a question about when the Fed would completely halt bond purchases, 42 said they expect this by mid-2014. The remaining seven economists expect the program to end in the second half of 2014 or the first half of 2015.

“The most pronounced market impact will likely occur when the Fed announces the first reduction in monthly purchases, which we expect to be in September, as the market rushes to fully price in the eventual termination of QE,” said Mary Beth Fisher, head of U.S. interest rate strategy at Societe Generale in New York, in a note to clients.

Some Fed officials have sounded more optimistic over the past two months, feeding the tapering talk. Yet the data have generally softened recently, with second-quarter growth tracking below 2 percent and inflation around 1 percent per annum.

Michael Hanson, U.S. economist at Bank of America Merrill Lynch, expects the statement released after the two-day policy meeting to recognize some of this weakness, and looks for the FOMC to modestly revise its economic projections lower as they “mark-to-market.”

He thinks it very unlikely, however, that the Fed would announce a tapering of QE purchases at the same meeting where they cut their forecasts.

“Uncertainty about the pace of output and job growth, and the path for inflation, also may keep the FOMC cautious for now,” Hanson said. “We won’t learn any details of that debate until the minutes are released three weeks later.”

Moreover, it makes sense to delay any reduction in monetary stimulus for a few months while the fiscal drag linked to the sequestration cuts to federal spending is at its heaviest.

From a rates perspective, the hawkish surprise would be if Bernanke doesn't acknowledge that incoming data have been soft or that there are downside risks to the Fed’s growth forecasts, according to Barclays Plc strategists led by Rajiv Setia. The dovish surprise would be if he manages to delink the timing of any tapering from eventual rate hikes -- this is clearly a difficult proposition without taking a clear stand on how much of the drop in labor participation rate is cyclical versus secular -- something on which the Fed has already sent mixed messages.

Some in the markets have speculated that the Fed will map out a timeline or conditions for tapering QE3 at this meeting. Hanson, however, doesn't believe there's enough agreement among Fed officials to do that, beyond reiterating the desire to satisfy both its employment and inflation mandates and to repeat that the buying pace could be revised up or down.

Policymakers will have plenty of opportunities later in the summer to provide additional details regarding their views on the economy and what it might mean for both the timing of the start of tapering and also the pace of any tapering.

Bernanke will testify before the Senate Banking and House Financial Services Committees on July 17 and 18, the FOMC will meet again on July 30-31, and there will be a plethora of speakers at Jackson Hole in late August. This flurry of events seems a good opportunity for the FOMC to prepare the market for an eventual start to policy normalization.

Muddled Criteria

The Fed’s intentions for its interest rate policy are relatively clear. The fed funds rate will be held in the range of zero to 0.25 percent as long as the unemployment rate is above 6.5 percent, the outlook for inflation over the next two years is less than 2.5 percent, and inflation expectations are stable.

But the criteria for changes in the quantitative easing program are not as clear.

Last September, when the current QE program was launched with the initiation of $40 billion a month in purchases of agency mortgage-backed securities, the FOMC stated that its purchases would continue until the outlook for the labor market improved “substantially.” The problem is that there doesn't seem to be a clear consensus on the FOMC as to what would qualify as a "substantial" improvement.

Committee members said they would be looking at a number of labor-market indicators to gauge when a substantial improvement was taking place.

In determining the size, pace and composition of the asset purchases, the FOMC would also take account of “the likely efficacy and costs of such purchases.”

“Quantitative easing is a grand experiment,” said Kevin Logan, HSBC's chief U.S. economist. “Measuring its efficacy and costs is not a simple exercise and not something that can be easily ascertained by financial market participants.”

Tapering Is Not Tightening

The Fed, famous for its ambiguous “Fed Speak,” wants the world to understand that “tapering” isn't “tightening.” In other words, doing less actually means doing more.

Provided the U.S. economy continues to recover and the benefits of additional asset purchases diminish relative to the risks, the Fed might therefore decide to slow the pace of these purchases and eventually halt them completely.

While this would be a reduction in monetary stimulus compared to what would've happened if the Fed had maintained the same pace of purchases, it wouldn't amount to a change in direction or a withdrawal of the stimulus already in place.

“Quantitative easing only becomes quantitative tightening when the central bank starts to sell back the assets it has bought or drain the additional liquidity in other ways,” Capital Economics analyst Julian Jessop said in a note. “In practice, the Fed may be content to hold assets until they mature and indeed may prefer to do so in order to minimize capital losses.”

The Fed’s investment purchases have swollen its portfolio to $3.4 trillion -- a fourfold increase since before the 2008 financial crisis. Eventually, the Fed will need to gradually sell its portfolio.

The signal that the asset purchases will probably be curbed at the next meeting or two could take several forms. The most obvious way would be to upgrade the assessment of the labor market outlook in the statement. The last statement already noted that "labor market conditions have shown some improvement in recent months." Average payroll growth in the past six months has been 194,000, compared with 130,000 in the six months leading up to QE3.

The markets may interpret any scaling back of asset purchases as the first step along the road to monetary tightening and start to price in a return to more-normal interest rates immediately. Therefore, good communication is crucial.

© Copyright IBTimes 2025. All rights reserved.