Low Oil Prices Drive Surge In Global Oil Demand; Crude Supplies Remain "Exceptionally High": IEA Report

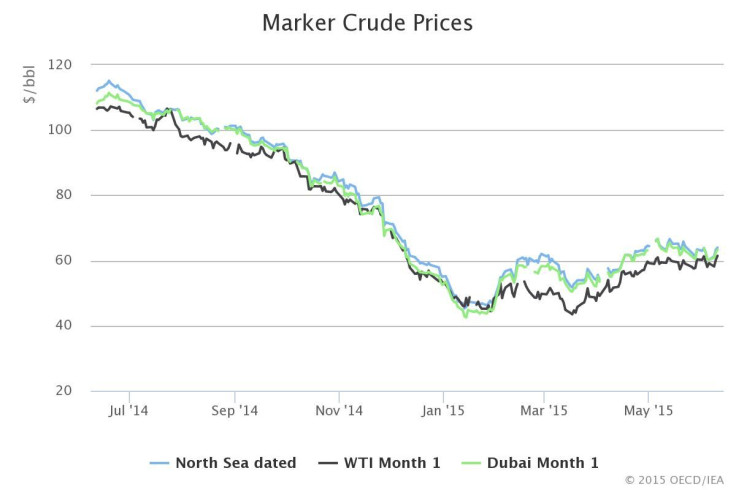

Low oil prices are driving demand for crude this year as countries and consumers take advantage of cheaper barrels. The International Energy Agency on Thursday raised its forecast for global oil demand growth in 2015, attributing the boost to the lower prices, economic recovery and a relatively cold winter.

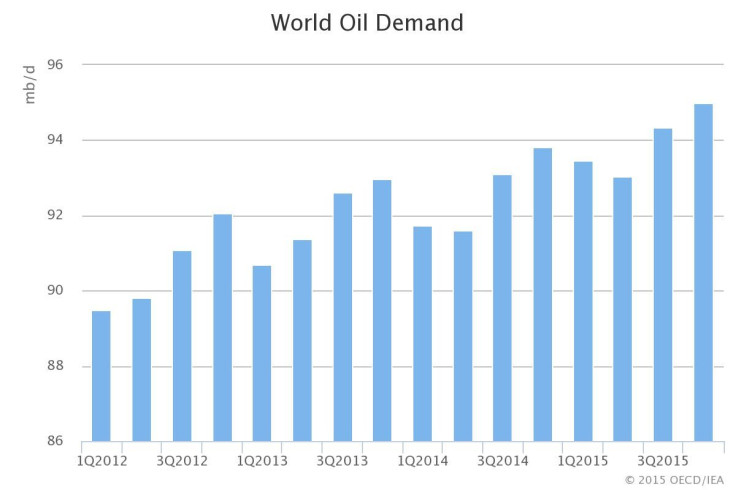

The Paris-based agency revised its forecast by 280,000 barrels per day to 1.4 million barrels this year, bringing total demand to about 94 million barrels per day, the IEA said in its monthly Oil Market Report. In the first three months of 2015, oil demand grew by 1.7 million barrels per day, up from a quarterly average growth of just 0.7 million barrels.

Two other government forecasters offered slightly lower forecasts for global oil demand growth this week. The U.S. Energy Information Administration said it expects global consumption will grow by 1.3 million barrels a day in both 2015 and 2016. OPEC, in its monthly oil market report, kept its forecast for oil demand growth unchanged at 1.18 million barrels a day.

A global glut of crude oil supplies helped drive the price plunge as U.S. shale oil production surged and the Organization of Petroleum Exporting Countries, led by Saudi Arabia, maintained their output despite oversupply.

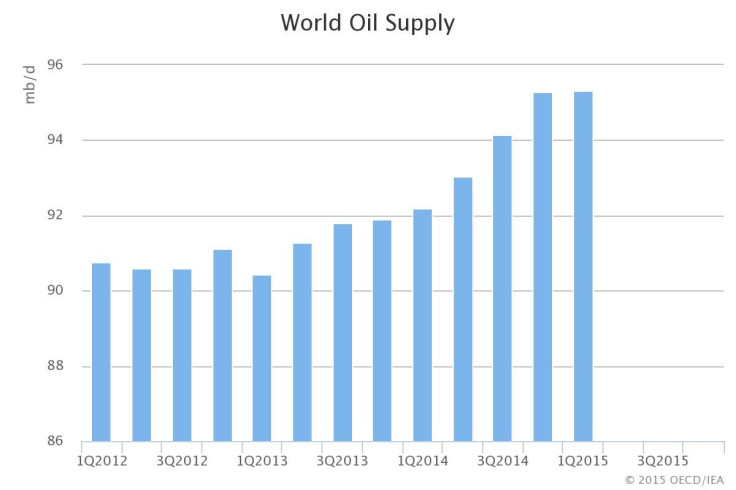

In its latest report, the IEA said global oil supplies fell by 155,000 barrels per day in May to 96 million barrels on lower output from non-OPEC countries, including the United States. Still, the agency said global production growth remains “exceptionally high” and will likely keep soaring in the next six months. The IEA raised its forecast for supplies from non-OPEC countries, projecting growth of 195,000 barrels per day to 1 million barrels for 2015.

Production by OPEC members rose to more than 31 million barrels a day in May -- its highest since August 2012 -- and is likely to stay around those levels in the coming months. Middle East producers will keep pumping to “sustain higher rates to preserve market share and meet summer domestic demand,” the agency said.

At a meeting last week in Vienna, OPEC members opted not to cut production in the second half of 2015, a move that could help prop up prices but would cede market share to non-OPEC producers.

© Copyright IBTimes 2025. All rights reserved.