Motorola Mobility Smartphone, Tablet Prices to Hurt in Q3 With Product Delays

Motorola Mobility Holdings Inc.'s (NYSE: MMI) launch of several sub-$200 smartphones for emerging markets will boost units but hurt average selling prices in third quarter, Jefferies said.

Motorola Mobility expects third quarter earnings between break-even and $0.10 per share, while Street estimates profit of $0.24 per share and Jefferies predicts loss of $0.05 per share. The company guided full year 2011 earnings of $0.48 to $0.60 per share, while Street predicts $0.70 per share and Jefferies now expects $0.48 up from $0.26 per share.

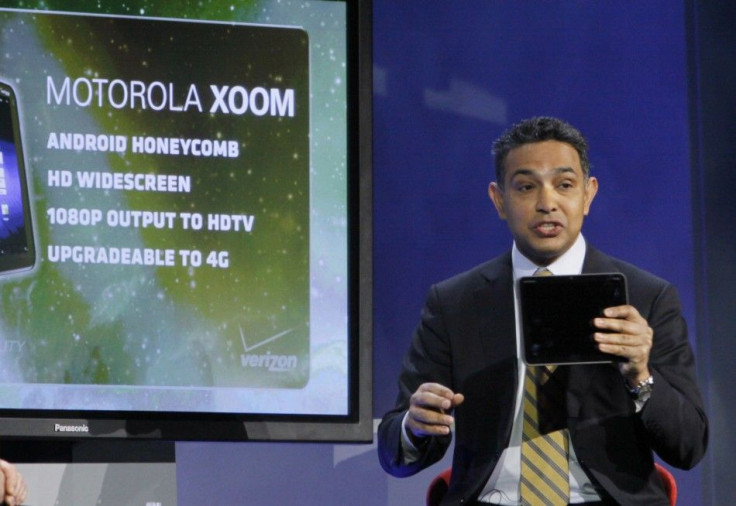

The third quarter guidance was lower than Street estimates due to home revenue down seasonally (though Home revenues were up 3 percent quarter-over-quarter in third quarter of 2010); LTE Bionic and LTE Xoom launching in September, both later than expected; and Xoom price cuts.

"With several new product launches, we expect sell-in to be solid, but competition from Huawei and ZTE in low-end smartphones and Apple Inc. in the high-end (iPhone 4S) and mid-range (new low-cost iPhone) will pressure margins," said Peter Misek, an analyst at Jefferies.

Motorola reduced its price of Xoom, which was launched at Verizon on February 24, to $499 from $799 at Verizon Wireless on July 25 to compete with Apple Inc.'s iPad and tablets like Samsung Galaxy. Consumers weren't willing to pay a premium for the Motorola device, which like Galaxy is based on Android software from Google Inc., this has led to the price cut.

"Motorola's Bionic, a high-speed device for Verizon Wireless, would be delayed until September, much later than analysts had expected for the device whose launch had already been delayed to the summer from its original target for a second quarter launch," Chief Executive Sanjay Jha told Reuters.

A high-speed version of Motorola's Xoom tablet, also announced in January, will also be delayed until September, Motorola said. It had also originally slated that product launch for the second quarter.

In the fourth quarter, Motorola Mobility intends to launch another Long Term Evolution (LTE) handsets and two LTE tablets.

Jha told Reuters that he had misjudged pricing in the highly competitive tablet market but vowed that Motorola's profit would be back on track in the fourth quarter, when he promised to introduce more competitive products.

Motorola Mobility reported its second quarter adjusted earnings of $0.09 per share on revenue of $3.3 billion, while Street predicted profit of $0.06 per share on revenue of $3.1 billion. Jefferies estimated profit of $0.08 per share on revenue of $3.2 billion.

The company's smartphone units for the second quarter were 4.4 million (Jefferies at 4.3 million, Street at 4.4 million), and total handsets were 11 million (Jefferies at 10.5 million, Street at 9.6 million). It has also sold 440,000 tablet computers, ahead of Street view of about 366,000.

"As expected, Motorola Mobility upsided second quarter due to strength in Brazil/China, and revenue guidance was reasonably strong due to new handset launches; however, margin pressure led to second half EPS guidance that was above our estimates but below consensus. Long-term competitive concerns remain, so we maintain our estimates ahead of second quarter earnings," said Misek.

In addition, Motorola Mobility's management stated that it was firmly focused on monetizing their extensive patent portfolio; however, the need to cross-license with the other major patent holders leaves mainly new entrants like the PC original equipment manufacturers (OEM) as the main targets, and they do not have extensive handset or tablet revenues yet.

Misek believes OEMs’ lack of control over Android will eventually lead to commoditization. Competitors will have to accept lower margins or big players such as HTC, Samsung (already has Bada OS), and Motorola Mobility may create an alternative mobile OS.

Additionally, Misek said Motorola Mobility's tablet demand has been significantly higher than expected on the Street. Misek believes Motorola Mobility could be an attractive acquisition target for those wishing to enter the smartphone/tablet space, paired with Nokia Corp.'s shrinking market share.

© Copyright IBTimes 2025. All rights reserved.