Natural Gas: Hottest Monthly Moves Since 2009, On Cold Snap

U.S. natural gas prices have posted their biggest monthly gain since September 2009 thanks to the frigid weather in January, according to Standard & Poor’s.

January 2014 has been a remarkable month for commodities overall and for natural gas specifically, as record cold temperatures disrupted the movement of goods and drove up home heating demand.

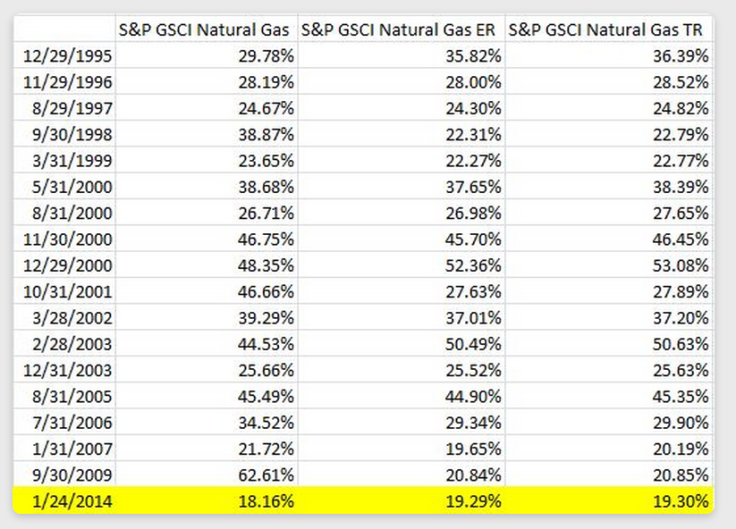

S&P’s GCSI natural gas index had gained 19.3 percent earlier this week, since its sluggish start in the new year. That’s the largest monthly gain since September 2009, wrote S&P commodities vice president Jodie Gunzberg in a blog post.

“Only 17 months of the 240 in the history of the index have seen bigger gains than 19.3%,” wrote Gunzberg. The index has existed in this form since January 1994.

U.S. natural gas prices have been driven up by a tight supply and demand balance in recent weeks, Citigroup analysts said in a recent note. Rising U.S. production amid a broad North American energy boom may not meet demand in the short-term. Natural gas prices rose 32 percent in 2013.

Now the question is whether natural gas will end January and earn the month a “bull market” title, defined as a rise of 20 percent or more in value. There hasn’t been a bull market month for natural gas since 2009, on the index model.

On Wednesday, the index gained 17.9 percent for the month of January, falling shy of the 20 percent threshold. The benchmark spiked up 9.2 percent on Jan. 24, and on Monday was up 44 percent relative to its recent low on Nov. 4, 2013.

“For the first time in a long time, natural gas is in backwardation, which is relatively rare. We almost never see backwardation, which means there’s a shortage in natural gas,” Gunzberg told IBTimes in a phone interview. Natural gas has only been in backwardation about 7.6 percent of the time in the history of the index.

“Any traders in the front month have a chance to profit,” she added. “It’s difficult to replenish commodities, and this [trend] has been pretty persistent,” for January, though the fundamentals were in place at the end of December, she said.

Natural gas on New York’s mercantile exchange (NYMEX) for February delivery rose above $5 per million British thermal units in Wednesday’s trading, beating a key price threshold. Citi called that $5 threshold “unthinkable”.

About half of U.S. households use natural gas to heat their homes. U.S. natural gas demand hit its second highest on record on Tuesday, at 133 billion cubic feet per day, according to the Wall Street Journal.

© Copyright IBTimes 2024. All rights reserved.