Preview: China's February Economic Data And NPC Meeting

The Lunar New Year holidays have clouded the picture and made it hard to assess the underlying strength of the Chinese economy. Amid mixed data for the world’s second-largest economy, everyone is now waiting to see if President Xi Jinping and his team are really serious about the reforms revealed last November.

China’s services sector regained some momentum, but its manufacturing sector took a hit in February. The government’s official purchasing managers’ index dropped to an eight-month low -- barely hovering above the 50 level that separates contraction from expansion. The final HSBC PMI index fell for a third straight month and well into contractionary territory.

The official survey is weighted more towards bigger and state-owned enterprises, while the HSBC survey focuses more on smaller firms and those in the private sector.

The Chinese government has been trying to steer the country away from its reliance on exports and enhance the role of domestic consumption.

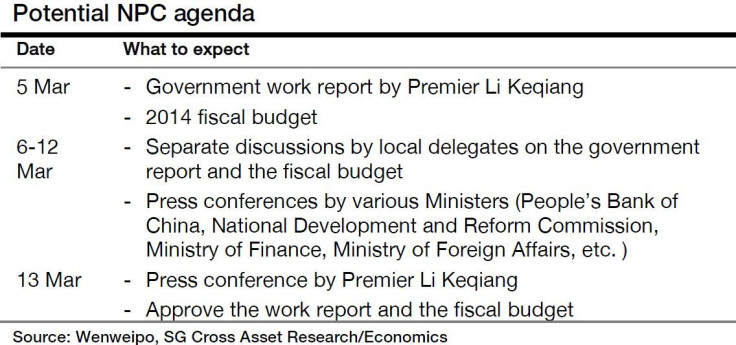

The once-a-year meeting of China’s national legislature kicks off Wednesday, and will likely conclude around mid-March.

This is the first parliamentary session that President Xi Jinping and Premier Li Keqiang will preside over, having taken on the leadership mantle last March. It is also the first since the Third Plenum meeting in November.

Hence, investors will be looking for any shift in policy focus, the likely growth impact, and possible reform breakthroughs, including implementation details or even timetables.

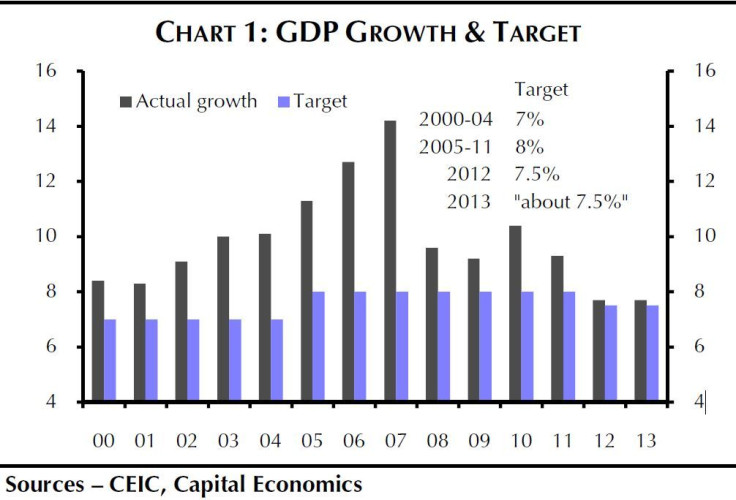

In 2013 China's economy grew 7.7 percent, steady from the previous year, just ahead of the official target of 7.5 percent, which would have been the slowest growth since 1999.

Most economists expect the government to set its 2014 GDP growth target at “around 7.5 percent,” unchanged from 2013.

February Data Preview

Friday (9 p.m. ET) – Trade Balance: Economists are looking for a correction in February following China’s surprisingly strong trade growth in January. Export growth probably slowed to 6.8 percent year-over-year last month after the strong 10.7 percent rise in January. Import growth likely held up better, at 8.0 percent in February (January was 10.0 percent), in part helped by the low base from last year. As a result, the trade surplus likely narrowed to $14.5 billion from $31.9 billion.

Saturday (8:30 p.m. ET) -- Consumer Price Index and Producer Price Index: Inflation was probably pulled down last month by the New Year distortion.

“As usual, most food prices have fallen since the New Year holiday, which ended in early February,” economists at Capital Economics said in a note. “By comparison, food prices were still high one year before, when the holiday ended in late February.” Meanwhile, non-food inflation has probably changed little, they added.

Consensus estimates puts CPI inflation at 2.0 percent year-over-year in February, from 2.5 percent in the previous month.

However, the fall in inflation is likely to be short-lived. Capital Economics thinks a reversal of the benign base effect is likely to push inflation higher over coming months, but with broad money and credit growth slowing, they do not expect inflation to become a policy concern this year.

Meanwhile, PPI inflation probably dropped again to negative 1.9 percent.

Sunday (9 p.m. ET) – Bank Lending: Bank lending usually surge at the beginning of the year and drop back in February. New RMB bank loan likely fell to 716 billion yuan in February, compared to 1,320 billion in the first month of the year. Outstanding loan growth probably remained at 14.3 percent, while M2 money supply also held at 13.2 percent.

March 13 (1:30 a.m. ET) – Industrial Production, Fixed-Asset Investments and Retail Sales: Industrial production is expected to show a slight slowdown in pace in February. Economists expect IP growth to come in at 9.5 percent, compared with 9.7 percent in January. Over the same period, fixed-asset investment growth slowed to 19.4 percent last month, from 19.6 percent.

Consumers are also tightening their purse strings a little. Retail sales growth for February probably slipped to 13.5 percent, from 13.6 percent in the prior month.

© Copyright IBTimes 2025. All rights reserved.