Purple States Most Likely To Be In The Red: Wells Fargo Report

While opinion polls in places like New Hampshire, Ohio, Nevada and Wisconsin continue to find no clear trend as to whether the residents will support a Democrat or a Republican for president, a new report by asset manager Wells Fargo Advisor Wednesday found those very states unambiguous in their spending preferences in running large budget shortfalls. It seems the toss-up "swing" states might be purple politically, but when it comes to fiscal policy, they all lean heavily red.

That finding was among the most interesting in an election-themed report by asset manager Wells Fargo Advisors released Wednesday, which looked at historical voting-year patterns and focused on the looming policy issues to be resolved -- or not -- by the election. The report was bullish on stocks over the long term, breaking rank with other asset managers who have recently extolled the likely end of the secular bull market in equities. It also deals with possible outcomes investors might face in certain national debt and tax policy reform scenarios.

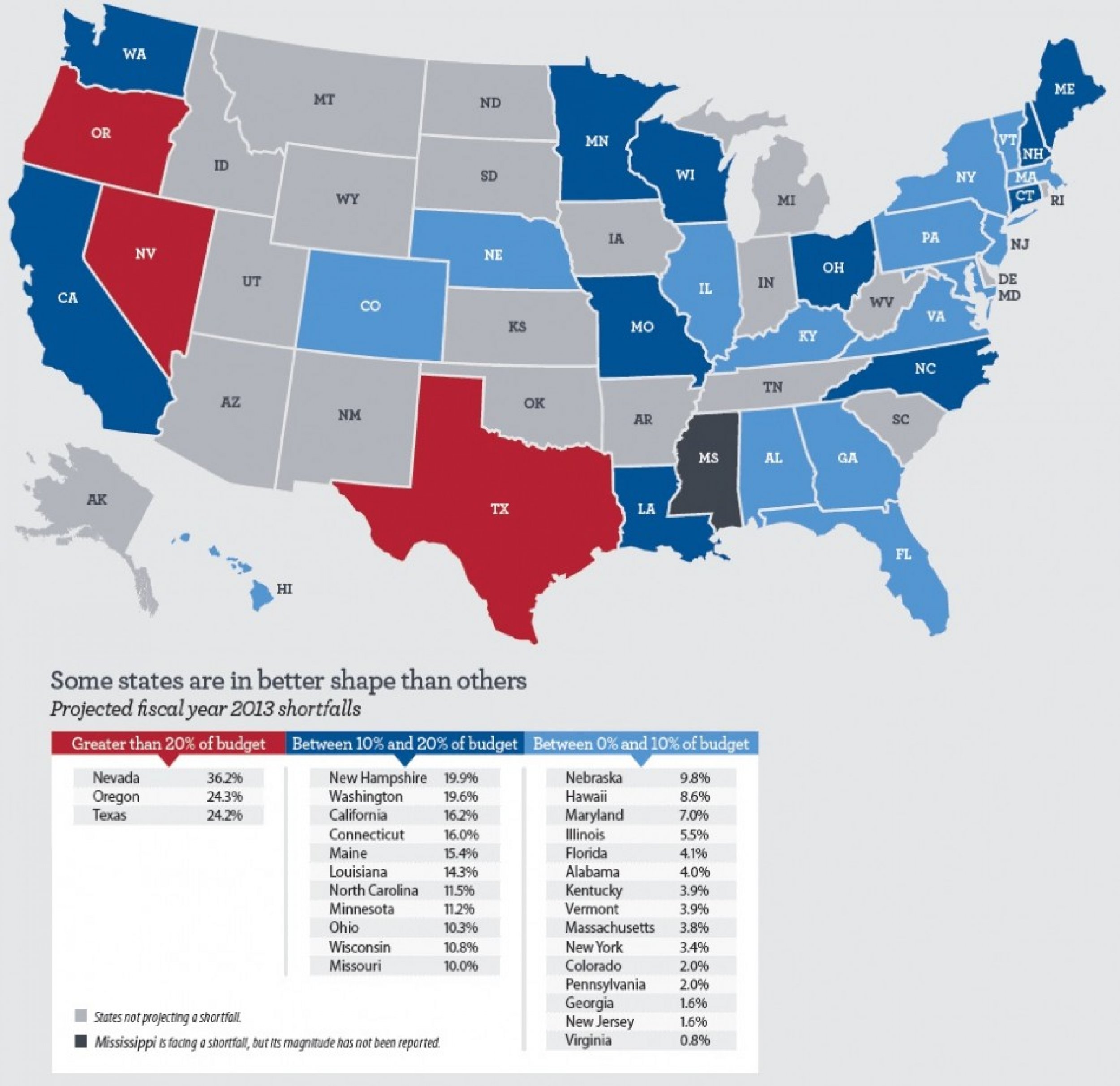

In a section dealing with sovereign and municipal debt, however, the report strays into the lesser-discussed area of state-level fiscal policy, noting that "as a lingering result of the last recession, more than half the states face projected shortfalls for 2013," with some states in the hole "more so than others."

"To get these houses in order, these states are likely to increase taxes, cut spending or both," the report states.

But superimposing the map of projected 2013 shortfalls on a map of Electoral College polling might have given the Wells Fargo team a different conclusion. It appears a disproportionate number of states projecting the worst shortfalls -- four out of the 11 with looming deficits of over 10 percent -- are battleground states, suggesting further political dynamics could be at play in those states' decisions to run high deficits. Indeed, out of the eight states deemed as Romney/Obama "toss-ups" by The New York Times, seven (Colorado, Florida, New Hampshire, Nevada, Ohio, Virginia and Wisconsin) are running busted budgets into next year. Only Iowa is fiscally balanced.

While Wells Fargo's verdict on the report is these states will somehow have to tighten their belts in their future, a more cynical assessment of their position suggests municipal leaders could exploit the "swing" nature of their localities to extract concessions and subsidies from the federal level -- no matter which party wins the presidency -- and delay the fiscal pain on their constituencies.

© Copyright IBTimes 2025. All rights reserved.