September 2013 US Auto Sales Preview: A Split Labor Day Weekend Favored August; Retail Auto Sales Seen Lowest After A Summertime Binge

[UPDATE Sept. 26, 2 p.m. EDT]

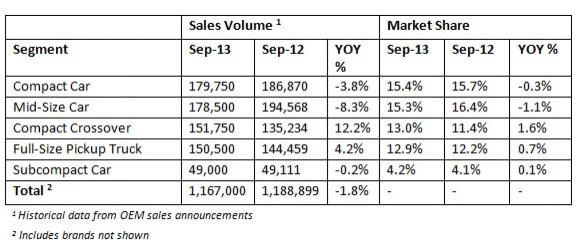

Kelley Blue Book expects U.S. vehicle sales to dip 1.8 percent in September to 1.17 million units.

“Despite the cool down this month, Kelley Blue Book forecasts sales will remain on track to exceed 15.6 million units in 2013 because of strong product introductions from automakers,” said Alec Gutierrez, senior analyst at Kelley Blue Book.

Sales of compact crossovers, such as the Honda CR-V and the Ford EcoSport, will likely see the biggest jump. Sales of the little SUVs are up nearly 22 percent this year so far. Compacts are also expected to continue to out-perform full sized sedans.

“Calendar abnormality will snap 27-month winning streak for auto industry,” says a headline from Edmunds.com, underscoring the theme of the month: that September U.S. vehicle sales are down due to the timing of the three-day Labor Day weekend, an unofficial start to the time of year when dealers are trying to clear the current year inventories and make room for next year’s models.

“The monthly SAAR [seasonally adjusted annualized rate] is up year over year, and the industry is still selling more cars per day than it did last year,” says Edmunds.com Senior Analyst Jessica Caldwell. “Many of the fundamentals that have driven strong car sales over the last year are still in place, and we can expect them to contribute to a solid final quarter to close out 2013.”

Original story follows:

Consider it the calm after the storm.

The world’s largest automakers will report softer sales in September when they report monthly figures on Oct. 1. This comes after the seasonally adjusted annualized rate in August (SAAR) topped 16 million for the first time since November 2007 -- before the auto industry crisis pummeled annual sales down to 10.4 million in 2009.

August sales were buoyed this year compared to last year because the first day of the Labor Day weekend landed on the last day of that month. Dealers tend to push sales heavily during that three-day holiday in order to begin clearing inventory ahead of the next model year. Last year, the entire Labor Day sales push arrived in September.

“Labor Day sales clearly pulled ahead from September volume and resulted in a lackluster month,” said Jesse Toprak, senior analyst for TrueCar.com, which expects U.S. vehicle sales to be down 4.4 percent to 1.13 million unit sales for the top eight auto companies. “Nevertheless, the fundamental drivers for the market demand are strong and we should have no problems reaching 15.7 million unit sales this year.”

Last year, total annual U.S. car sales touched 14.5 million. For the month, TrueCar estimates the SAAR to stand at 15.4 million while J.D. Power and LMC Automotive see a more bearish 15.2 million.

End-of-summer retail auto sales -- which excludes fleet purchases such as government or rental company procurements -- are up if you combine this month and last to account for the split Labor Day weekend sales.

“When combined, August and September retail sales are expected to be up 10.6 percent, compared with August and September 2012, which underscores the continued trajectory in growth and overall health of the industry,” said John Humphrey, senior vice president of the global automotive practice at J.D. Power.

September retail SAAR, which is a better metric to gauge U.S. new-car-buyer sentiment, is expected to be the third-lowest monthly retail SAAR this year after a slump in February and March. But that sluggishness was offset by gradually-growing demand between April and August. In short, U.S. consumers bought an increasingly higher number of cars and light trucks throughout the summer, and September has just seen buyers taking a break from their summertime spree.

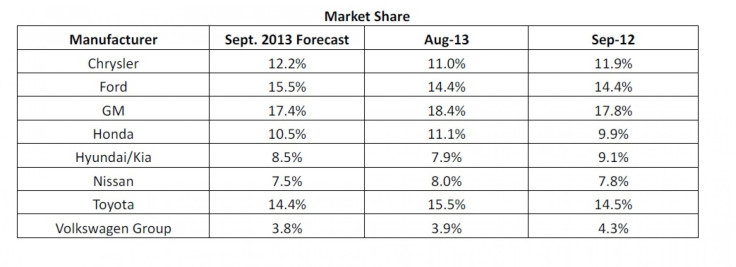

TrueCar expects Ford Motor Co. (NYSE:F) to have outsold Toyota Motor Sales U.S.A. by about 10,000 units. Ford and Toyota have been running neck-and-neck behind General Motors Co. (NYSE:GM) in recent years. Ford’s market share is expected to have risen around a basis point, to 15.5 percent while Toyota’s share is seen having dropped by about as much. Incentive spending dropped, too, according to TrueCar, though the Detroit 3 continues to spend more than their competitors to encourage people to buy their cars. General Motors Co. (NYSE:GM) sees annual sales landing in the upper 15 million figure by the end of the year.

Earlier this month, Bob Carter, senior vice president of automotive operations for Toyota Motor Sales U.S.A., told Automotive News he expects annual U.S. car sales to remain roughly between 15.5 million and 16.5 million through 2019. The general industry consensus has been that in 2018, U.S. vehicle sales would hit 17 million. The last time sales topped 17 million was in 2001.

© Copyright IBTimes 2024. All rights reserved.