Stocks were poised for a higher open, putting the S&P 500 on track to snap a 2-day drop, after better-than-expected results from Microsoft and General Electric Co propelled what has been a solid earnings season to date.

Stocks were poised for a higher open, putting the S&P 500 on track to snap a 2-day drop, after better-than-expected results from Microsoft and General Electric Co propelled what has been a solid earnings season to date.

General Electric Co topped Wall Street's profit and revenue forecasts for the first quarter, helped by strong demand for energy equipment and railroad locomotives.

Stock index futures rose on Friday, indicating the S&P 500 may snap a 2-day decline, after better-than expected results from Microsoft and General Electric Co propelled a solid earnings season.

The companies whose shares are moving in pre-market trade Friday are: Deutsche Bank, Microsoft Corp, EDAC Technologies, Goodyear Tire & Rubber, First Solar, General Electric, Advanced Micro Devices, Riverbed Technology, Sandisk Corp and Nokia Corp.

Stock index futures rose on Friday, indicating the S&P 500 may snap a 2-day decline, after quarterly results from Microsoft and General Electric Co propelled a solid earnings season.

Stock index futures rose on Friday, indicating the S&P 500 may snap a 2-day decline, after quarterly results from Microsoft and General Electric Co propelled a solid earnings season.

Futures on major US indices point to a higher opening Friday as investors awaited the earnings from major firms including General Electric Co. and McDonald's.

Since Apple introduced the first iPhone in June 2007, one question has dominated the conversation: When's the next one coming out? While Apple keeps its lips sealed until the official unveiling, there are plenty of reasons why consumers shouldn't expect a new iPhone to debut in two to three months. The iPhone 5 is coming, but it's coming in October. Here are five reasons why:

U.S. stock index futures pointed to a higher open for equities on Wall Street on Friday, with futures for the S&P 500, the Dow Jones and the Nasdaq 100 rising 0.2 to 0.4 percent.

Verizon Wireless plans to put its marketing weight behind Microsoft Corp's next mobile phone software to help develop a strong competitor to Apple Inc and Google Inc, according to the chief financial officer of Verizon Communications.

Organizers announce that Microsoft will be the official innovation provider, working on ways to use Xbox and other technology at the GOP event.

Microsoft (Nasdaq: MSFT), the world's biggest software company, reported results Thursday that beat analyst estimates for both earnings and revenue.

Stocks closed firmly lower Thursday following a choppy start, as rumors of a possible French sovereign debt downgrade and a batch of mixed U.S. data overshadowed improving corporate earnings.

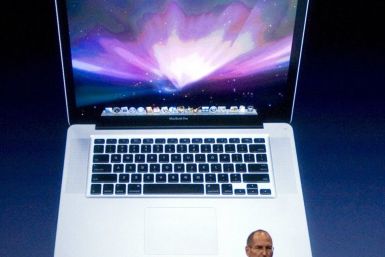

Apple will reportedly release a new lineup of MacBook Pro laptops as early as May, but many expect the advanced laptops to be unveiled in June, just in time for the Worldwide Developer's Conference in San Francisco.

Shares of Qualcomm (Nasdaq: QCOM), the biggest designer of mobile chips, plunged more than 5 percent in early Thursday trading after missing second-quarter earnings estimates.

Stocks were set to open little changed on Thursday as investors grappled with euro zone uncertainty, a raft of corporate earnings and softer-than-expected data on the domestic labor market.

Stock index futures rose on Thursday after Spain sold all of its debt at an auction and ahead of a raft of corporate earnings and economic data.

Eurosclerosis may finally have hit the technology sector.

Filmmaker James Cameron seems quite busy these days with his efforts to explore the unexplored. After making a successful dive to the bottom of the Mariana Trench, the deepest point on Earth, the Titanic-maker has now joined hands with Google executives Larry Page and Eric Schmidt in backing Planetary Resources, a mysterious company that promises to help ensure humanity's prosperity.

When Apple's shares fall, is Wall Street's entire performance at risk?

Microsoft is aiming to steal a large portion of Apple iPad sales, so much so that Apple’s market share drops below 50 percent in the middle of 2013.