Sri Lanka Central Bank Raises Rates, Targets Inflation Despite Contraction In Economy

Sri Lanka's central bank raised key interest rates to the highest in two decades on Thursday to bring down record inflation, despite the country wilting under a devastating economic crisis.

With foreign exchange reserves at a record low, the island nation is struggling to pay for essentials like food, medicine and fuel. Growth has been stifled - the economy contracted an annual 1.6 percent in the January to March period and is expected to have shrunk more in the second quarter.

Inflation though touched a record 54.6% year-on-year in June while food inflation accelerated to 80.1%, prompting the central bank to raise rates to address the rise in prices as a priority.

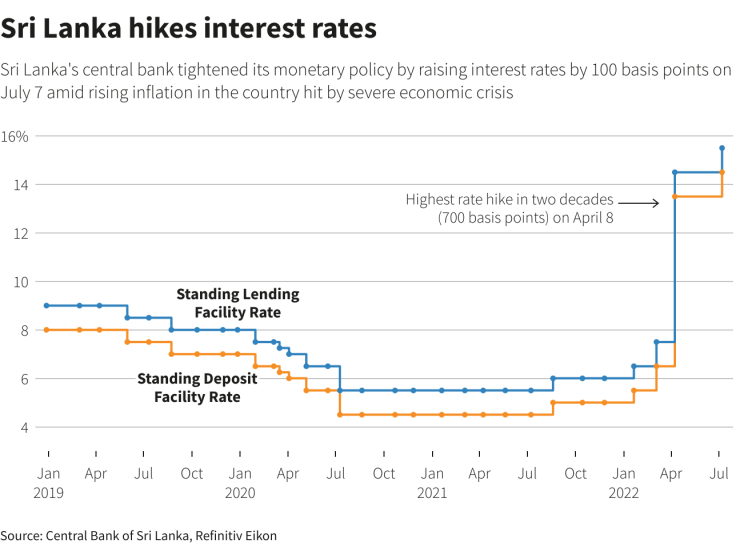

The bank increased the standing lending facility rate by 100 basis points to 15.50% while the standing deposit facility rate was similarly raised to 14.50%, the highest since August, 2001.

Graphic: Sri Lanka hikes interest rates,

"The Board was of the view that a further monetary policy tightening would be necessary to contain any build-up of adverse inflation expectations," the central bank said in a statement.

There has been significant progress made in negotiations with the International Monetary Fund (IMF) for a credit facility while negotiations are on with bilateral and multilateral partners to secure bridge financing and ease the shortfall in reserves, the central bank said.

"There has been a change in stance from the central bank, perhaps following discussions with the IMF," said Dimantha Mathew, Head of Research at First Capital.

"I don't think they are concerned about growth at all and have shifted focus to easing currency pressure and money printing to stabilise the economy," he added.

The central bank estimates a contraction in growth of 4% to 5% this year, with inflation to hit 60% by year-end, Prime Minister Ranil Wickremesinghe told parliament on Tuesday, though the government targets a smaller contraction of 1% in growth next year.

The central bank also said ensuring external sector stability and overall macroeconomic stability would require commitment from all stakeholders in the economy and it called for coherent and consistent action, including from the government.

"Faster implementation of the expected fiscal reforms aimed at strengthening government revenue and expenditure rationalisation is needed," it said, adding that improvements in the financial position of state-owned enterprises were also key.

It said these measures would over time would lead to a decline in government financing needs and help scale down monetary financing at a faster pace.

Sri Lanka is scheduled to present an interim budget to parliament in August, which will include new revenue measures and cut expenditure, Wickremesinghe told parliament last month.

The IMF indicated the need for stronger fiscal measures to put public finances back on track and boost debt sustainability following a ten-day visit to the country late last month.

Sri Lanka is pushing for a possible $3 billion extended financing programme from the IMF which would help it unlock other bridge financing options to pay for essential imports.

Sri Lanka hopes to hold a donor conference with the involvement of China, India and Japan after a staff level agreement is reached with the IMF and will present its debt sustainability framework to the global lender by August.

(Editing by Raju Gopalakrishnan)

© Copyright Thomson Reuters {{Year}}. All rights reserved.