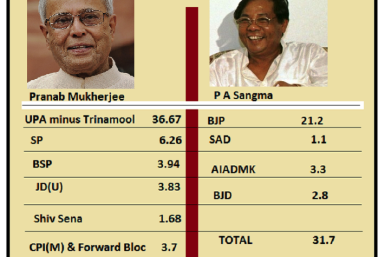

Pranab Mukherjee, ruling UPA party's nominee and former finance minister of India filed his nomination papers for the July 19 presidential elections on Thursday, in the presence of Prime Minister Manmohan Singh, Congress Party chief Sonia Gandhi and other leaders.

The newspapers that give Rupert Murdoch's News Corp. (Nasdaq: NWSA) its name may soon be on their own after the media giant's board approved a breakup that could radically reshape the global media landscape.

Asian shares rose on Thursday on encouraging U.S. economic data, but prices could falter with markets tense ahead of a European summit deeply divided on how to tackle the protracted euro zone debt crisis and stop it spreading further.

Indian Prime Minister Manmohan Singh took charge of the finance ministry on Wednesday and has initiated action to set up a unified mechanism for the ministry. The prime minister held a meeting with his key advisors and officials in this regard on Wednesday, local media reports said.

Rhode Island taxpayers are on the hook for more than $100 million over the next eight years because of the collapse of 38 Studios, Former Red Sox and Phillies pitching ace Curt Schilling's video-game enterprise, which filed for bankruptcy earlier this month

Peter Madoff has reportedly agreed to a 10-year prison term.

Latin America and China are closer than ever, and Prime Minister Wen Jiabao is touring the continent with a bucketful of money. Everybody wins? Some critics are skeptical

It's not turning out to be a good week for Morgan Stanley (NYSE: MS). Over the past few days, the bank has been embroiled in two international scandals and cut by analysts at Goldman Sachs. That follows a month that saw a major credit downgrade, participation in the fumbled IPO of Facebook Inc. and behind-the-scenes grumbling by the FDIC. The bank has lost more than one-third of its market capitalization since late March.

Refugees from Myanmar's embattled state of Kachin are suffering from a lack of humanitarian aid in China's Yunnan Province, according to a Tuesday report from Human Rights Watch (HRW).

Beverages giant Coca Cola announced Tuesday that it would invest nearly double the amount of money, along with its bottling partners, to $5 billion by 2020. The investment of $5 billion is higher by $3 billion from the earlier announcement made in November 2011 for a five-year period.

The Chinese government has spent billions to buy Japanese stocks as the euro zone crisis lingers, in an effort to diversify its investments, the AFP reported.

The 54-cent decline in the average price of gasoline over the last 3 months should add approximately $54 billion of incremental income to U.S. consumers.

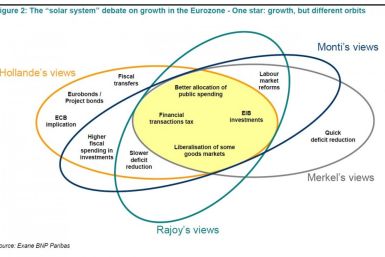

An eye-catching illustration included in a report by BNP Paribas Exane explains why the Continent's leader seem unable to solve the ever-worsening eurozone crisis: in spite of being ostensibly committed to the same goals, top policy-makers disagree on the more aggressive policies most experts believe are needed. It's almost like they're on different planets.

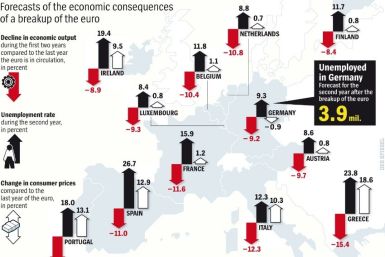

A graphic published by Der Spiegel, Germany's top newsweekly, is making the rounds among global financial blogs and Facebook walls, succinctly putting into numbers the horrific economic carnage a collapse of the common currency union would entail.

Dell (Nasdaq: DELL), the No. 3 PC maker, seeking to battle Oracle (Nasdaq: ORCL), the No. 1 database developer, has bid as much as $2.34 billion for Quest Software (Nasdaq: QFST).

The weekend brought a sobering warning from the Bank for International Settlements, which suggested that the emerging markets are facing their own version of the boom and bust cycle that brought the developed world to its knees three years ago.

China's annual growth target for 2012 looks increasingly in jeopardy as demand at home falters and Europe's debt crisis worsens, complicating matters for Beijing as the country heads into a once-in-a-decade leadership transition.

In an attempt to boost growth and save the sliding rupee, the Reserve Bank of India (RBI) Monday announced a series of measures like allowing Indian companies to borrow more money from overseas for refinancing their outstanding rupee loans.

Global rating agency Moody's said Monday that it was retaining the outlook for India's rating as stable and said slowdown in economic growth might be a short-term problem.

An inch of time is an inch of gold, but you can't buy that inch of time with an inch of gold. Does this Chinese proverb ring true in the case of Indians who invest in gold for a 'good time' tomorrow? Or is the craze for the yellow metal ruining the country's economy?

The top after-market NYSE gainers Friday were: Teva Pharmaceutical, Lloyds Banking Group, Thompson Creek Metals Company, St. Jude Medical and Flotek Industries. The top after-market NYSE losers were: Hovnanian Enterprises, MGIC Investment Corp, Astrazeneca Plc, Tejon Ranch and 3D Systems Corp.

German Chancellor Angela Merkel resisted pressure on Friday for common euro zone bonds or a more flexible use of Europe's rescue funds but agreed with leaders of France, Italy and Spain on a ?130 billion ($156 billion) package to revive growth.