Amazon.com Inc shares dropped to levels not seen since March Wednesday on concern that big spending and aggressive pricing by the No. 1 Internet retailer will hit profit during the crucial holiday season and well into next year.

Two reports released today show two groups, retail investors and professional asset managers, have been moving in markedly different directions in the past two weeks. The armchair stock pickers are getting out of U.S. equities while the pros are claiming they are dumping more cash into the American stock market.

The bulk of the job cuts (1750) will impact the investment banking unit, Cacib.

Morgan Stanley has returned $700 million to investors after its main real estate fund performed weaker than expected, reported the Wall Street Journal.

Wal-Mart shoppers witnessed Lilia Blandin being stabbed to death by her husband in the middle the store on Saturday. Wal-Mart refused

Prime Minister Manmohan Singh expects to succeed in his push to open the domestic retail market to foreign companies after regional elections conclude by the end of March.

Worries that India's evolution into an economic superpower may be overhyped and signs the government may lack the will to further dismantle a protectionist legacy drove India-themed funds to the bottom of performance league tables in November.

Freeport McMoRan Copper & Gold Inc. and its Indonesian union signed a pay deal on Wednesday to end a three-month strike that had paralysed output at the world's second-biggest copper mine, a union official and the company said.

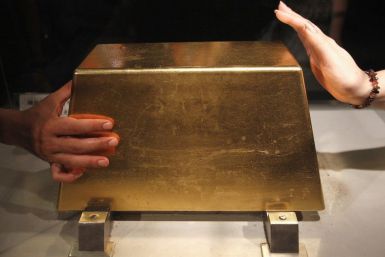

Rajesh Exports, the world's biggest jewellery maker, expects to raise gold imports by 17 percent next year to power its renewed thrust in the competitive and fragmented local jewellery market as a cushion against a volatile export market.

India's Rajesh Exports, the world's biggest jewellery maker, expects to raise gold imports 17 percent next year to power its renewed thrust in the competitive and fragmented local jewellery market as a cushion against a volatile export market, its chairman said on Wednesday.

The Federal Reserve on Tuesday pointed to turmoil in Europe as a big risk to the U.S. economy, leaving the door open to a further easing of monetary policy even as it noted some improvement in the U.S. labor market.

The Federal Reserve on Tuesday pointed to turmoil Europe as a big risk to the economy, leaving the door open to a further easing of monetary policy even as it noted some improvement in the labor market.

Retail sales grew at their slowest pace in five months in November, tempering expectations for a strong holiday shopping season.

The Federal Reserve on Tuesday left monetary policy on hold but said financial market turbulence posed threats to economic growth, leaving the door open to further easing next year.

It's an understatement to say that the Great Recession took its toll on department store chains, but there are survivors, and Nordstrom (JWN) is one.

The amount of gold held in exchange-traded products is near record highs and although the gold price is suffering from investors' desire for the safety of cash, the risk of this $116 billion stash of bullion being jettisoned is distant.

Retail sales rose less than expected in November as a drop in receipts for food and beverages weighed against stronger sales of motor vehicles, tempering some of the expectations of a strong holiday shopping season.

Samsung Galaxy Nexus is yet to hit U.S. shores officially but some lucky Android fans seem to have already acquired the highly anticipated Ice Cream Sandwich-powered smartphone from Best Buy and Verizon retail stores over the weekend.

In something akin to King James I's succession of Queen Elizabeth, menswear is poised to overtake womenswear and claim fashion's royal throne.

The top pre-market NASDAQ stock market gainers are: Urban Outfitters, Diamond Foods, Netflix, Arena Pharma, DryShips and Clearwire. The top pre-market NASDAQ stock market losers are: ProShares UltraPro Short and Amazon.

Futures pointed to a slight rebound on Wall Street on Tuesday, with futures for the S&P 500 up 0.46 percent, Dow Jones futures up 0.41 percent and Nasdaq 100 futures up 0.34 percent at 5:28 a.m. ET.

A sharp drop in bullion prices prompted some buying interest on Asia's physical market, but many remained reluctant to purchase large quantities as the year end approaches and the eurozone debt crisis threatens to further sink prices.