Global growth is slowly improving as recovery in the United States gains traction and dangers from Europe recede, but risks remain elevated and the gains are very fragile, the International Monetary Fund said on Tuesday.

The International Monetary Fund on Tuesday raised its projection of growth in the U.S. gross domestic product to 2.1 percent this year and 2.4 percent next year, from 1.7 percent in 2011.

Senate Republicans on Monday afternoon blocked President Barack Obama's Buffett Rule legislation, which would have put a 30-percent minimum tax on millionaires.

The Federal Reserve is independent but it does not exist in a vacuum, as waning appetite at the central bank for contentious bond purchases suggests.

Investment management firm Loomis Sayles' stock market forecast for 2012 and beyond is quite bullish.

South Korea's central bank on Monday trimmed its forecast for economic growth in Asia's fourth-largest economy this year due to a global downturn and weak domestic demand.

After suffering their worst two weeks of the year, stocks will look to quarterly earnings to determine whether the recent pullback has been exhausted or more losses are justified.

Reports on retail sales and housing starts in March highlight the economic calendar next week, April 16-20. Economists will be watching for any lingering signs of a positive boost from the recent warm weather, as well as indications of whether the strength in consumer demand continues.

A preliminary survey of consumer confidence for April shows the lackluster job creation seen in March is playing into people's pessimism more than economists had expected. But a recent, tiny, decline in gasoline prices, following a dizzying climb at the beginning of the year, is at least making consumers feel better about inflation and hence, expectations for the future.

The number of Americans filing for jobless aid hit a two-month high last week and more applications were received in the prior week than initially reported, suggesting a cooling in the labor market recovery.

Risky assets rose on moderate volume and moderately bad news Thursday, as investors seemed to be placing a paradoxical bet that a slowdown in economic growth would jolt the U.S. central bank into action -- inflating the prices of stocks, commodities and other assets -- while at the same time assuming the slowdown would not be so harsh as to throw the current recovery completely off track.

The Fed is also well aware that employment had peaked in each of the past two springs before resuming growth late in the year.

Stocks rose on Thursday as lower yields on some euro-zone debt eased some concerns and rumors about China's strong GDP increased investors' appetite for risk.

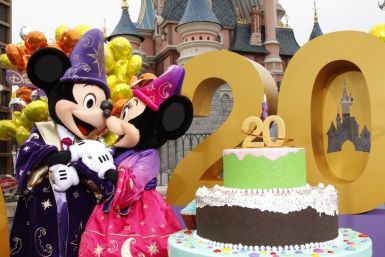

It's a not so happy birthday for Disneyland Paris as it celebrates its 20th Anniversary with serious financial woes.

Dudley said strong first-quarter data might have been the result of unseasonably warm weather in much of the United States that pulled forward some economic activity and hiring.

Stocks edged higher in early trading on Thursday as concerns about rising yields in some euro zone countries eased and on bets corporate America will beat a lowered bar of earnings expectations.

The relentless decline in home prices is nearing an end and prices should rise for the first time in seven years in 2013, but a possible new wave of foreclosures could threaten the recovery, according a Reuters poll of economists.

Stocks were set to rise slightly at the open on Thursday after futures pared gains following an unexpected rise in initial jobless claims in the latest week.

The disappointing performance of the U.S. labor market in March shows it is too early to conclude the economy is out of the woods, despite months of encouraging economic data, New York Federal Reserve Bank president William Dudley said on Thursday.

New claims for unemployment benefits rose last week to their highest level since January, a development that could raise fears the labor market recovery was stalling after job creation slowed in March.

Claims for jobless benefits rose to 380,000 last week, giving economists another piece of data to worry about after a gloomy job market showing in March. Meanwhile, a Federal Reserve report published Wednesday painted a picture of a recovery that continues to press ahead, however, modestly, amid concerns of higher fuel prices.

Stock index futures edged higher on Thursday ahead of data on the jobs market and producer prices, while a tick down in benchmark bond yields in Italy and Spain signaled easing concern about the euro zone's debt troubles.