Tariffs Take A Toll On iRobot

iRobot (NASDAQ:IRBT) turned in a remarkable performance for the second quarter, but heading into its third-quarter report, fears related to the ongoing trade dispute between Washington and Beijing had investors worried.

This article originally appeared in The Motley Fool.

As I pointed out in a recent preview, "All eyes will be on the results and the accompanying guidance for signs that the trade dispute and the resulting tariffs might spell trouble moving forward." The company reported third-quarter results on Wednesday and even though iRobot turned in a better-than-expected performance, confirmation of the impact of tariffs sent the stock plunging more than 11 percent in after-hours trading, though it closed on Thursday up about 1.5 percent.

All the right stuff

iRobot reported revenue of $265 million, up 29 percent year over year, easily topping analysts' consensus estimates of $245.11 million. Net income of $31.9 million was up an impressive 45 percent compared to the prior-year quarter, generating diluted earnings per share of $1.12, more than double the $0.48 expected by analysts.

Growth in the U.S. market was particularly robust, up 45 percent year over year, driven by the recent release of two new models: the Roomba i7/i7+ and the Roomba e5.

But that impressive performance wasn't enough to counter the bad news on tariffs.

A 5 percent hit to the bottom line

Despite all the good news, investors in after-hours trading seemed to have latched on to the bad news from the company's earnings release, which outlined the impact of China tariffs on next quarter's results. "Our full-year 2018 operating income expectation includes an anticipated negative tariff impact, of approximately $5.0 million in Q4, which was not previously included in our financial expectations."

In prepared remarks, iRobot Chairman and CEO Colin Angle expanded on the impact, saying, "The imposition of 10 percent tariffs went into effect on Sept. 24. We made the decision not to pass on those additional costs to U.S. retailers or consumers in 2018 and as a result, we expect lower gross margins in Q4 resulting from the tariff, with full-year gross margin of approximately 50 percent."

The news gets even worse: The 10 percent tariffs are scheduled to increase to 25 percent on Jan. 1, taking a toll on robotic vacuum cleaners manufactured in China.

What the future holds

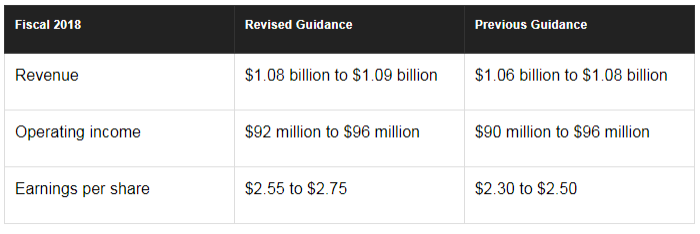

In light of the company's positive quarterly performance, iRobot raised its full-year guidance for the fiscal year ending Dec. 29.

While investors shouldn't put too much weight on what Wall Street analysts are expecting, knowing their estimates gives you a bead on what the broader market is thinking. iRobot's revised guidance placed it comfortably above analysts' consensus estimates for the year, which were calling for revenue of $1.07 billion and earnings per share of $2.44.

For the fourth quarter, analysts had been expecting earnings per share of $0.88 on revenue of $385 million, though those estimates may change.

Wall Street hates uncertainty and the realization that tariffs could significantly impact iRobot's bottom line just gave the market a big dose to swallow. Additionally, the company's decision to hold the line on prices for now ramped up investor anxiety. We'll have to wait and see how the ongoing trade dustup unfolds, but for now, iRobot's future just got a whole lot less certain.

Danny Vena has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends iRobot. The Motley Fool has a disclosure policy.