At the end of a volatile week, markets seem ready for a breather ahead of data on jobs and trade.

Earnings from major companies and key data points such as trade, jobless claims and manufacturing PMI will hold investors’ interest.

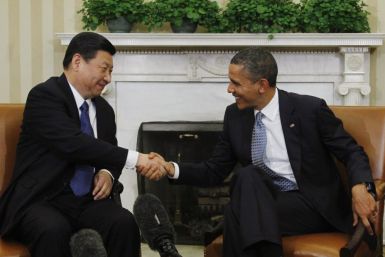

A meeting between President Barack Obama and Chinese President Xi Jinping could set the tone for a new economic dynamic.

Dow futures signal that the blue chip index will open above its recent record high.

India’s headline inflation declined sharply to 6.62% in January from 7.18 percent in December – its slowest pace in three years.

A slowdown in exports, a slump in the earnings of domestic companies and surging food prices cast downward pressure on the world's second-biggest economy in August as the China's National Bureau of Statistics reported Sunday that the Consumer Price Index rose 2 percent.

Asian markets gained this week on buoyed investor confidence with indications of an improving U.S. economy and the hopes of an announcement of stimulus measures by China to regain the economic growth momentum.

Most of the Asian markets fell Friday as investors were disappointed to note that China's trade balance for July was worse than expected, increasing concerns about the faltering economic condition.

The U.S. trade deficit in June was the smallest in 1-1/2 years as lower oil prices curbed imports, according to government data on Thursday that suggested an upward revision to second-quarter growth.

U.S. stock index futures point to a higher open Thursday ahead of the Labor Department's weekly jobless claims data and the Bureau of Economic Analysis' trade balance report.

U.S. stock index futures point to higher opening Wednesday, but investors remain watchful amid concerns that the sluggish global economy and the euro zone debt burden will hurt the earnings of companies.

Japan, which is still floundering from last year's earthquake-tsunami, is once again nearing a recession, economists say.

China's announcement of the unexpected interest rate cut this week has given an indication to market players that policymakers are increasingly rattled by the state of the economy.

Many analysts anticipated China's balance-of-trade figures for May would be OK, but the customs numbers reported Sunday were better than that expectation: Year on year, the country's exports rose 15.3 percent, and its imports rose 12.1 percent.

With Europe rattling markets and the rush to dollars, traders have dragged down Brent Crude to cap-off what looks to be its worst performance in two years.

Japan reported Wednesday a rise in trade deficit in April compared to a year earlier as the nuclear energy crisis has resulted in the increase of oil and gas imports.

Gold steadied in Europe on Thursday after falling to a four-month low in the previous session, as an uptick in the euro after Spain moved to clean up its banks and Europe's bailout fund approved a key payment to Greece took some pressure off prices.

Japan reported Thursday a record trade deficit for fiscal year 2011 as exports tumbled on account of falling global demand and a nuclear energy crisis that resulted in the rise of oil and gas imports.

Futures on major US indices point to a higher opening Thursday ahead of key weekly jobless claims and February trade balance reports from the government.

Argentina’s economy expanded at a lower rate in the fourth quarter than in the previous quarter due to a slackening in the manufacturing sector and weaker consumer sentiment.

A noticeable progress is seen in the export figures of Japan for February with global economy showing indications of recovery.

Stocks were set for a slightly lower open on Monday as economic data in China and this week's Federal Open Market Committee announcement gave investors reason to pause after a three-day rally.