US Coal Miner Bankruptcies Are Latest Sign Of Suffering For Beleaguered Energy Industry

In the latest sign of suffering for the U.S. coal industry, Alpha Natural Resources is reportedly in talks to obtain bankruptcy financing. The report Thursday arrived just a day after a second coal mining company, Walter Energy, filed for Chapter 11 bankruptcy protection.

As financial troubles mount for America’s coal companies, a wave of consolidations and asset sales may soon be underway, energy analysts say. But corporate shake-ups won’t solve the sector’s longer-term problems. With power companies increasingly shifting to cheaper natural gas and cleaner renewable energy, and with U.S. coal exports set to decline, the fate of America's coal industry is murky, experts say.

“A very significant portion of the demand is starting to dwindle,” said Edgar van der Meer, a senior analyst with NRG Expert in Toronto.

The challenge for coal companies is twofold. Prices for metallurgical coal -- the type used in steel-making -- have plunged to 11-year lows as China’s economy drags, battering miners’ profits. At the same time, demand for thermal coal for power plants is steadily sliding amid an abundance of shale gas and concerns about climate change.

Earlier this year, natural gas usurped coal as the biggest producer of U.S. electricity for the first time, the U.S. Energy Information Administration reported Tuesday. In April, natural gas produced 31.5 percent of the country’s electricity, while coal accounted for 30.2 percent.

All this comes as coal miners are grappling with debt loads in the billions of dollars -- the result of expansions and acquisitions made in recent years when the coal sector’s outlook seemed brighter.

Alpha Natural Resources had about $3.1 billion in long-term debt as of March 31. The Bristol, Virginia, company is now seeking a loan of up to $400 million to help it through bankruptcy should it file for chapter 11 protection in early August, the Wall Street Journal reported Thursday.

Walter Energy has a $3 billion debt load related to its 2011 acquisition of Canada’s Western Coal Corp. The Birmingham, Alabama, coal miner filed for bankruptcy protection Wednesday after agreeing to hand ownership of the firm to senior creditors, the Journal separately reported. Patriot Coal Corp., a West Virginia coal miner, filed for Chapter 11 bankruptcy in May, citing rising costs and liabilities.

“Coal companies are far too in debt compared to the opportunities in the market,” said Matt Preston, research director for North American coal markets at Wood Mackenzie. “There’s a structural shift in the amount of coal required to satisfy the U.S. market. There has to be some downsizing, really.”

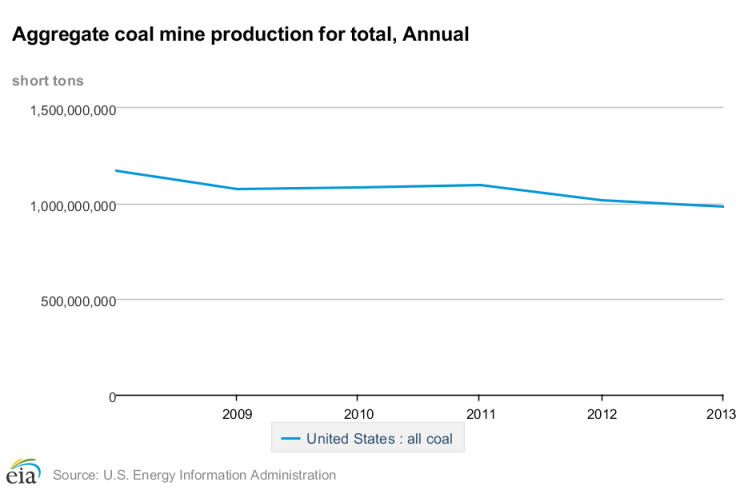

A report by the Carbon Tracker Initiative found that in the past five years, the U.S. coal industry lost more than three-fourths of its value. Peabody Energy, the world’s largest private coal company, lost 80 percent of its share price over that same period. More than 260 coal mines were closed between 2011 and 2013, the environmental group said in March.

In the short-term, the pain may subside somewhat for coal companies. Natural gas prices are expected to rise in coming months, putting them back on par with thermal coal prices. Demand for steel-making coal will likely recover when China’s economic growth rebounds.

But the coming decades will bring steep challenges for the sector. Amid growing supplies of natural gas and wind and solar energy, many operators of power plants may find it easier to shutter aging and polluting facilities rather than adhere to stringent environmental regulations. Already, 200 out of 523 coal plants have shut down over the past five years for similar reasons, the Sierra Club’s Beyond Coal campaign said this week.

The Obama administration’s proposed Clean Power Plan to curb carbon dioxide emissions will likewise discourage investments in new coal plants. If the plan takes effect, coal-fired power plants might account for only one-third of total U.S. electricity generation in 2030, down from 52 percent in 2000, federal analysts estimate, although the decline may actually be steeper.

Given such obstacles, healthier coal companies may be inclined to buy their bankrupt competitors -- not to grow market share, but to boost their chances of survival, van der Meer said.

Acquiring such firms “is a way of scaling back -- of taking up the assets and consolidating for the cost efficiencies, but not keeping the growth of the now-bankrupt company,” he said. “We see the players that remain having a stronger base from which to be competitive in the market.”

Chiza Vitta, director of metals and mining at S&P Ratings Services in Dallas, said that despite the challenges, he believes coal will continue to play an integral role in U.S. and global energy production. He said the companies that acquire steeply discounted coal assets are taking a chance that coal prices will recover and could eventually return to profitability.

“Any sale is not going to be a quick fix,” he said. “It’s a hope that things may change.”

© Copyright IBTimes 2025. All rights reserved.