U.S. Job Growth Solid In May; Unemployment Rate Steady At 3.6%

U.S. employers hired more workers than expected in May and maintained a fairly strong pace of wage increases, signs of labor market strength that will keep the Federal Reserve on an aggressive monetary policy tightening path to cool demand.

The Labor Department's closely watched employment report on Friday also showed the unemployment rate holding steady at 3.6% for a third straight month, even as more people entered the labor force. It sketched a picture of an economy that continues to expand, although at a moderate pace. The U.S. central bank's interest rate hike campaign and tightening financial conditions have left investors fearful of a recession next year.

"The economy is miles away from being wrecked on the shores of recession with the economy continuing to hire workers at this fast of a clip," said Christopher Rupkey, chief economist at FWDBONDS in New York. "It is not slowing enough to put the inflation fire out. The Fed's work is not done."

The survey of establishments showed that nonfarm payrolls increased by 390,000 jobs last month. Data for April was revised higher to show payrolls rising by 436,000 jobs instead of 428,000 as previously estimated.

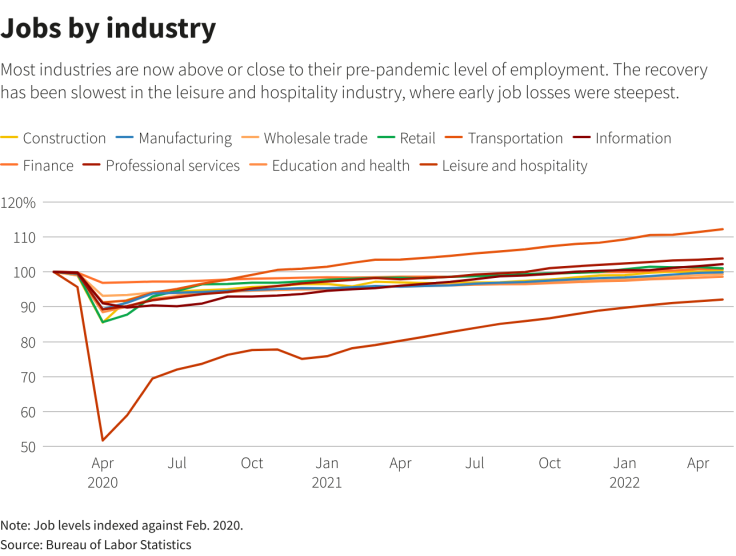

Employment now is just 822,000 jobs below its pre-pandemic level. Most industries with the exception of the leisure and hospitality, manufacturing, wholesale trade and local government education have recouped all the jobs lost during the pandemic.

Economists polled by Reuters had forecast payrolls increasing by 325,000 jobs last month. Estimates ranged from as low as 250,000 jobs added to as high as 477,000.

The broad increase in hiring was led by the leisure and hospitality industry, where payrolls increased by 84,000 jobs, with restaurants and bars accounting for 46,000 of positions. Leisure and hospitality employment is still down by 1.3 million from its February 2020 level.

There were hefty increases in professional and business services as well as transportation and warehousing payrolls. Construction employment rose by 36,000 jobs, while manufacturers added 18,000. Manufacturing employment is 17,000 below its pre-pandemic level.

The Fed is trying to dampen labor demand to tame inflation, with annual consumer prices increasing at rates last seen 40 years ago. There were 11.4 million job openings at the end of April, with nearly two positions for every unemployed person.

Average hourly earnings increased 0.3% last month, matching April's gain. That lowered the annual increase to a still-strong 5.2% from 5.5% in April. The slowdown was probably because of a calendar quirk. The 15th of the month fell outside the period during which the government surveyed employers and households for May's employment report, which could have resulted in rises in bi-monthly pay not being captured.

The Fed has increased its policy interest rate by 75 basis points since March. It is expected to hike the overnight rate by half a percentage point at each of its next meetings this month and in July. Fed Vice Chair Lael Brainard said on Thursday she saw little case for pausing in September.

U.S. stocks opened lower. The dollar rose against a basket of currencies. U.S. Treasury prices fell.

Graphic: Jobs by industry Jobs by industry -

SUPPLY EDGES UP

Details of the household survey from which the unemployment rate is derived were also upbeat. Household employment rebounded by 321,000 jobs after declining in April.

About 330,000 people entered the workforce. As a result, the labor force participation rate, or the proportion of working-age Americans who have a job or are looking for one, rose to 62.3% from 62.2% in April. A rise in labor supply is key to slowing wage gains.

Though the cries of a recession are growing louder, most economists believe the economic expansion will persist through next year. They acknowledged that high inflation was eroding consumers' purchasing power and business investment, but argued that the economy's fundamentals were strong and that any downturn would likely be mild.

The economy's outlook has also been dimmed by a weakening global environment in part because of Russia's war against Ukraine and China's zero-COVID policy.

© Copyright Thomson Reuters {{Year}}. All rights reserved.