U.S. Retail Sales Rise Strongly; Manufacturing Output Accelerates

U.S. retail sales rose strongly in April as consumers spent more on motor vehicles amid an improvement in supply and increased spending at restaurants, providing a powerful boost to the economy at the start of the second quarter.

The broad rise in retail sales reported by the Commerce Department on Tuesday suggested demand was holding strong despite high inflation and souring consumer sentiment. It assuaged fears of an imminent recession. The economy's underlying strength was underscored by other data showing production at factories accelerated in April.

Rising wages as companies scramble for scarce workers and massive savings accumulated during the COVID-19 pandemic are underpinning spending. Consumers are also increasing their usage of credit cards.

"Given this show of strength from consumers, speculation that the U.S. economy is in danger of an imminent plunge into recession looks badly misplaced," said Paul Ashworth, chief U.S. economist at Capital Economics in New York.

Retail sales rose 0.9% last month. Data for March was revised higher to show sales advancing 1.4% instead of 0.5% as previously reported. April's increase in retail sales, which reflected both strong demand and higher prices, was in line with economists' expectations.

Retail sales are mostly comprised of goods and are not adjusted for inflation, which appears to have peaked in April.

The increase in retail sales was led by receipts at auto dealerships, which rebounded 2.2% after falling 1.6% in March. That offset a 2.7% decline in sales at gasoline stations. Prices at the pump retreated from record highs in April. They have, however, since surged to an average all-time high of $4.523 per gallon as of Monday, according to AAA.

Excluding gasoline, retail sales rose 1.3%. Receipts at bars and restaurants, the only services category in the retail sales report, increased 2.0%. Clothing store sales gained 0.8% as many workers return to offices. Online store sales advanced 2.1%.

Sales at electronics and appliance retailers jumped 1.0%, while receipts at furniture stores increased 0.7%. But sales at building material, garden equipment and supplies stores dipped 0.1%. Sales at sporting goods, hobby, musical instrument and book stores fell 0.5%.

U.S. stocks were trading higher. The dollar fell against a basket of currencies. U.S. Treasury yields rose.

STRONG DEMAND

According to the Bank of America, aggregate credit and debit card spending increased 13% on a year-on-year basis in April. The bank noted that while inflation was leading to higher spending, it was "clear consumer strength goes beyond this." Consumer price inflation increased 8.3% on a year-on-year basis in April.

A tight labor market is generating strong wages and allowing cash-squeezed consumers to take a second job or pick up extra shifts, providing some cushion against inflation. Households are sitting on at least $2 trillion in excess savings, some of which are being deployed to maintain spending.

But with the Federal Reserve adopting an aggressive monetary policy stance to cool demand and curb inflation, retail sales are expected to slow later this year. The U.S. central bank has raised its policy interest rate by 75 basis points since March. The Fed is expected to hike that rate by half a percentage point at each of its next policy meetings in June and July.

Excluding automobiles, gasoline, building materials and food services, retail sales increased 1.0% in April. Data for March was also revised higher to show these so-called core retail sales increasing 1.1% instead of dipping 0.1% as previously reported.

Core retail sales correspond most closely with the consumer spending component of gross domestic product. Last month's solid rise in core retail sales suggests that consumer spending got off to a strong start in the second quarter.

GRAPHIC: Core retail sales and GDP

Strong consumer spending and robust business investment in equipment helped to underpin domestic demand in the first quarter even as GDP contracted at a 1.4% annualized rate because of a record trade deficit and a slight moderation in the pace of inventory accumulation relative to the October-December period.

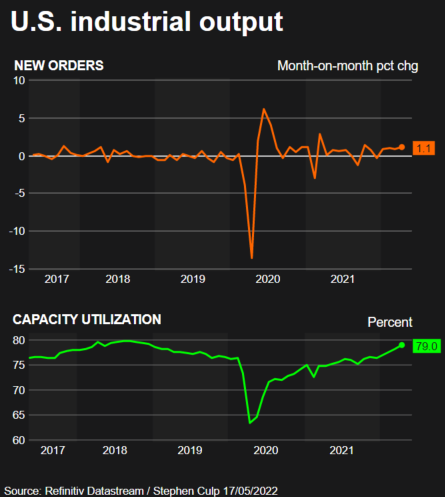

A separate report from the Fed on Tuesday showed manufacturing output increased 0.8% last month, matching the gain in March. Economists had forecast factory production would rise 0.4%. Output jumped 5.8% compared to April 2021.

Production at auto plants increased 3.9% last month after accelerating 8.3% in March. Most durable goods industries posted gains, with only nonmetallic mineral products, electrical equipment, appliances and components, and furniture and related products recording losses.

April's rise in manufacturing output combined with a 1.6% increase in mining to lift industrial production 1.1%. That followed a 0.9% advance in March.

GRAPHIC: Industrial output

Production at mines is being boosted by higher crude oil prices, which have driven the cost of gasoline to record highs. Utilities production rebounded 2.4% after dipping 0.3% in March.

Capacity utilization for the manufacturing sector, a measure of how fully firms are using their resources, increased 0.6 percentage point to 79.2% in April. That was the highest level since April 2007 and raised capacity utilization 1.1 percentage points above its long-run average.

Officials at the Fed tend to look at capacity use measures for signals of how much "slack" remains in the economy - how far growth has room to run before it becomes inflationary.

© Copyright Thomson Reuters {{Year}}. All rights reserved.