US Used Car Prices Are Falling, Which Could Drag On New Vehicle Sales

Industry watchers have been waiting for the five-year rebound in U.S. new motor vehicle sales to begin decelerating from a strong recovery pace fueled by cheap borrowing costs, and one of the first signs the market is beginning to level off would be a drop in used car prices. Lower used car prices mean less money for trade-ins and more incentive to buy used, factors that drive down new car sales.

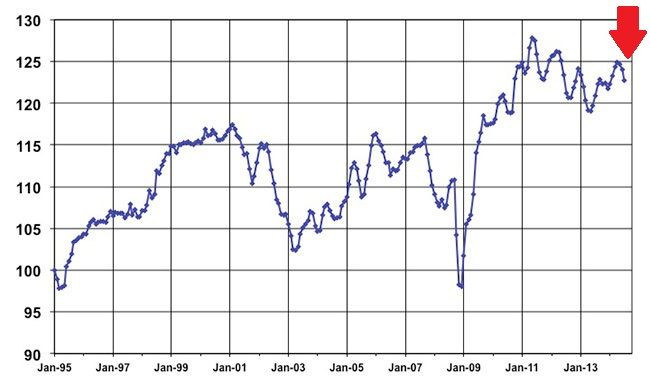

July marked the third consecutive monthly decline in used car prices, according to used car auction company Manheim, which tracks the prices of after-market autos. This slide is coming as auto companies have been increasing incentives like rebates and zero-percent financing offers to lure new-car buyers.

“We see an alignment of forces that could drive the largest decline in used-car prices in history,” Morgan Stanley autos analyst Adam Jonas said. “Used-car prices are probably the single most important metric analyzed when judging the health and well-being of the U.S. auto cycle.”

Used car prices hit a historic peak in May 2012, as recession-weary U.S. car owners squeezed out as many miles from their aging cars as possible. As the economy slowly recovered, consumers became more willing to take on additional debt. This year, new-auto sales are expected to reach pre-recession levels of about 16.2 million cars, up from 10.4 million in 2009.

But auto lending recently hit an all-time high of $902 billion, too, consumer reporting agency Equifax reported, as the U.S. Federal Reserve keeps the cost of borrowing down at historic lows. When the Fed begins pushing rates up again, which is expected to begin next year if current economic conditions remain, then borrowing costs will rise, too.

But is a three-month decline in auto sales enough to raise concerns the U.S. auto sector is peaking just as it reaches pre-recession levels and ready to take a downward turn?

“Over the medium term -- 12 to 18 months -- the answer is yes. Especially, of course, if they [used car prices] plummet,” said Nicholas Colas, chief market strategist at ConvergEx Group, a global brokerage company based in New York. “You can certainly call into question the industry’s reliance on subprime loans [loans to high risk borrowers with low credit scores] and leasing, and how long the cycle can last. That’s fair enough, especially since light vehicle demand is entering its sixth year of improvement.”

© Copyright IBTimes 2025. All rights reserved.