Volkswagen Profit Rises, But Diesel Concerns Linger

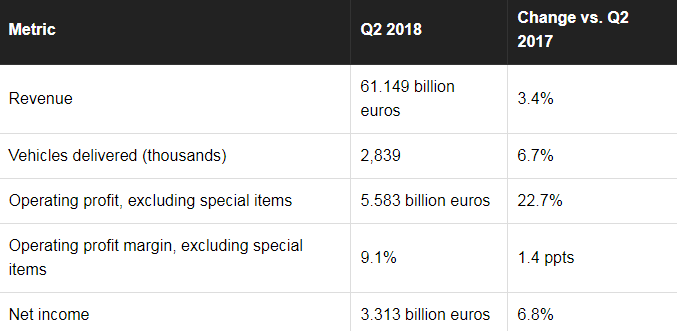

Volkswagen AG (NASDAQOTH:VLKAY) said that its second-quarter net profit increased 6.8% to 3.31 billion euros ($3.85 billion) -- despite a one-time charge of 1.6 billion euros related to the company's 2015 diesel-emissions cheating scandal.

This article originally appeared in the Motley Fool.

Excluding that one-time charge, VW's operating profit rose 23% to 5.58 billion euros, on a 6.7% increase in global deliveries. That adjusted operating profit beat the Wall Street consensus estimate of 4.98 billion euros, as reported by Thomson Reuters.

But VW's share price fell after its CEO said that an upcoming new emissions-test protocol could present significant challenges for the company.

How Volkswagen's business is performing

For the most part, Volkswagen's core business is in good shape. Sales in all of its worldwide regions were up in the first half of 2018, with strong gains in regions like China and Brazil where some rivals have recently struggled. Global first-half sales for the Audi and namesake VW brands rose 4.5% and 6.3%, respectively.

Profitability within the core brands was also strong: The VW brand's first-half operating margin was a healthy 5%, Audi's was 8.9%, and powerhouse Porsche's was a hearty 18.4%. (Porsche's operating margin still trails that of its old racing rival Ferrari, which came in at an eye-popping 23.9% in the second quarter.)

Concerns about a new emissions test

But that 1.6-billion-euro hit for the diesel issue, much of it related to a hefty fine imposed on the company by the German government in June, reminded investors that the diesel scandal has so far cost the company over $32 billion -- and there may be more consequences to come.

One indirect consequence is looming: The European Union is in the process of implementing a new, stricter emissions-test protocol. Called the Worldwide Harmonized Light Vehicle Test Procedure, or WLTP, the new protocol will test emissions and fuel economy using stricter standards based on extensive real-world data.

Testing under the new WLTP standards began for certain categories of vehicles last September. But beginning next month, all new cars sold in Europe must pass the new tests -- and CEO Herbert Diess isn't sure how quickly VW will be able to get all of its models certified for sale in Europe: "[Our] cash flow development will be impacted by WLTP in the second half. WLTP is a real challenge for our performance this year. We plan a significant reduction of vehicles and temporary storing until the WLTP homologations for these vehicles are received. This will have a substantial impact on both working capital and cash from Q3 onwards."

The problem: Any VW Group vehicles that aren't certified ("homologated," in the industry's jargon) can't be sold in Europe after the end of this month -- and it may take VW a few tries, and some engineering work, to get some of its vehicles to pass.

That's why Diess is predicting a drop in deliveries in Europe, and a dent in VW's cash flow, over the next couple of months.

Looking ahead: VW maintains full-year guidance

Despite Diess's concerns about the WLTP rollout in Europe, VW maintained its full-year guidance. It still expects:

- Global deliveries "moderately above" 2017's result (2017 result, rounded to nearest thousand: 10,741,000)

- A revenue increase "by as much as 5%" year-over-year (2017 result: 230.682 billion euros)

- Operating margin, excluding special items, between 6.5% and 7.5% (2017 result: 7.4%)

The upshot: The diesel scandal's fallout remains a drag, but VW's core business is on track and performing well.

John Rosevear has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.