What Is An ETF?

Exchange-traded funds (ETFs) have taken the investing world by storm, and investors have piled into them to take advantage of the opportunities that they provide. All told, investors have put about $3.5 trillion into ETFs as of October 2018, according to the Investment Company Institute's statistics, and hundreds of different ETFs are available for purchase.

The popularity of ETFs owes itself to their unique characteristics and features. We'll go into great detail below about what ETFs are and why they're useful for investors, but above all, ETFs have opened the door to a wide variety of investments to which many investors had never before been able to gain access. With their efficiency, diversification, simplicity, and broad focus, ETFs have benefits that no other investment vehicle can match.

What are ETFs?

Exchange-traded funds are baskets of different types of investments that are pooled together into a single entity, which then offers shares to investors that are subsequently traded on major stock exchanges. Each share of an ETF gives its owner a proportional stake in the total assets of the exchange-traded fund.

ETFs generally track various benchmarks, with each fund investing with the objective of matching the returns of the benchmark that the fund has chosen. There are a few ETFs that have portfolio managers that actively select their own investments, but because of the disclosure rules that require such funds to tell investors about their holdings on a daily basis, most managers who want to manage money using active management strategies choose vehicles other than ETFs.

Most ETFs are considered to be registered investment companies for tax purposes. That means that they rarely pay any corporate taxes at the fund level, but any taxable income that they bring in is required to be passed through to their shareholders. For instance, ETF investors who focus on funds that invest in dividend-paying stocks are entitled to receive their proportional share of the dividend income that the ETF generates from its investment portfolio. Funds typically accumulate dividends over short periods of time and then distribute the total at regular intervals, such as quarterly or annually.

One unique aspect of ETFs is how shares get created and redeemed. Rather than working directly with shareholders, most ETFs use special market makers to facilitate trade. These market makers can create new ETF shares by purchasing the underlying stocks or other investments held by the fund and delivering them to the ETF company, which in turn issues shares that the market maker can sell. Conversely, the market maker can deliver a large block of ETF shares to the fund company and get the corresponding investment securities back in kind. This structure ensures that the market for ETFs remains efficient, and it also contributes to some of the tax advantages you'll learn about in more detail below.

Why do so many investors like ETFs?

The advantages of ETFs have contributed to their nearly ubiquitous use in the financial markets. The biggest benefit to investors of ETFs is that you don't need to have a lot of money to invest in exchange-traded fund shares, and each share gives you exposure to a well-diversified portfolio of investments. Most ETF shares trade for $100 or less, but even one share will give you a small fractional interest in dozens or even hundreds of different companies. By contrast, if those with limited money to invest instead decide to buy shares of just one or two individual stocks, then they risk losing everything if something bad happens to those particular companies. Of course, they also have the opportunity to see dramatic returns if those individual companies do particularly well, which is less likely with a well-diversified ETF. Nevertheless, most investors are more comfortable with the steady profit potential that exchange-traded funds offer.

Besides their ease of access, you can find ETFs that cover almost the entire range of available investment assets in the financial markets. Stock ETFs are by far the most common, but you can also find funds that target other asset classes. Bond ETFs, commodity ETFs, foreign exchange ETFs, and hybrid ETFs that mix and match multiple types of assets are readily available if you want exposure.

In addition, the way that ETFs target those asset classes differs. Some ETFs aim to give you the broadest possible swath of investments in a given asset class, seeking to offer an entire market in a single fund. Other ETFs drill down on particular subsectors of an asset class, letting you benefit from trends that favor one industry or type of company over rivals or companies in completely different areas of the market. Given that there are so many ETFs on the market, the odds of finding one that matches up with your particular desires for investing are better than you might think.

For budget-conscious investors, ETFs also offer a fairly cost-effective way to invest. Most ETFs don't charge extremely high management fees, because the responsibilities that the fund manager has are limited to doing whatever's necessary to track the performance of the index that the ETF has chosen as its benchmark. That saves ETFs the cost of paying investment professionals to pick certain investments over others in the hopes of outperforming the market. When you compare the typical fees that ETFs charge to those of similar options for diversified exposure to a particular asset class, you'll often find that the ETF offers the lowest-cost option available.

The only thing to keep in mind on this final point is that there are some costs that are unique to ETFs. Because ETF shares trade on exchanges, you'll usually have to pay a commission to your brokerage company in order to make purchases and sales of given ETFs. Yet in part because of their popularity, many ETF providers that also have affiliated brokerage companies allow their own brokerage customers to buy and sell ETF shares at no commission. That gives both the ETFs and the brokerage division a competitive advantage over their rivals. Yet even if you do end up paying a commission, the rise of discount brokers has made it a lot less painful to bear that cost than it was in the distant past.

ETFs vs. mutual funds: What's the difference?

Many investors who are just getting acquainted with ETFs already have some experience with mutual funds. That makes sense because the mutual fund market is older and quite a bit larger than the ETF market. Even with the rise of ETFs, mutual fund assets dwarf them, with more than $18.4 trillion in assets as of October 2018. However, the mutual fund market has grown less than 1% over the past year, compared to nearly 7% growth for ETF assets, so ETFs are closing the gap.

Mutual funds have a lot of similarities to ETFs. They're pools of investments that match up with a given investment objective, and investors can buy shares of mutual funds in small dollar amounts to get access to a diversified portfolio of investment holdings. Index mutual funds track specific benchmarks just like most ETFs do, but there are more actively managed mutual funds than there are actively managed ETFs. Mutual funds are also treated as regulated investment companies in determining income tax liability, and you can find a wide variety of mutual funds that cover asset classes including stocks, bonds, and cash as well as certain other types of investments.

Like ETFs, mutual funds pass their costs through to their investors, and the expenses for index mutual funds are fairly similar to what an ETF investor would pay. Yet that's where some of the similarities end, because actively managed mutual funds are in a completely different league in terms of cost. Typical actively managed mutual funds charge roughly 1% of investors' assets every year. That compares to less than a tenth that much for a wide swath of ETFs, as well as index mutual funds. The drain on your investment returns that the fees for active management represents is one of the biggest contributors to the relative growth of the ETF industry compared to mutual funds.

One key difference between mutual funds and ETFs is when you can trade shares. For mutual funds, you're only able to buy and sell fund shares as of the close of regular trading on weekdays. Even if you enter an order first thing in the morning, nothing happens until the end of the trading day. That can create huge lags that in turn can cause you to get a much different price for your mutual fund shares than you had initially expected at the time you entered your purchase or sale order. By contrast, because you can trade ETFs any time the market's open, you're able to react quickly to news that moves the market. Sometimes, that can mean capitalizing on a favorable opportunity that might well have disappeared by the time the market closes.

Also, mutual funds have some negative tax attributes that most ETFs are able to avoid. Especially for mutual funds that are actively managed, when the fund sells shares of its holdings at a profit, it has to distribute the resulting capital gains tax liability to its shareholders. These distributions typically happen at year-end, and if you hold your mutual fund shares in a regular taxable account, then you can end up having to pay substantial amounts of capital gains tax as a result. This is true even if you automatically reinvest the distribution into additional fund shares. The IRS won't hesitate to tax those mutual fund capital gains distributions -- even if you never touch the cash. As you'll see in more detail below, ETFs are able to avoid some of these tax pitfalls, allowing investors to keep more of their hard-earned money.

What's the difference between an ETF and a closed-end fund?

Less well-known than mutual funds or ETFs are closed-end funds. This relatively small $270 billion market mixes some attributes of mutual funds and ETFs. Closed-end funds are structurally similar to mutual funds, and they've been around a lot longer than ETFs. However, closed-end fund shares trade on stock exchanges, giving you the same advantages of immediate trading access that ETFs provide.

The big difference between ETFs and closed-end funds is in the number of total shares outstanding. Exchange-traded funds have mechanisms whereby certain market participants have the ability to create or redeem large blocks of ETF shares with the financial institution that manages the ETF. As a result, when there's high demand for ETF shares, these market participants can go to the ETF manager and make a block purchase of shares that it can then turn around and sell to individual investors on the exchange.

By contrast, with closed-end funds, there are only a fixed number of fund shares available at any given time. The company that manages the closed-end fund does not have the ability to issue new shares at will. Instead, any subsequent offerings of shares have to be handled in the same way that a publicly traded company issues new stock in secondary offerings, with registration and regulatory requirements.

Because closed-end fund companies rarely choose to do that, supply and demand considerations among investors seeking out a fund play a huge role in the price of closed-end shares. If everyone's interested in a particular fund, then those shares might well trade at a premium above what the proportional value of the fund's underlying assets would suggest is the appropriate number. If a particular fund falls out of favor, then the shares can trade much more cheaply than the value of the assets held within the fund. Because fund investors can't demand that the fund turn over its underlying investments, these premiums or discounts can persist for years.

Closed-end funds have mostly fallen out of favor, because they tend to be actively managed and have fees that are even higher than their traditional mutual fund counterparts, let alone typical ETFs. Nevertheless, there are some areas of the financial markets in which closed-end funds continue to prosper. ETF investors can usually get a better deal by seeking out exchange-traded funds with similar investment objectives.

How do taxes work with ETFs?

As mentioned above, ETFs typically pass through the tax attributes of the income their investments generate. If an ETF holds stocks whose dividends qualify for favorable tax treatment, then shareholders will get the benefits of that treatment. Similarly, holders of ETFs that invest in tax-free bonds don't have to pay income tax on the interest payments they receive from the ETF.

ETFs have some key tax advantages over mutual funds. ETFs and mutual funds are both required to pass through any tax liability to their shareholders on an annual basis, but mutual funds tend to make trades in their investment portfolios more frequently than ETFs. That results in greater capital gains tax liability that gets passed through to mutual fund shareholders year after year. Conversely, ETF investors are largely able to avoid having to pay taxes related to capital gains during the period as long as they hold on to their ETF shares.

What types of ETFs are there?

ETFs are broken into various categories:

- Stock ETFs focus on owning individual stocks.

- Bond ETFs primarily own bonds.

- Commodities ETFs put their money into various commodity-linked investments.

By far, the majority of assets in ETFs are invested in stock funds, with less than 20% going into bonds, commodities, and hybrid-style ETFs.

There are further subdivisions in these categories. For stock funds, nearly three times as much money is invested in U.S.-focused stock ETFs than in international or global stock ETFs. Out of almost $2.1 trillion in money dedicated to U.S. stock funds, about $1.7 trillion is in broad-based ETFs that seek to cover wide swaths of the entire stock market. By comparison, only about $375 billion is invested in more focused ETFs that drill down on specific sectors or industry groups within the market.

Most stock ETFs weight their holdings by the market capitalization of the companies they hold, so a fund's position in a stock with a market cap of $10 billion would be twice that of another stock with a $5 billion market cap. However, there are notable exceptions to this rule, with some using equal-weight strategies while others use different fundamental business metrics like earnings or dividends to decide how much of each stock to own.

In addition to these categories, there are some other kinds of ETFs you should be familiar with:

- Leveraged ETFs offer returns that are some multiple of the return of the underlying index. For instance, one popular leveraged ETF is set up to generate daily returns that are equal to twice the return of the S&P 500 index. If the S&P climbs 1% in a day, then the ETF should rise 2%. If the index falls 1%, then the ETF will lose 2%.

- Inverse ETFs are set up to move in the opposite direction of the underlying index. For instance, an inverse S&P 500 fund would rise 1% if the S&P fell 1% on that day, but the ETF would lose 1% if the S&P rose 1%. Inverse ETFs can also be leveraged to produce some multiple of the inverse of the daily return of the index.

There are also some exchange-traded products that aren't funds at all. Some financial companies structure products as debt, with exchange-traded notes being available on major stock exchanges just like ETFs. ETNs share a lot in common with ETFs, but one key distinction to understand is that ETNs represent debt obligations of the company that sponsors them. There's therefore credit risk involved, and unlike how most ETFs work, an ETN doesn't actually have to hold any assets related to the index that it tracks.

4 simple tips to find the right ETF for you

With hundreds of different offerings to choose from, there's no perfect set of ETFs that's right for everyone. However, in order to come up with a customized list of ETFs that fit your own particular investment strategy, you'll want to consider following this four-part plan:

- First, decide how much of your money you want to allocate very broadly across asset classes. For instance, investors seeking a balanced investing approach with a slight bias toward faster growth might decide to put 60% of their money into stock ETFs and 40% into bond ETFs. More conservative investors would likely put less money into stocks, while those seeking more aggressive growth could reduce their bond ETF allocations.

- Second, figure out whether you're comfortable with broad exposure to the entire stock or bond market, or if you'd prefer to have a more discerning approach to investment selection. It's easy to find broad exposure through ETFs that track some of the most popular stock and bond market indexes in the market, such as the S&P 500 or the Dow Jones Industrial Average. Picking individual sectors or industry groups gets a lot more customized, but you can generally find ETFs that will get the job done.

- Third, unless there's a compelling reason to do otherwise, eliminate any ETF that charges more than 0.10% in expenses. It might seem overly miserly to insist on this step, but once you build up a sizable nest egg, even small percentages going to expenses add up to a lot of money. Having $1 million invested in an ETF can save you a boatload of money compared to the $10,000 per year that a mutual fund with a 1% expense ratio would charge -- but even 0.10% means $1,000 going out of your hands into the pockets of your ETF provider each and every year. As you'll see below, there are some circumstances in which it's impossible to find a good ETF with that low an expense ratio that covers the specific area you're interested in, but even then, finding the lowest-cost provider available is a valuable exercise.

- Last, once you've identified low-cost ETFs that match up with the investment objectives you think will do best over the long run, see if you can score any deals that will reduce your fees even further. If you like ETFs from a particular family of funds, see if there's a way to get access to those funds without paying commissions. Especially if you want to make regular additions to your investment account, finding a commission-free option can save you thousands over the course of your lifetime.

Obviously, where you end up going through these steps will be a lot different from what another investor might choose. But neither of you is wrong. As long as you're comfortable that the ETF you've selected will give you exposure to investments you think will do well, then following the simple four-step process above should give you good candidates.

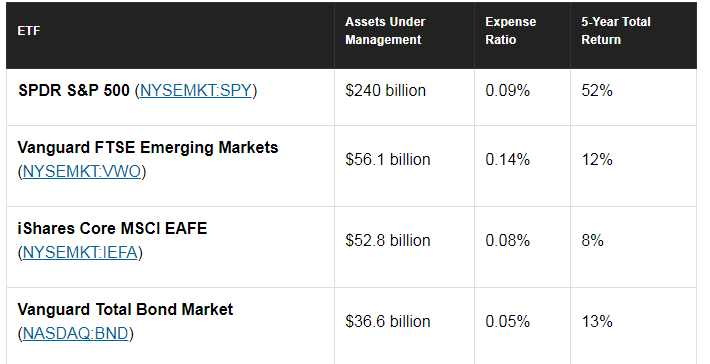

To help give you a sense of which ETFs are most likely to fit with these criteria, you'll find four solid choices below.

Each of these ETFs covers a different part of the investing universe. The SPDR S&P 500 was the first major exchange-traded fund available to investors. It aims to match the return of the S&P 500 Index by owning all 500 of the U.S. companies that are its components.

By contrast, the Vanguard and iShares ETFs listed above focus on international stocks, with the Vanguard fund looking at emerging market economies while the iShares fund owns shares of companies based in established developed-market economies. Note that the emerging markets ETF has an expense ratio above the 0.10% threshold mentioned earlier -- that's because investing in these small international markets is more expensive than making similar investments in the U.S., but rest assured that the Vanguard ETF's expenses are among the lowest available in this category of ETFs.

Finally, the Vanguard bond ETF owns a broad swath of fixed-income securities. These include Treasury bonds, debt issued by various government entities, and corporate bonds representing company borrowings.

Don't let their returns trick you: despite being a tough time for international stocks and the bond market, these funds have held up well compared to their peers.

Take a closer look at ETFs

ETFs are a great way to invest for the long run, and their combination of long-term growth and low costs can make them a valuable tool in anyone's investing strategy. Going through the universe of ETFs can seem like a daunting task, but, in reality, there are dozens of great ETFs that can all help you reach your financial goals successfully.

This article originally appeared in the Motley Fool.

Dan Caplinger owns shares of iShares Core MSCI EAFE ETF and Vanguard International Equity Index Funds. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.