The 2008 Recession Could Resurface, And Here's Why Crypto Might Be A Solution

The financial crisis of 2008 is among the most crippling monetary disasters the world has ever experienced. It exposed the shortcomings of financial institutions and banks, and it left people yearning for a better monetary system. Back then, people kept their returns in banks for security purposes.

During the well-known recession, banks used their customers' money to fund investment projects, some of which never paid off. Moreover, citizens failed to repay the loans offered by the banks, which forced the hands of governments to bail out financial institutions from bankruptcy. As the global economy is interconnected, these events almost brought the entire world's economy to a halt. And so, investors and merchants brought forth queries about whether saving their earnings in financial institutions was even the right call.

A Brief Outlook on the 2008 Recession

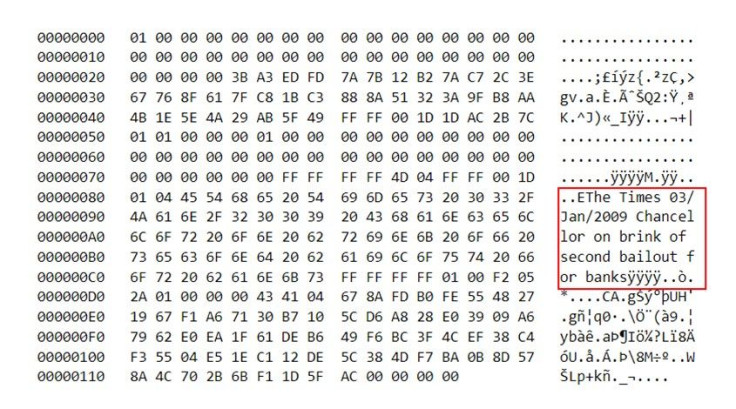

Some of the factors behind the recession events included deregulation, securitization and lending standardization in the financial space. In order to bring solutions to these issues brought about by financial institutions, handy developments such as cryptocurrencies, specifically bitcoin, came into the light.

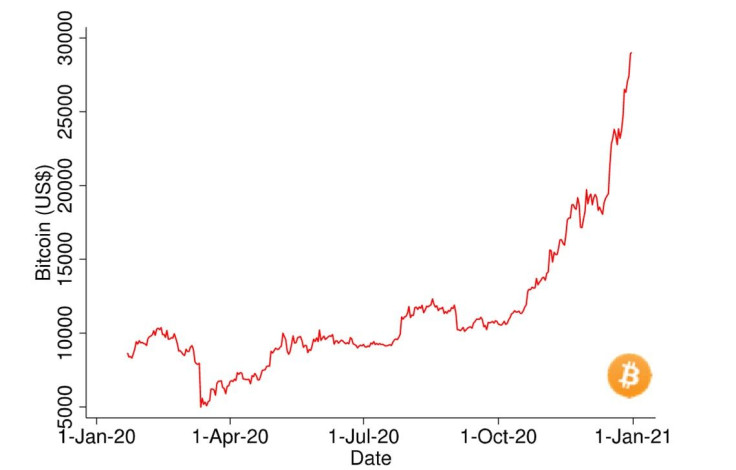

Bitcoin being the first of its kind, cryptocurrencies have proven their resilience in surviving financial struggles over the years. A clear example was the COVID-19 pandemic in 2020 that crippled the global financial economy while crypto thrived.

Cryptocurrencies could survive a recession, with experts predicting an upcoming recession fostered by global issues like the Ukraine war, the pandemic and rising inflation.

The Impending Recession

Huge monetary and fiscal cliffs are currently being witnessed in the U.S. economy. Considering the war in Eastern Europe, these cliffs are getting steeper. The Ukraine war exacerbates a negative supply that had already been initiated by the recent pandemic. A contraction in global growth is predicted with rising inflation.

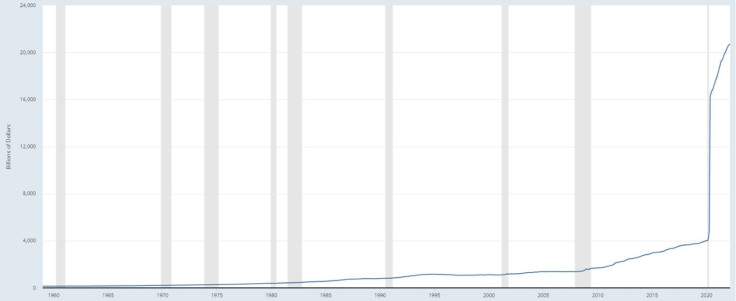

Considering that Russia is a producer of 12% of global oil supply and Ukraine accounts for 25% of global wheat production, the war and sanctions will slow the economy. Also, in the wake of the recent pandemic, the national debt vaulted over $30 trillion, soaring the debt to GDP ratio to 125%. Consumption is at 70% of GDP, meaning that the economic growth rate is going to plunge.

Following the current events happening all around the globe, a recession event is likely to occur in the coming years. Regardless, cryptocurrencies can be used to curb most of these issues. Even Michael Hartnett, the chief investment strategist at the Bank of America, noted that a recession shock is coming based on the current inflation rates.

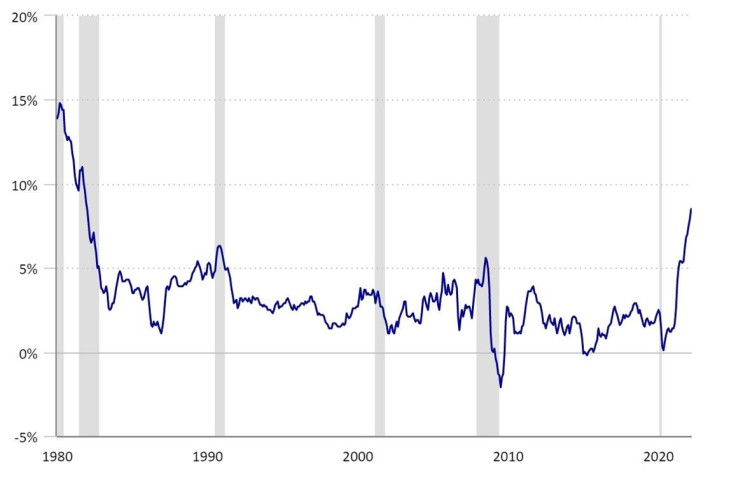

Despite other recession events happening over the years, solutions in curbing the root factors of these events have been realized. Following the recent government report last month, an 8.5% surge was witnessed in the consumer prices in March, a pace only seen in December 1981. Even though the last recession was sparked by the recent pandemic, the major reason behind the upcoming recession will be rising inflation.

Recession events across Europe are likely inevitable considering the Ukraine war that might escalate, considering Germany fiercely resisting pulling the plug on Russian gas and oil. The China region of Asia might also be facing a recession already, with the COVID-19 lockdowns threatening to slow down the economy.

Below are ways how cryptocurrency could circumnavigate the problems that arose:

Transparency

Transparency is a crucial part of a stable economy. Banking institutions are never clear about how they handle their customers' funds, and as such, some individuals have lost trust in them. Being among the issues associated with the recent recession events, cryptocurrencies offer a way out based on their transparent nature.

Considering that blockchains are more transparent and immutable, such factors could expose financial institutions that commit fraud. Instead of the central bank constantly following each bank's records, the ledger data can be traced easily, stopping similar financial crises from happening.

Being a fact for most regulations, security regulations usually result in obfuscated information availed to the public, yielding to unintended consequences. The prohibitive costs ensure the company data and info stays opaque, incentivizing wrong behavior. However, blockchain technology can curb this issue as it is an immutable distribution ledger. All transaction histories are open to the public using the technology.

The blockchain has ushered in an era of financial transparency. Crypto markets and blockchain technology give a window into an economy where transparency, not regulation, serves everyone better.

Genuine Trust Empowering the Masses

Financial institutions and governments normally detect contractions and expansions in the monetary supply. Keeping that in mind, digital currencies include the masses as part of the financial system. These cryptocurrencies connect the global economy and assist in providing economic recession solutions in poorly banked states. It is also possible to make currency exchanges across borders, and the traditional monetary system exposes unfair lending practices.

Considering the complete trust most people had in financial institutions, too much trust is bestowed on financial institutions such as banks, who in turn conduct shady activities. Regardless, the crypto space seeks to enhance genuine trust by eliminating shady record-keeping and funds management. The blockchain network uses nodes to approve transactions before being recorded in the ledger. To include a transaction, all nodes must agree. Otherwise, any disagreement in nodes approved might render the transaction ineligible.

Inflation Proof Cryptocurrencies

Central banks all over the world have the mandate and power to print money at any given time. As such, the supply of fiat currency is unlimited. The result of this is rising inflation, which might, in turn, cause a recession event much sooner. It happens when the quantity of fiat currency exceeds the demand. Inflation events hamper a country's population productivity, which in turn results in a negative GDP.

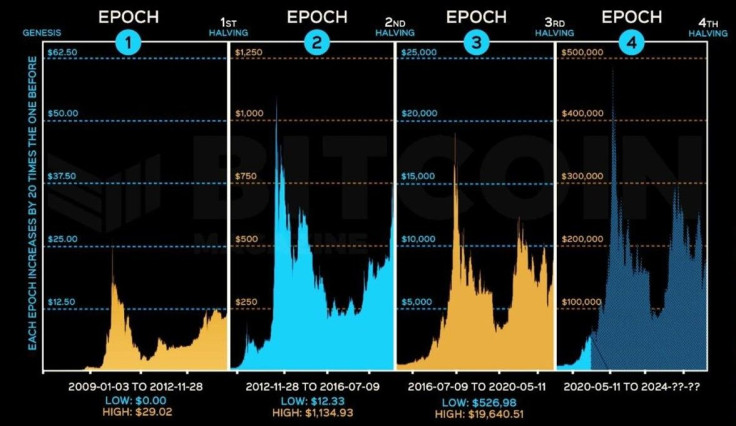

However, cryptocurrencies' market supply remains constant (in most cases), eliminating any chances of inflation. Take bitcoin for example. The biggest cryptocurrency is limited to only 21 million coins, and mining it gets difficult after every halving event. Regardless, the coins in supply will never exceed the demand for the coin, considering it is the most valuable crypto in the digital currency market.

Decentralization of Financial Services

Centralization of the services offered by the financial institutions was among the reasons behind recession events. However, most cryptocurrencies are decentralized in nature, ensuring that digital assets are free from government control. Part of the reason behind the global financial crisis back in 2008 was minimizing lending requirements and low-interest-rate policies that had people taking huge loans.

Central banks all over the globe have had control over economies for a long time and set policies that have direct impacts on the economy. Even controlling money supply and money in circulation leads to recession.

Policies on interest rates, such as low rates on loans, would result in an increase in mortgages. The central banks use these sets of policies to achieve their goals. Being decentralized, crypto has the power to improve scarcity and eliminate the centralization of the bank services. It does this while still maintaining a stable economy with an available cash balance. The decision-making process is also distributed, in turn circumventing a recession crisis.

Cryptocurrencies, a Possible Solution to the Financial Problems

Huge monetary and fiscal cliffs are currently being witnessed in the U.S. economy. Considering the war in Eastern Europe, these cliffs are getting steeper. The Ukraine war exacerbates a negative supply that had already been initiated by the recent pandemic.

A contraction in global growth is predicted with rising inflation. Consequently, people would almost automatically be looking to save their funds in banks, which might not be the best of ideas.

Nevertheless, cryptocurrencies present solutions that circumvent the challenges financial institutions face, especially the central banks. Adopting the use of cryptocurrencies might just be the only solution to curb recession events that might cripple the economy in the future.

Rahul owns no cryptocurrencies.

International Business Times holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

© Copyright IBTimes 2025. All rights reserved.