What Is Bitcoin Halving And When Is The Next One Coming? Bitcoin's Rarity Explained

KEY POINTS

- The next Bitcoin halving is expected in 2024

- The halving will drop the BTC mining rewards to 3.25 BTC

- Nearly 90% of the entire supply has already been mined

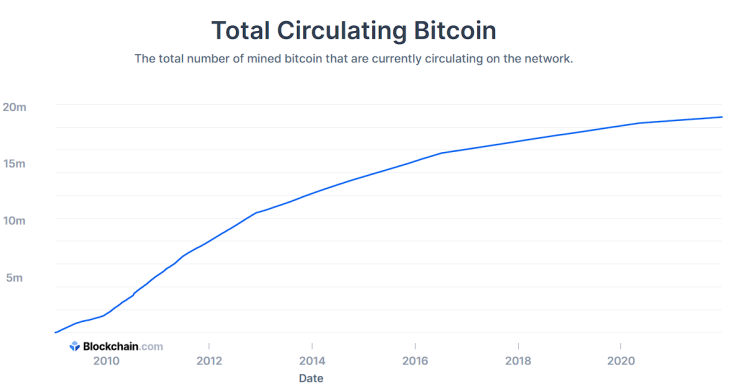

Bitcoin's lure is primarily based on its limited supply - only 21 million BTC tokens can be mined ever. About 90% has already been mined in just over a decade but the last of the Bitcoin is a long long time away.

The answer lies in a periodical process called halving — the halving of the rate of supply of new coins and the fee for miners for validating coin creation roughly every four years.

Having a fixed supply is one of the main reasons why BTC is considered a deflationary asset and a hedge against inflation by supporters like Raoul Pal, the CEO of Real Vision.

I don't think he gets true demand push inflation but he will get fiat devaluation, in conjunction with the other central banks all on the same mission.

— Raoul Pal (@RaoulGMI) August 28, 2020

Overall, I think #Bitcoin outperforms gold. Gold can go up 2x or 3x or even 5x while bitcoin can go up 50x or even 100x.

Mining, rewards and halving

Bitcoin mining is the process of validating transactions by solving complex computational problems. Rigs that mine Bitcoin consume large amounts of electricity and to make it economically feasible for miners, they are given block rewards.

At the start of Bitcoin's journey in 2009, each block reward was worth 50 BTC, i.e., for mining each block in the Bitcoin blockchain, miners were given 50 BTC. After the creation of every 210,000 blocks, the reward would halve. This process takes almost four years, leading to four-year Bitcoin cycles.

Every Bitcoin halving in history has led to a price surge for the token. For example, after the Bitcoin halving in May 2020, the token went on to create new all-time highs in May and November. Bitcoin mining rewards act as incentives. However, the economic feasibility and relative ease of mining are gradually decreasing.

"Just like there's a limited amount of gold on Earth, the amount of Bitcoin is limited to 21 million," Buchi Okoro, CEO of Quidax, an African cryptocurrency exchange, told BusinessInsider. "You could almost think of Bitcoin as a natural resource, but for the internet. That's why it's called 'digital gold.'"

As per data from CMCMarkets.com, the block reward was 50 BTC when around 50% of the entire supply was mined. On the other hand, in the first halving on Nov. 28, 2012, around 75% of the supply was mined and the reward was 25 BTC.

In the next halving of July 9, 2016, the block reward was reduced to 12.5 BTC and over 87.5% of the supply was completely mined. The latest mining event that took place in 2020 dropped the BTC reward to 6.25 BTC.

HODL #bitcoin pic.twitter.com/yJgf6N0rMD

— ChartsBTC (@ChartsBtc) December 18, 2021

Bitcoin fourth halving: BTC becomes rare

The data from TheHalving.com shows that the next halving event is expect in 868 days, or end of April 2024 when the block reward will drop to 3.125 BTC at block number 1,050,000. The current circulating supply for the world's biggest cryptocurrency stands at 18,905,682 BTC and 125,091 blocks are left to be mined by 2024.

As of now, nearly 10% of the entire supply of the world's biggest cryptocurrency is left to be mined.

This means that the competition among miners will increase and the energy consumption will surge. The mining process will become increasingly difficult for individual miners because of the decrease in mining reward and increase in investment in electricity.

By 2024, it is expected that 96.875% of the supply will be mined followed by around 99.21875% in the halving event of 2031. The block reward will be reduced to 0.78125 BTC, making Bitcoin mining a low-profit activity for miners.

Some 90% of the entire supply has already been mined and it seems that the rarity of the token will drive the prices in the future. Currently, Michael Saylor's MicroStrategy owns nearly 0.6% of the entire supply — a total of 122,478 bitcoins acquired for ~$3.66 billion, making him one of the biggest owners.

MicroStrategy has purchased an additional 1,434 bitcoins for ~$82.4 million in cash at an average price of ~$57,477 per #bitcoin. As of 12/9/21 we #hodl ~122,478 bitcoins acquired for ~$3.66 billion at an average price of ~$29,861 per bitcoin. $MSTRhttps://t.co/Xke8QhoYpy

— Michael Saylor⚡️ (@saylor) December 9, 2021

© Copyright IBTimes 2025. All rights reserved.