5 Ways Verizon’s Shrewd Use of Tech Tools Kept it up in Strike

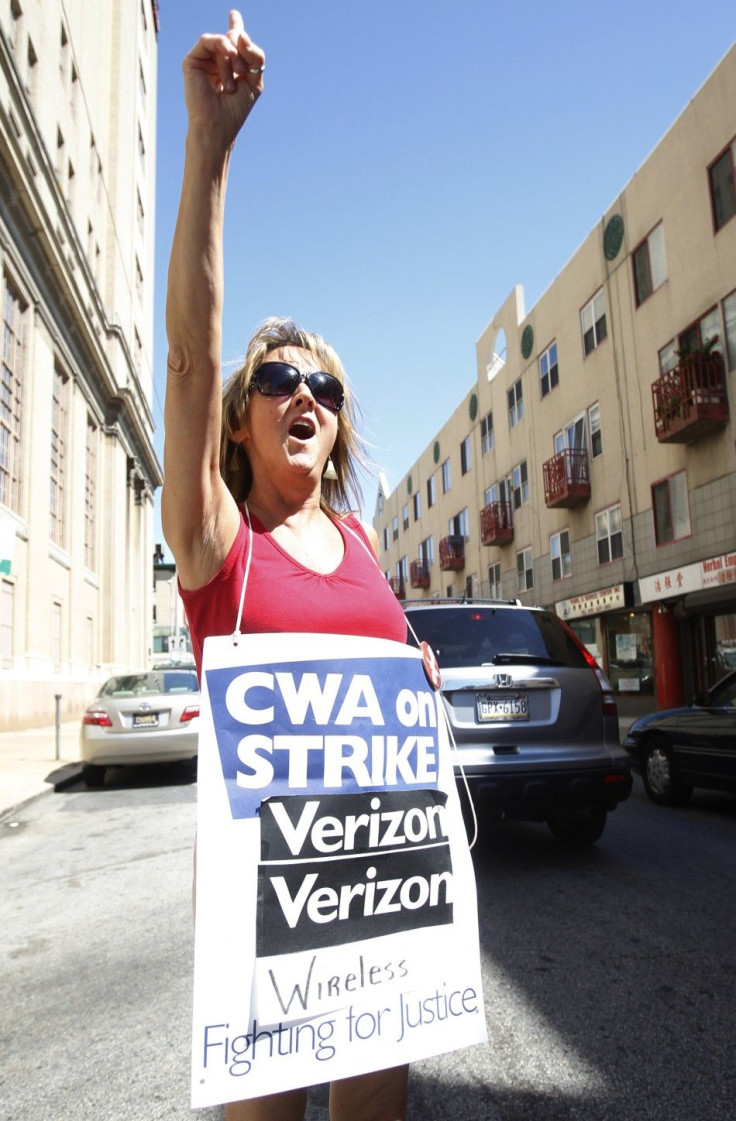

One reason why the two-week strike against Verizon Communications ended Monday is because the No. 2 U.S. telecommunications provider used all the technology tools it owns to keep the network up.

Another is that without the 45,000 members of the Communications Workers of America and the International Brotherhood of Electrical Workers, Verizon's Middle Atlantic customers were unhappy.

Technical support took longer. Inquiries from homes took more time to handle. Service calls for installation and repairs were stretched out at a time when Verizon customers could switch to another carrier or a cable operator like Comcast, Time Warner Cable and Cablevision.

Shares of New York-based Verizon inched up 11 cents Monday to $34.81, after both sides said they had a framework for negotiations. That's about their level when the strike began, leaving Verizon's market capitalization just below $100 billion.

At that level, the company is one of the country's biggest spenders on technology products that manage and maintain a network that now provides video as well as the voice, data and computer services everyone takes for granted. It's also integrated with Verizon Wireless, the mobile provider jointly owned with Britain's Vodafone.

Verizon officials declined to discuss their network performance Monday. The strike is over but it's not over, a top media executive said in an interview. Management doesn't want to discuss strategy while bargaining is set to resume. A 2007 Verizon walkout cost the company $40 million in revenue. The 2011 figure isn't available.

Here are five reasons why Verizon's network stayed up with minimal disruption:

Years of investment in telecom equipment dating back to AT&T days. Verizon is the result of several mergers of telephone companies that spun out of the old American Telephone & Telegraph in 1983, as well as the acquisitions of independent carriers including New England Telephone, GTE and MCI Communications.

But one of the underpinnings is a network of high-speed switches provided mainly now by Alcatel-Lucent, the Franco-American telecom equipment provider. Lucent, of course, was the successor company to what was once Western Electric and then AT&T Network Solutions, then ultimately spun off as Lucent.

In essence, the late AT&T CEO Jim Olsen once explained on a factory tour where the 5ESS switches were made, All these are really giant circuit packs, or computer switches.

The Internet backbone is filled with switches and routers from other makers, including Cisco Systems and Juniper Networks.

Verizon and predecessor have spent billions on these systems since 1983. Last year, the company's capital expenditures were $10.5 billion.

Software and middleware tools handled maintenance. Verizon is one of the top customers of database providers, especially Oracle, which itself has snapped up dozens of leading software companies in services and middleware such as BEA Systems, Siebel Systems and PeopleSoft. Besides monitoring traffic with specialized network management software, executives can pull up accounts and see records easily.

Verizon also is a huge consumer of security software, especially because it provides communications for U.S. government departments including Defense, Treasury, Labor and Homeland Security. These include products from providers like CA as well as from McAfee, now a part of Intel.

Billing services are handled by software specialists like Amdocs and others. Millions of customers pay bills electronically directly or through credit- and debit-card accounts.

Telecom networks are now computer companies. Now that the switches are providing video and other services, Verizon is using transactional processing servers from the biggest vendors like Hewlett-Packard and IBM. But it also now has its in-house systems as it prepares to offer more services to the cloud for enterprises and the government.

Earlier this year, Verizon acquired Terremark Worldwide, a Miami-based specialist in cloud computing, for about $1.4 billion. Now the company itself is better-positioned to battle Amazon, Google and others in the cloud for future computing services.

The wired home played a role. The digital network runs itself. Just about all of Verizon's three million FiOS customers now have a box from Tellabs, of Naperville, Ill., installed in their business or residence, which constantly monitors network traffic. In turn, they rely upon Verizon's 485,000 network route miles that includes fiber optics.

Verizon managers played a low-key role. Although CEO Lowell McAdam and other executives played tough before the strike, seeking to eliminate fully paid health insurance as well as some holidays and other provisions of the 2009 contract, once it started, they were invisible.

CWA President David Cohen was prominent, as were some other union officials, but senior Verizon executives didn't call press conferences or go on TV to inflame the situation. Part of the reason was that they needed to monitor other managers who were filling in for strikers. But another was recognition that Verizon customers have free choice in the market now.

Whenever a settlement comes, one thing we will see is a statement, handshakes between top Verizon and CWA and IBEW leaders and a commitment to offer the best service. The reason is that even with all the technology tools in the world, without people, the network can't run at 100 percent efficiency.

© Copyright IBTimes 2025. All rights reserved.