Affirm App Gives Loans For Designer Jeans, Holiday Flights And More

The holiday shopping season can take a brutal toll on our wallets, one and all. But there are plenty of tricks people can use to save money and tap into credit options, sans credit cards, by using apps like the PayPal and Affirm. PayPal co-founder Max Levchin launched the fintech startup Affirm in 2013. They offer small loans for everything from Expedia’s plane tickets to designer jeans or Louis Vuitton bags at Tradesy.

Affirm’s chief of staff and head of international expansion, Ryan Metcalf, told International Business Times the startup works with 1,200 retailers nationwide and issued $1 billion worth of loans in 2017.

“We are able to approve 126 percent more people than industry averages. A large portion of these people have no access to credit or if they do they are being mispriced in the market because their FICO score is outdated,” Metcalf said. “Around one in 10 Americans have ‘unscorable’ credit reports. That’s around 30 million people. So we’re also able to offer credit to those people as well.”

According to the Fair Isaac Corporation’s data, 20 percent of American credit card owners are ranked as “subprime” because their FICO score is 600 or lower. Many experts believe FICO scores are outdated or inaccurate. The nonprofit think tank Urban Institute called current FICO scores an outdated metric “based on models established in the late 1990s.” Yet they still play a huge role in determining credit rates.

The national averages for credit card interest rates range from 12.8 to 23.4 percent, although rates vary depending on local laws, personal details and many other factors. For example, a South Dakota–based First Premier Bank charged between 59.9 and 79.9 percent APR in 2010 on a MasterCard with a $300 limit. CNN Money reported this particular card had almost 300,000 active users in 2011.

Affirm’s loans, which are offered through a partnership with Cross River Bank in New Jersey, generally vary between 10 to 30 percent interest. Dozens of merchants, selling everything from furniture to festive coffee beans, even offer special offers with no interest at all. Right now those zero interest offers include jewelry at Diamond Nexus, SuperJeweler and Valliani Jewelers.

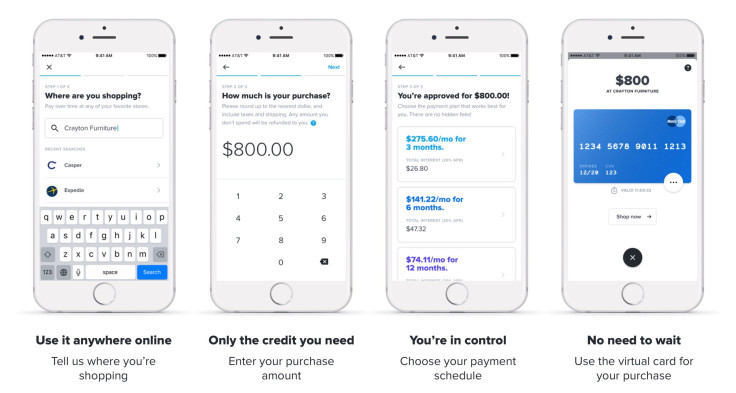

For people with inflated interest rates, online shopping with fintech apps can be a whole lot cheaper. Even if you have a credit card with a solid rate, budgeting with it can be pretty tricky. On the other hand, Affirm’s transparency feature clearly lists how much the interest will cost over time.

“When you use Affirm, we tell you upfront how much it is going to cost you as a percentage of interest and the full dollar amount,” Metcalf said. "Whereas with a credit card you have no idea how much something is going to cost you in 3, 6 or 12 months.”

Hidden credit card fees are another big difference between using a credit card or an app like PayPal or Affirm. In 2013, Credit.com estimated service fees alone cost consumers $997.9 million a year. Fee income has been steadily rising for years, with penalty fees now reportedly earning credit card companies $12 billion annually. All things considered, Metcalf said American credit card companies now make $90 billion a year from extra fees.

“The reason we don’t have late fees or extra fees of any kind is we wanted to make sure that we had full confidence the people we lend to can pay us back on time and in full,” he said. “If we lend to somebody who can’t pay us back on time and in full, we actually eat the cost. Because we take on all the risk of our loans.”

![PAYPL2085_HolidayCards[1][1]](https://d.ibtimes.com/en/full/2622107/paypl2085-holidaycards11.jpg?w=736&f=e1e25955c6a3c7ddafc64cdbab1eda95)

Critics argue apps like Affirm encourage people to spend more than they can afford. Since that’s never a good idea, check out PayPal’s holiday e-cards if you’re looking to send smaller amounts of gift money. PayPal partnered with sarcastic fashion icon Leandra Medine to make a new set of holiday e-cards for festive peer-to-peer transactions, including Hanukkah designs. Hanukkah starts this year on December 12. So there's still plenty of time to scour for deals on little gifts too. There's nothing quite like bragging about how much money you didn't spend while shopping.

© Copyright IBTimes 2025. All rights reserved.