Amazon Escalates Its War On FedEx

Amazon.com (NASDAQ:AMZN) has been aggressively building out its in-house delivery capabilities in recent years, emerging as a key competitive threat to longtime delivery and logistics partners like UPS and FedEx (NYSE:FDX). FedEx had said in June that it opted not to renew its contract with the e-commerce giant for expedited FedEx Express service, preferring to instead "focus on serving the broader e-commerce market." Two months later, the companies' rift widened even more after Amazon ceased FedEx Ground deliveries altogether.

As Amazon continues to ramp up one-day deliveries amid the busy holiday shopping season, it just took another shot at its historical shipping partner.

Banning FedEx

This week, The Wall Street Journal reported that Amazon has now barred third-party sellers from delivering Prime-eligible packages through FedEx's ground delivery network. Amazon cited poor delivery performance for the decision, according to the report. Third-party merchants are still free to use FedEx Express, which is faster but costs more, for Prime orders and FedEx Ground when shipping non-Prime orders. In his most recent annual shareholder letter, CEO Jeff Bezos noted that third-party merchants accounted for 58% of physical gross merchandise sales in 2018.

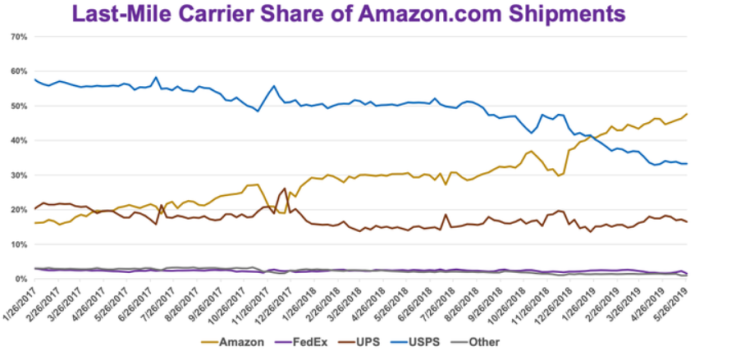

In a statement to the Journal, FedEx downplayed the impact on its business as "minuscule." FedEx's June statement noted that Amazon represented a mere 1.3% of revenue in 2018. FedEx shared this chart of last-mile carrier share during its last earnings release, which shows how little FedEx has historically contributed to Amazon last-mile deliveries, as well as Amazon's growing proportion as it takes greater ownership over getting those packages to your doorstep.

After years of dismissing the competitive threat that Amazon represents, FedEx CEO Fred Smith finally conceded that Amazon is an emerging rival in the delivery and logistics business. In fact, Smith said that Amazon is now among the competitors that he thinks about "every day." Amazon this year started to include language in regulatory filings that it competes in "transportation and logistics services."

Amazon has been criticized for its last-mile delivery operations, which rely heavily on a growing army of third-party contractors that face incredible stress in meeting deadlines, often driving all over town to deliver dozens of packages in a shift for a flat rate. Many of these workers don't receive benefits and are sometimes responsible for expenses like fuel and maintenance on personal vehicles.

Those criticisms aren't stopping Amazon from investing in one-day delivery. Amazon CFO Brian Olsavsky said in October that the company was including a "$1.5 billion penalty" in the fourth quarter related to increased shipping costs, but reiterated that the investment was worth it since one-day deliveries are driving "revenue acceleration" and "unit growth acceleration."

FedEx reports fiscal second-quarter earnings results this afternoon after the close, so investors will want to hear any color that management is willing to provide on the souring relationship with the e-commerce behemoth.

This article originally appeared in the Motley Fool.

Evan Niu, CFA owns shares of Amazon. The Motley Fool owns shares of and recommends Amazon and FedEx. The Motley Fool has a disclosure policy.