Anglo American (AAL) Credit Rating Cut To Junk Status Again On Uncertainty Over Restructuring Plan

The British mining giant Anglo American Plc saw its credit assessment cut to junk for the second time this week.

Fitch Ratings reduced Anglo American’s credit rating to BB+, with a negative outlook, from BBB-, the ratings agency said in a statement Wednesday. The downgrade follows a similar move by Moody’s Investor Service this week and marks a new low for large mining companies grappling with falling commodity prices.

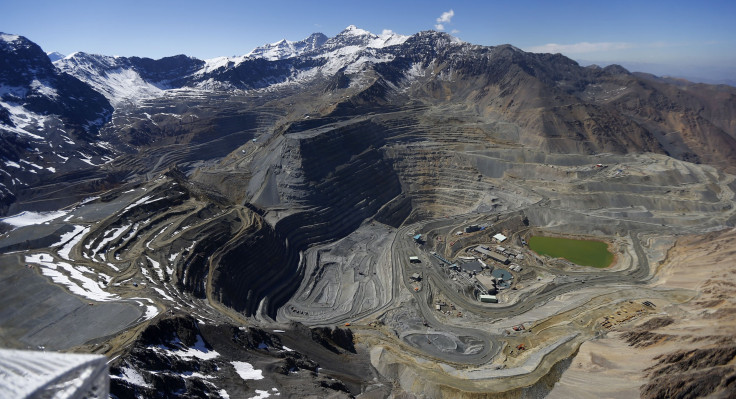

Fitch cited the “high level of uncertainty” about Anglo American’s restructuring plan, which the company unveiled in December and outlined in a Tuesday earnings call. Anglo, the world's fifth-biggest diversified global mining group by market value, said last year it would cut its assets by 60 percent and reduce its workforce to 50,000 from 135,000 — the deepest job cuts announced in the sector since the commodity price plunge began.

Fitch noted that several of the miner's assets are marginally profitable or loss-making. “This raises the question of whether they will attract a purchase multiple that is acceptable [to management],” the ratings agency said in the statement.

Mining companies worldwide, including Glencore Plc and Rio Tinto Plc, have been slammed in the last year by cooling global demand and weaker-than-expected growth in China.

Moody’s on Monday pointed to deepening economic uncertainties as it cut Anglo America’s credit rating three notches to Ba3 from Baa3. “The current environment is not a normal cyclical downturn, but a fundamental shift in the operating environment for the global mining sector,” Moody’s said in a statement.

Analysts raised similar questions about the mining giant’s ability to execute the massive restructuring and debt-reduction plan. “With the downturn likely to be deeper and longer than previously anticipated, the rating agency believes that price risk remains to the downside, given global economic uncertainties and slowing growth in China,” Moody’s said.

Anglo American said Tuesday its net loss doubled to $5.62 billion in 2015, after the company faced impairment charges of $3.8 billion due to the massive rout in commodity prices. The miner announced plans to sell assets worth $3 billion to $4 billion to repair its battered finances and increase earnings before interest and tax by $1.9 billion in 2016.

London-listed shares of Anglo American (LON:AAL) were trading up 11.5 percent at 3:20 p.m. GMT, rising higher than the London Stock Exchange’s 1.28 percent afternoon gain.

© Copyright IBTimes 2025. All rights reserved.