Apple's iPhone US Installed Base Estimated At 189 Million

In its most recent earnings release, Apple (NASDAQ:AAPL) for the first time gave an official disclosure regarding just how big its global installed base of iPhones is: over 900 million. That figure was up 75 million over the past 12 months, which when compared to the over 200 million iPhones that Apple likely sold in 2018, confirms that the majority of unit sales are expectedly upgrades. The Mac maker points to that large and growing installed base as the underlying driver of its services business.

The U.S. could represent approximately one-fifth of that worldwide installed base.

Apple is still growing U.S. iPhone users

Consumer Intelligence Research Partners (CIRP) has released estimates today regarding the U.S. iPhone installed base, pegging domestic users at 189 million. That would represent an addition of just 4 million U.S. iPhone users in the fourth quarter. CIRP's installed base estimate would account for 21% of Apple's official 900 million figure.

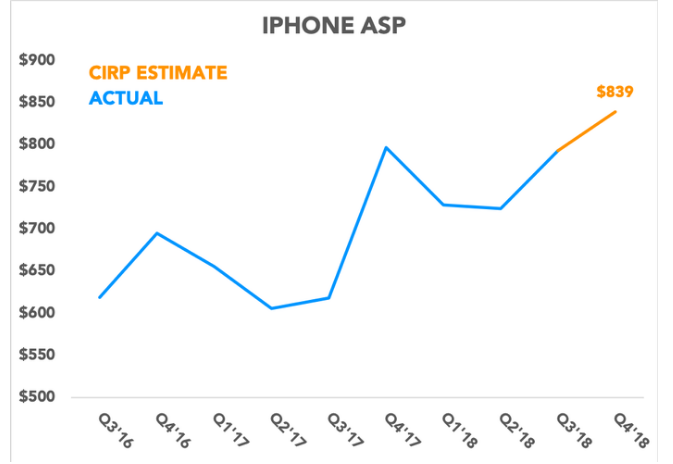

CIRP also estimates that Apple sold a total of 62 million iPhones in the fourth quarter at an average selling price (ASP) of $839. The company no longer reports unit sales, only telling investors total iPhone revenue, which fell 15% to $52 billion. Most of that weakness was attributable to emerging markets, particularly China, while sales in the U.S. grew 4% to $32 billion. While Apple's Americas segment includes both North and South America, the company also discloses its mix of international and domestic sales, which can be used to derive U.S. revenue.

"With slowing iPhone sales, the installed base of iPhones in use in the US grew only slightly in the quarter," CIRP co-founder Josh Lowitz said in a statement. "As Apple itself indicated, iPhone revenues declined relative to last year, driven primarily by reduced demand in overseas markets. US sales remain relatively stable, which shows up in slight growth in the US installed base."

If Apple was indeed able to hit an overall iPhone ASP of $839, that would represent a significant gain in ASP to a new record. The company's official record ASP was recorded in the fourth quarter of 2017, when ASP hit $796. Those gains would be driven by Apple reaching even higher with iPhone pricing, which can now go as high as $1,450.

Monetizing the installed base

While the Mac maker has given investors some new granular detail around the installed base, and intends to continue doing so "on a periodic basis," according to CFO Luca Maestri, the company is still coy about how many users are actively spending money on its digital platforms.

"The level of engagement of our customers in our ecosystem continues to grow," Maestri said last week. "The number of transacting accounts on our digital stores reached a new all-time high during the quarter, with the number of paid accounts growing by strong double-digits over last year."

Apple is changing its reporting structure in ways that highlight the services business, such as now disclosing gross margin for the segment. If Apple really wants investors to perceive it as a services company -- and value it accordingly -- the next metrics that the tech titan should consider disclosing are how many accounts are actively transacting and just how much they're spending on average.

This article originally appeared in the Motley Fool.

Evan Niu, CFA owns shares of Apple. The Motley Fool owns shares of and recommends Apple. The Motley Fool has the following options: long January 2020 $150 calls on Apple and short January 2020 $155 calls on Apple. The Motley Fool has a disclosure policy.