Apple’s US Mac Sales See Significant Growth In Q4 2013 While Worldwide PC Shipments Suffer Worst Decline Since 2009

Apple’s (NASDAQ:AAPL) U.S. market share saw significant growth in the fourth quarter of 2013, while overall worldwide PC shipments experienced the worst decline in PC-market history since the financial crisis, according to a new report released by Gartner on Thursday.

Gartner said that PC shipments in the U.S. totaled 15.8 million units in the fourth quarter of 2013, a 7.5 percent decline from the same period in 2012. HP (NYSE:HPQ) continued to be the leading vendor, despite a 10.3 percent decline in shipments in the U.S., while Apple’s market share rose to 13.7 percent from 9.9 percent in the holiday quarter in 2012, representing an impressive 28.5 percent annual growth. Dell (NASDAQ:DELL) and Lenovo (HKG:0992) were the only other PC vendors that added market share in the quarter.

“Holiday sales of technology products were strong in the U.S. market, but consumer spending during the holidays did not come back to PCs as tablets were one of the hottest holiday items,” Mikako Kitagawa, principal analyst at Gartner, said in a statement. “We think that the U.S. PC market has bottomed out. A variety of new form factors, such as hybrid notebooks, drew holiday shoppers' attention, but the market size was very small at the time.”

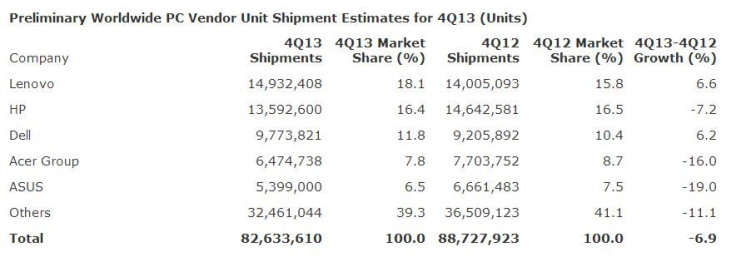

The U.S. PC market, which dropped 7.5 percent year-on-year in unit sales in the fourth quarter, fared marginally worse than the worldwide PC market that suffered a 6.9 percent decline from the fourth quarter of 2012. Worldwide PC shipments totaled 82.6 million units in the fourth quarter of 2013, down from 88.7 million units during the same period in 2012.

Lenovo took the lead in the fourth quarter, accounting for 18.1 percent of worldwide PC shipments while HP came second with a 16.4 percent share of the market during the same period. Dell continued to maintain third position, accounting for 11.8 percent of the market, while Acer (TPE:2353) and Asus (TPE:2357) rounded out the top five, both suffering annual shipment declines. Here too, Lenovo and Dell saw a gain in market share while others did not.

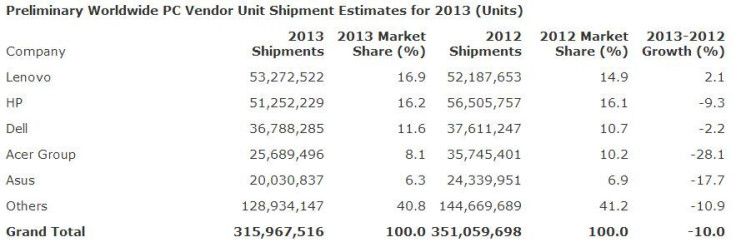

For the entire year, PC shipments touched 315.9 million units, a 10 percent decline from 2012. According to Gartner, this is the worst decline in PC market history, equaling the shipment level in 2009 at the height of the financial crisis. Lenovo took over the top spot in the global PC market, accounting for 16.9 percent of the market, while HP fell to second spot after experiencing a shipment decline of 9.3 percent.

“Strong growth in tablets continued to negatively impact PC growth in emerging markets,” Kitagawa said. “In emerging markets, the first connected device for consumers is most likely a smartphone, and their first computing device is a tablet. As a result, the adoption of PCs in emerging markets will be slower as consumers skip PCs for tablets.”

© Copyright IBTimes 2025. All rights reserved.