BlackBerry Is Not Dead, But Reports Of A Turnaround Are Very Premature

Pronouncing Blackberry dead has been everyone's favorite pastime since the iPhone burst onto the scene in the last decade, creating the modern smartphone industry. But the company is still hanging in there and occasionally tantalizes its few remaining devotees with signs of life.

The latest sign came Friday when it reported better-than-expected results, sending its shares up more than 10 percent, leading the narrative to shift ever so slightly. At a time when encryption is headline news, can the company's class-leading security give it a glimmer of hope?

BlackBerry's revenue for the most recent quarter of $557 million was 31 percent down from the same period last year. And yet the upside reaction to BlackBerry's much narrower loss, $0.03 versus an expected $0.14, is a indication of just how low the expectations are for this once-dominant company.

BlackBerry's biggest selling point for years was its class-leading security credentials, and as a result BlackBerry devices were a huge success among corporate and government customers, an area BlackBerry CEO John Chen highlighted in a blog post this week where he oddly criticized his competitors — particularly Apple — for failing to acquiesce to government requests to access customer data.

Getting Profitable

In an interview with CNBC following the publication of the results, Chen said leveraging BlackBerry's security credentials would be vital to making its hardware business profitable: "We need to get our device business profitable," Chen said. "We are going to focus a lot on privacy and security, then we will move to distribution channels and get the volume back, and then we will begin making money."

However, that is going to be an uphill task, considering BlackBerry chief financial officer Brian Bidulka said on an investor call that to become profitable, BlackBerry would need to sell 5 million smartphones annually. The company's recently launched Priv, its first Android-based smartphone, features some unique BlackBerry software as well as the iconic BlackBerry keyboard. Chen says bringing BlackBerry security to the Android platform gives it an edge over other manufacturers, but in a hugely competitive market it is unclear if this will be enough.

"I am sure [security] will [help] in the enterprise space. For consumers, despite a lot of talk about privacy and security, there is no evidence that we are actually seeking a phone that can provide either or both," Milanesi said.

Encryption is a hot topic at the moment in the wake of recent terror attacks in Paris and San Bernardino, California, which some claim were facilitated by the use of encrypted messaging services. In his blog post this week, which at times reads like a sales pitch to governments around the world, Chen said his company is uniquely placed to offer both security and the ability to comply with government requests without the need to build backdoors into their systems.

"We reject the notion that tech companies should refuse reasonable, lawful access requests. Just as individual citizens bear responsibility to help thwart crime when they can safely do so, so do corporations have a responsibility to do what they can, within legal and ethical boundaries, to help law enforcement in its mission to protect us."

During the most recent quarter, BlackBerry says it sold just 700,000 smartphones, with an average selling price of $318. For comparison, in its most recent quarter, Apple sold just over 48 million iPhones at an average selling price of $666. BlackBerry's fall from grace since 2008 — when it dominated the nascent smartphone market with over 40 percent market share — has been mirrored by the rise of Android and iPhone. After years in the wilderness, BlackBerry now believes it is in a position to make a comeback.

"We delivered accelerating growth in enterprise software and higher revenue across all of our areas of focus," Chen said in a release. "BlackBerry has a solid financial foundation, and we are executing well. To sustain our current direction, we are stepping up investments to drive continued software growth and the additional Priv launches," he said.

No Evidence Of Turnaround

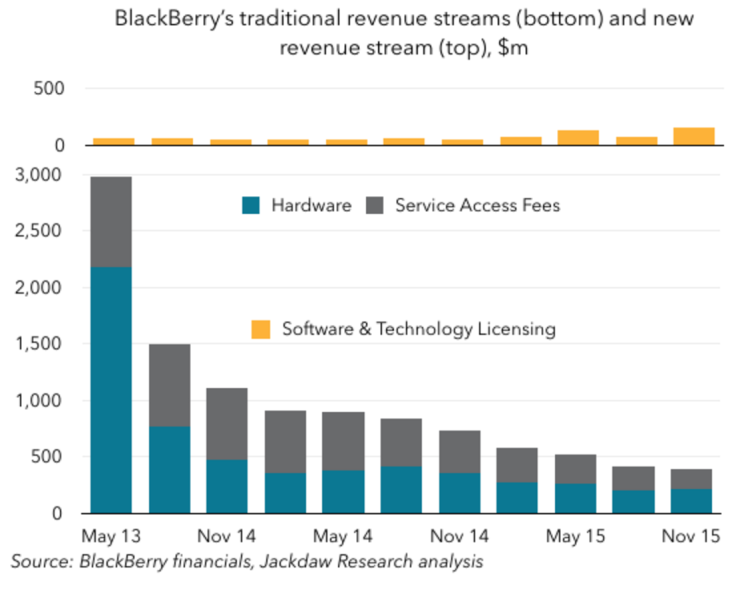

However, this view of the company is not shared by everyone. "I don't think there's evidence of a turnaround here, at least not a meaningful one," Jan Dawson, chief analyst at Jackdaw Research, told International Business Times. "The one thing that's really growing is the 'software and services' category, but that's a really opaque group of revenue sources, because it combines big one-off license sales with continuing enterprise software and service sales, and it's very hard to separate those two."

While Carolina Milanesi, chief of research at Kantar Worldpanel ComTech, agrees that hardware sales "did not look encouraging," she did point out one sign of encouragement: "It shows the Good [Technology] acquisition was a good move and that software will be the future if Blackberry, as we know it, wants to continue to exist." In September BlackBerry bought Good Technology, a rival in the enterprise mobile management market, for $425 million.

© Copyright IBTimes 2025. All rights reserved.