BP Oil Spill: False Negatives & False Positives, In Blistering Lawyer Editorial

Oil giant British Petroleum BP PLC (LON:BP) placed prominent ads in leading national newspapers last week, showcasing examples of fictitious damage claims from those alleging to be hurt by the massive 2010 Gulf oil spill.

That’s part of a widespread publicity campaign the UK company has launched in past weeks, attempting to back its interpretation of the oil spill settlement, which is now being contested in court.

But a recent editorial by lawyer Tom Young, who represents those seeking damages because of the spill, puts the false fraudulent claims at a fraction of what he calls the “false negatives,” or those who may deserve compensation but never received any.

Citing court statistics, Young points out that 28,000 denials of claims, on the grounds of incomplete documentation, may be thanks to strict standards, and not because these businesses were unharmed by the spill.

Small businesses must file detailed monthly profit-and-loss statements, which many Key West, Fla., businesses simply don’t have, he wrote. Startups must also account for the origin of all of their sales, meaning they’d have to obtain physical addresses of customers, he continued.

“The company [BP] ... is using its considerable advertising muscle to obfuscate and manipulate,” wrote Young in a posting on TheLegalExaminer.com, which describes itself as "community of attorneys, safety industry experts, and consumer advocates committed to providing visitors with up-to-date regional legal news and safety information from its nationwide network of 500 attorneys at nearly 100 different law firms."

But Young added in an email to IBTimes that he has “no issue with the documentation requirements.” He called the new compensation system far better than the previous system, known as the Gulf Coast Claims Facility (GCCF), which involved more control by BP.

“Any business that could not meet the settlement's documentation requirements was free to "opt out" of the claims program and file its own lawsuit for losses against BP,” added Young in his email.

BP didn’t respond to requests for comment. The court statistics dated Dec. 13 are publicly available on the official court-approved oil spill settlement website.

BP has already made payments of $3.8 billion to more than 40,000 claimants. There have been 256,593 claims submitted in total, with the most from Florida, and for a business’ economic loss. BP has issued notices offering to pay an additional $1.15 billion, leaving their total offered and payments made at about $5 billion.

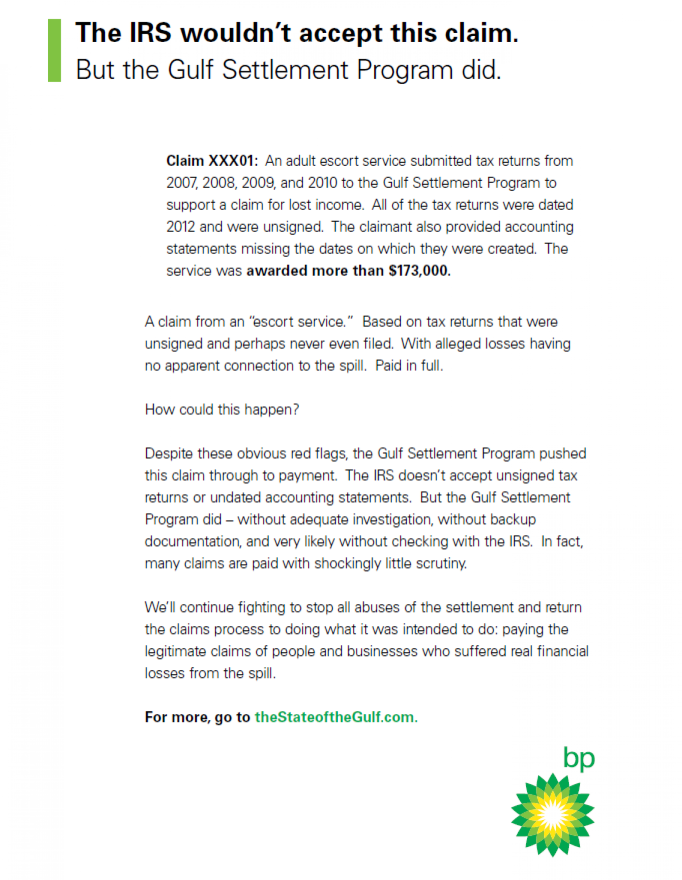

One prominent recent example of a fictitious claim involved an “adult escort service,” which submitted wrongly dated and unsigned tax returns from 2007 to 2012, along with undated accounting statements, to win awards of over $173,000.

The court-appointed attorney, Patrick Juneau, who is overseeing the claims, approved that payment, according to the Wall Street Journal. BP lists other allegedly fictitious claims, including $8 million awarded to celebrity chef Emeril Lagasse and $510,000 awarded to a global nuclear consultant, on a corporate website addressing settlement payments.

“BP will continue fighting to stop all abuses of the settlement and return the claims process to doing what it was intended to do: paying the legitimate claims of people and businesses who suffered real financial losses from the spill,” reads the website.

BP estimates that more than 1,000 claimants filed for false damages, with more than $600 million already paid out to such parties. They sent a letter to Juneau on Dec. 2, detailing problems with the settlement program.

The company won court permission earlier in December to halt payments to alleged victims, until they can show adequate proof of harm. The civil settlement has cost BP about $9.2 billion so far, up from an initial projected $7.8 billion. There has also been an investigation into Juneau’s handling of the funds, alleging improper payments by plaintiffs seeking favor, though an investigation cleared Juneau of any wrongdoing in September 2013.

Claims on BP’s oil settlement fund rose visibly earlier this year, ahead of key court hearings. According to the latest court statistics, BP has appealed 3,800 claim decisions, while claimants have appealed about 1,100 decisions. 32,400 claims have been deemed incomplete.

Young is a member of the BP Gulf Oil Spill Joint Prosecution Group, which represents apparent victims of the oil spill. He told IBTimes that the vast majority of the $3.8 billion already paid went out before Oct. 2, when an appeals court bounced the case back to a trial court to determine the intent behind the settlement.

"Since then, little, if any, business economic loss claims have been paid,” Young said.

The BP oil spill, also known as the Deepwater Horizon incident, killed 11 workers and dumped over 3 million barrels of crude oil into the sea.

© Copyright IBTimes 2025. All rights reserved.