Cisco Systems 3Q Results Beat Estimates As Growth Returns

A corporate diet, better focus and the explosion of Big Data sent earnings up for Cisco Systems Inc. (Nasdaq: CSCO), the No. 1 provider of Internet equipment.

The San Jose, Calif., giant reported that its third-quarter operating profit rose 14 percent to 48 cents a share, a penny ahead of estimates. Revenue rose 7 percent to $11.6 billion, higher than the range analysts had predicted.

Net income surged 20 percent to $2.2 billion, or 40 cents a share, also beating estimates.

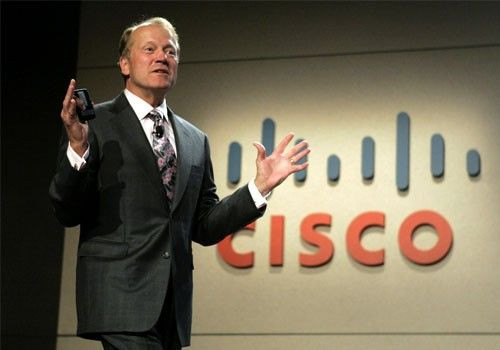

We delivered solid results this quarter, said CEO John T. Chambers.

At this time last year, Chambers noticed that the venerable company, which was the world's most valuable 12 years ago when its market capitalization was $555 billion in the Internet boom, had gotten too fat through acquisitions and was going to suffer from the global economic crisis.

To compete, Cisco announced a $1 billion expense reduction that led to 6,500 employee firings and a new focus on data consolidation and better performance. Subsequently, results for the current fiscal year have steadily improved and Cisco has regained share lost to rivals such as Juniper Networks Inc. (Nasdaq: JNPR), the No. 2 provider, Ciena (Nasdaq: CIEN) Hewlett-Packard Co. (NYSE: HPQ) and others.

Cisco shares have reacted mildly. For the past 52 weeks, they've gained 6.7 percent; for the year to date, they've risen 4 percent, underperforming the Nasdaq Composite's 11.7 percent jump.

Analysts expect Cisco's recovery to continue. Fourth-quarter earnings are expected to rise about 4 percent to 49 cents a share as revenue inches up 3.6 percent to $11.9 billion.

Cisco no longer provides earnings guidance in its announcement but does in investor calls. On Wednesday, Chambers said fourth-quarter results would range between 44 cents and 46 cents a share, sending Cisco shares down in after-hours trading as much as 8.4 percent.

UBS analyst Nikos Theodosopoulos rates Cisco a Buy with a target price of $24, despite a slow start to the third quarter but with more focused execution as a result of its diet. He forecasts earnings of 47 cents a share for the fourth quarter, slightly below consensus but sees full-year earnings at the consensus of $1.84 a share.

At Sterne Agee, analyst Shaw Wu also rates Cisco a Buy but has a target price of $27 because he believes the company is an underappreciated turnaround story similar to what we have seen with Apple Inc. (Nasdaq: AAPL), International Business Machines Corp. (NYSE: IBM) and EMC Corp. (NYSE: EMC) in the past.

Cisco shares closed up 7 cents at $18.78 in Wednesday trading, bringing its market value to $101.2 billion.

© Copyright IBTimes 2025. All rights reserved.