Coronavirus Economic Recovery: Atlanta Fed Official Says Many Businesses May Not Survive Another Month

KEY POINTS

- The paycheck protection program likely will run out of funding by Thursday

- The head of the Consumers Bankers Association says the $1 trillion is needed to satisfy the demand for PPP loans

- Bostic said the focus has to be on keeping as many companies viable as possible through the crisis

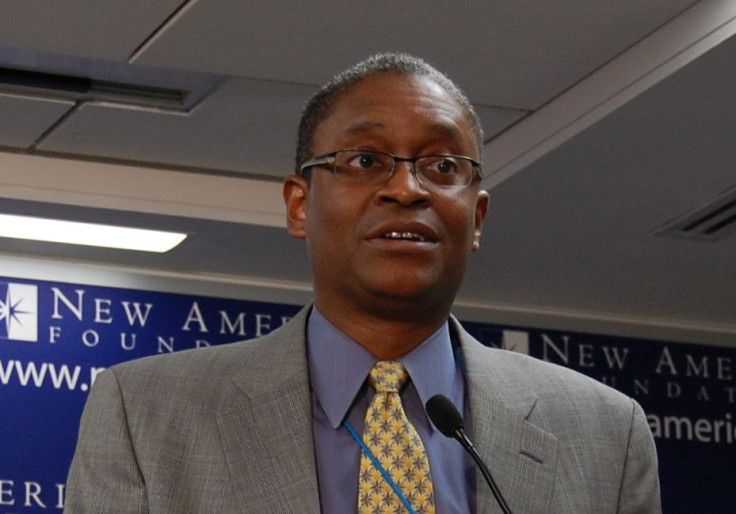

Atlanta Federal Reserve Bank President Raphael Bostic predicted many businesses won’t survive the next month as a result of the coronavirus pandemic as banking officials said they were about to run out of Small Business Administration funding for the paycheck protection program.

Bostic told a videoconference with Birmingham, Alabama, civic groups serious liquidity issues are looming in coming weeks and could translate into a solvency issue “and whether companies can exist at all.”

“Time is not our friend,” Bostic said. “The goal is really to get as many key companies as possible to still be around at the end.”

President Trump is looking to reopen the economy as soon as possible, but lack of adequate testing has dimmed hopes that will happen. Business and banking leaders have advised him it is more important to get the virus under control than to restart the economy.

Economic data released Wednesday indicated retail sales dropped 8.7% in March and manufacturing fell to its lowest level since the end of World War II.

The U.S. Federal Reserve has taken extraordinary action to try to shore up credit markets, injecting as much as $2.3 trillion into lending while cutting interest rates to near zero. It also is buying up junk bonds. At the same time, the $2.2 trillion coronavirus rescue package provided $349 billion for the paycheck protection program for small businesses and $500 billion for midsize and large businesses.

Bostic said these measures could be in vain if businesses close up shop.

“What we are seeing and hearing is credit challenges are becoming more widespread and more acute, and as that happens solvency becomes more into play,” Bostic said. “There are wide swaths of the economy seeing significant drops in demand, so the cash flows are so low they are eating through whatever savings they had at a more accelerated pace.”

The SBA had issued 1.3 million paycheck protection loans by Wednesday, totaling $305 billion and averaging $240,000 each. The funds were expected to run out by Thursday.

Richard Hunt, president of the Consumer Bankers Association, told reporters banks would need $1 trillion to satisfy demand.

Lawmakers and the White House are negotiating a deal to add $250 billion to the fund but those talks stalled over Democrats’ concerns not enough money is going to women- and minority-owned businesses or to those in underserved communities. Democrats also want the bill to contain $250 billion more for hospitals and local governments.

"We need speed. So, if Congress would just pass what we call a clean bill so we can get more money out to small businesses, that would be ideal,” he said.

© Copyright IBTimes 2025. All rights reserved.