Dow Jones Industrial Average Closes Lower After Walt Disney Co (DIS) Tumbles 9%

U.S. stocks closed mostly higher Wednesday, with the S&P 500 and Nasdaq snapping three straight days of losses. However, the Dow Jones Industrial Average closed lower after shares from media and entertainment giant Walt Disney Co. tumbled 9 percent following its latest mixed earnings results.

The Dow (INDEXDJX:.DJI) edged down 10.22 points, or 0.06 percent, to close at 17,540.47. The S&P 500 index (INDEXSP:.INX) added 6.52 points, or 0.31 percent, to end at 2,099.84. And the Nasdaq composite (INDEXNASDAQ:.IXIC) gained 34.40 points, or 0.67 percent, to finish at 5,139.94.

Seven of the 10 S&P 500 sectors closed higher, led by gains in information technology and consumer staples. The consumer discretionary and energy sectors were the biggest decliners, both down around 1 percent.

Walt Disney Co. (NYSE:DIS) led the Dow lower Wednesday, plunging 9 percent after the company missed revenue estimates and cut its outlook for profits in the cable business a day earlier. Dow component UnitedHealth Group Inc. (NYSE:UNH) was the biggest gainer in the index, adding 2.5 percent.

Shares of Etsy Inc. (NASDAQ:ETSY) plunged 28 percent, a day after the online crafts marketplace posted a loss for the April-June quarter, driven by a strong U.S. dollar and higher marketing expenses. The results marked the second straight disappointing report since the company went public in April.

Notable companies reporting quarterly earnings after the closing bell include electric car maker Tesla Motors Inc., wearable technology company Fitbit Inc. and weight loss company Herbalife Ltd.

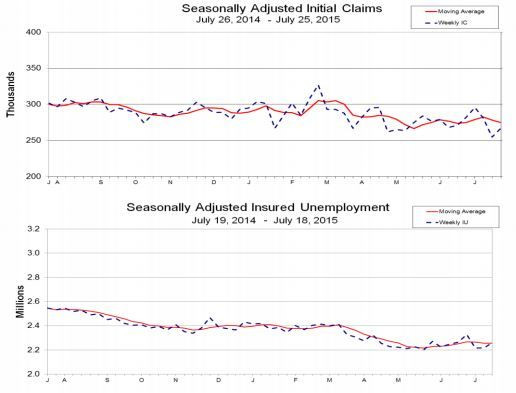

Market professionals are also looking ahead to Thursday’s financial calendar, with weekly jobless claims -- the number of Americans filing new claims for unemployment -- due out at 8:30 a.m. EDT.

The jobless claims report follows a report Wednesday that showed private employers added 185,000 jobs last month, down from the 229,000 jobs added in June, according to ADP.

U.S. jobless claims increased 12,000 to a seasonally adjusted 267,000 for the week ended July 25, the Labor Department said last week. Economists forecast that jobless claims last week rose by 6,000 to 273,000 for the week ending August 1, according to analysts polled by Thomson Reuters.

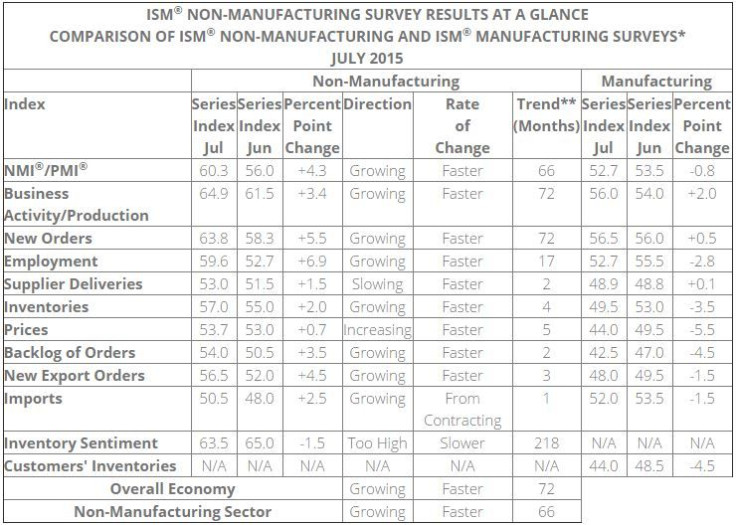

Meanwhile, the pace of growth in the U.S. service sector soared in July, recording its best reading in a decade. The nonmanufacturing purchasing managers index rose to 60.3 in July from 56.0 in June, its highest reading since August 2005, the Institute for Supply Management said Wednesday.

A reading above 50 signifies an expansion in activity.

The gains were driven by business activity, employment and new orders as respondents were confident about the economy, pointing to solid growth in the second quarter, says Gregory Daco, head of U.S. macroeconomics at Capital Economics.

“Nonmanufacturing activity remains much stronger than manufacturing activity, which is weighed down by the dual headwinds of a strong dollar and weak global demand,” Daco said.

Separately, data showed the U.S. trade deficit widened in June, rising 7.1 percent to $43.8 billion. Exports were down 0.1 percent as a strong dollar continues to weigh, while imports were up 1.2 percent driven by higher imports from Europe. Economists had expected the deficit to rise to $42.8 billion.

Economists are noticing a trend: the stronger dollar making U.S. products less attractive to overseas buyers and overseas products more attractive to domestic buyers. “This trend may well continue for a bit longer, although note [that] the impact of the stronger dollar will probably fade before long and the domestic economy is strong enough to compensate,” Steve Murphy, U.S. economist at Capital Economics, said in a research note Wednesday.

Economists say this doesn’t point to a revision to the 2.3 percent annualized increase in U.S. gross domestic product in the second quarter.

A strengthening domestic economy, particularly consumer spending and business investment, will help support gross domestic product growth of 2.5 to 3 percent annualized over the second half of the year, Murphy said.

© Copyright IBTimes 2025. All rights reserved.