Asian markets are expected to begin the week on upswing gains on the speculation of further stimulus measures from the central banks around the world to boost the fragile global economy. Most Asian markets ended last week on a negative note as investor confidence was weighed down by the mounting concerns over the euro zone debt crisis.

Employment in the television-news industry is the highest it has been since 2000, according to the Radio Television Digital News Association, a journalism trade group for electronic media.

Some blame oil. Others blame a loss of pleasure in the roads. Researchers call it “peak travel.” Whatever the reason, one thing's clear: Americans are not driving their cars as far away from home as they used to.

The top after-market Nasdaq gainers Friday were Meru Networks Inc, Lincoln Electric Holdings Inc, Amkor Technology Inc and Amarin Corporation Plc.The top after-market Nasdaq losers were WisdomTree Investments Inc, Alaska Communications Systems Group Inc, Ironwood Pharmaceuticals Inc and Mid-Con Energy Partners LP.

The top after-market NYSE gainers Friday were Sprint Nextel Corp, Belo Corp, Natural Grocers by Vitamin Cottage, Green Dot Corp and Sauer-Danfoss Inc. The top after-market NYSE losers were Tata Motors Ltd, Owens & Minor, Infoblox and Graphic Packaging Holding Co.

Most of the Asian markets fell in the week following the revival of the investor concerns about the deepening debt burden faced by the euro zone and worsening global economic growth.

IBTimes presents its weekly roundup of winners and losers in the financial world.

The president of CNN Worldwide, Jim Walton, said he would resign at the end of the year as the cable television network struggles with falling ratings.

Austrian media reports that the opera will likely have to raise ticket prices.

The influx of millions of conscientious and low-cost Chinese graduates in the global job market could exacerbate the woes of a U.S. job market that is already staggering from high unemployment.

The premature baby needed the incubator in order to survive and died shortly after being taken away from the life-saving machine.

The U.S. economy grew more slowly in the second quarter than in the first three months of the year as consumers, struggling with a softening jobs market, spent less, the Bureau of Economic Analysis said Friday.

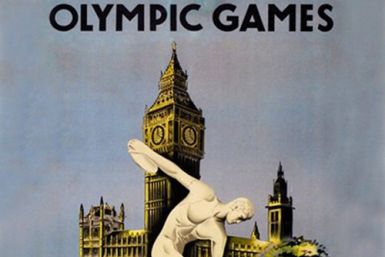

Rationing was so severe, that British athletes were forced to consume whale meat for sustenance.

U.S. GDP grew 1.5 percent in the second quarter, slightly better than economists expected but less than the previous quarter's growth and not enough to bring down the unemployment rate, the Bureau of Economic Analysis said Friday.

While all the headlines in recent months have been devoted to highlighting the "sluggishness" of job creation, the U.S. labor market is actually actively stitching together its wounds.

Expedia Inc, Barclays Plc, Synacor, Amgen, Nokia Corp, Starbucks Corp, Facebook, Logitech International, Newmont Mining and Zynga Inc are among the companies whose shares are moving in the premarket trading Friday.

ICICI Bank(ICBK.NS), India's top private lender, posted on Friday a 36.3 percent jump in quarterly profit, its strongest growth in more than a year, helped by robust loan growth, high fee income and better asset quality.

ICICI Bank, India's top private lender, Friday reported a 36 percent increase in its net profit in the first quarter of the financial year 2012, exceeding the market expectations.

Asian stock markets rallied Friday as comments from European Central Bank (ECB) president raised hopes for further central bank action in Europe to alleviate the sovereign debt crisis.

U.S. stock index futures point to a higher opening Friday following expectation among investors that central banks around the world will announce stimulus measures to regain the economic growth momentum.

Most European markets rose Friday amid hopes of stimulus measures to boost the economy after the European Central Bank promised to take steps to protect the euro.

Japan’s retail sales growth slowed down in June as compared to May, indicating that private consumption being affected by the faltering global economic conditions.

Asian markets rose Friday as investor sentiment turned positive following the promise from European Central Bank to take necessary steps to save the euro zone from collapsing.

The top after-market NYSE gainers Thursday were Netsuite Inc, Rentech Nitrogen Partners, Foot Locker, Cash America International and ENSCO plc. The top after-market NYSE losers were Green Dot Corp, Fortune Brands Home & Security, Superior Energy Services, Newmont Mining Corp and Renren Inc.

Starwood Hotels & Resorts Worldwide Inc. (NYSE: HOT), which operates the Sheraton, Westin and W hotel brands, is moving ahead with its expansion in China, even as the world's second-largest economy suffers a recent slowdown in growth.

The latest figures on U.K. GDP, released this week, were so demoralizingly bad that some economists and market-watchers are simply refusing to believe them, suggesting they are the result of a statistical anomaly and will be subject to large upward revisions soon.

As analysts began to eagerly predict Facebook earnings--its first as a public company--the social media giant's close ally Zynga posted dramatic losses, leading many to question the future the two tech companies may have together.

The 30-year U.S. mortgage rate fell to new record low of 3.49 percent in the week ending Thursday, an unprecedented 1.06 percent below last year's value of 4.55 percent, according to mortgage financier Freddie Mac, with the drop reflecting growing concern over the economy.

The proportion of kids who drank at least once a week plummeted from 20 percent in 2001 to 7 percent last year.

The U.S. shale gas boom will not lead to a near-term surge in U.S. gross domestic product growth or to a substantial decline in the unemployment rate, according to HSBC Chief U.S. Economist Kevin Logan.