An unusual bump in lobster catches is making fishermen mad as prices fall. And none are madder than those in New Brunswick, who blame their American colleagues -- and quite violently so.

Global oil demand growth will fall next year below already very weak levels of 2012 due to a slow-down in economic activity, the west's energy watchdog said on Friday.

Manchester United Ltd. (NYSE:MANU), one of the world's most storied sports franchises, began publicly trading Friday, but early signs indicated investors were giving a less-than-enthusiastic welcome to the 134-year-old club.

Fusion-IO, Barclays Plc, Southwestern Energy, Hewlett-Packard, Facebook, Nokia Corp, Weatherford International, Seadrill and GNC Holdings Inc. are among the companies whose shares are moving in the pre-market trading Friday.

The Renault-Nissan Alliance headed by superstar CEO Carlos Ghosn is hoping to beat the crowds in the nascent African automotive market with the largest assembly plant on the continent.

A global hike in food prices last month due to unfavorable weather conditions, compounded by exporting nations placing restrictions and importing nations stockpiling due to concerns over the grain price rally, could lead to a food crisis along the lines of the one that happened in 2007-08, the U.N.'s food agency warned Thursday.

Asian stock markets declined for the first time in five days Friday as weaker-than-expected Chinese trade data stoked fears of a growth slowdown in the world's second largest economy.

U.S. stock index futures pointed to a lower open Friday as China's trade data for July fell short of expectations.

European markets fell Friday as investor confidence was weighed down following disappointing trade data from China giving further indication that the global economic condition is faltering.

Indian inflation probably crept up in July as poor monsoon rains drove food prices higher, a Reuters polls showed on Wednesday, giving the RBI less room to cut interest rates to revive a flagging economy.

The top after-market NYSE gainers Thursday were Fusion-IO, Bally Technologies, ExactTarget, Christopher & Banks and Turquoise Hill Resources Ltd. The top after-market NYSE losers were Roundy's Inc, Scotts Miracle-Gro, EXCO Resources, Lions Gate Entertainment Corp and Delek US Holdings Inc.

China reported a trade surplus of $25.1 billion in July amid slower-than-expected growth in exports and imports, raising the concern that the world's second largest economy isn't doing enough to stimulate the economy and avert a slowdown.

Most of the Asian markets fell Friday as investors were disappointed to note that China's trade balance for July was worse than expected, increasing concerns about the faltering economic condition.

Kenya has thrown in a bid, along with Egypt and South Africa, to be the first African nation to host the Olympics in 2024. But the Kenyan economy might not be able to handle the financial burden.

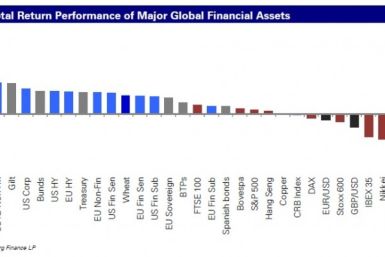

A report out Thursday morning by Jim Reid, head of Global Fundamental Credit Strategy, noted the global financial crisis is five years old today, tracing the beginning of the world's economic troubles to August 9, 2007.

Pakistanis consume heroin valued at $1.2 billion every year.

Employers in the restaurant and retail industries -- those with a large number of hourly wage workers who traditionally had minimal or no health insurance -- are more likely than other companies to drop their health plans or cut worker's hours in order to maintain their already slim profit margins.

The number of Americans lining up for new jobless benefits fell unexpectedly last week, the Labor Department said Thursday, suggesting that the battered labor market is healing.

Pluristem Therapeutics, Nokia Corp, Amarin Corp, Sprint Nextel, KB Home, Yelp Inc, Glu Mobile and Zynga Inc. are among the companies whose shares are moving in pre-market trading Thursday.

Technology may have a good second half of 2012 after all, despite all the fears of economic collapse, lower demand for PCs and other worries. After Computer Sciences reported better-than-expected results on Wednesday, Hewlett-Packard said third-quarter results would be stronger, too.

Keeping up with the Joneses can mean buying best-value vehicles for some of the wealthiest U.S. consumers.

Another employee of Infosys, India's leading IT player, has filed a lawsuit against the company, alleging harassment for his role in bringing to light the visa and fraud issue.

U.S. stock index futures point to a higher open Thursday ahead of the Labor Department's weekly jobless claims data and the Bureau of Economic Analysis' trade balance report.

Asian stock markets advanced for the fourth straight session Thursday after data showed that Chinese inflation continued to cool down in July, providing more room for further policy easing to boost growth.

European markets rose Thursday as investor confidence was lifted by hopes that China will announce stimulus measures to boost the economic condition and regain the growth momentum.

Crude oil futures advanced during the Asian trading hours Thursday after data showed Chinese inflation continued to cooled for a fourth straight month in July, rising hopes for monetary easing measures to support growth.

China’s industrial production grew at a reduced pace in July compared to June indicating that the weakening global demand and the debt burden faced by the euro zone are adversely affecting the country's economy.

The top after-market Nasdaq gainers Wednesday were Complete Genomics Inc, Allscripts Healthcare Solutions Inc, Silicon Graphics International Corp, Salix Pharmaceuticals Ltd and Photronics Inc.The top after-market Nasdaq losers were Boingo Wireless Inc, SunPower Corporation, Monster Beverage Corporation, Career Education Corporation and Alaska Communications Systems Group, Inc.

The Bank of Japan Thursday kept its key policy rate unchanged and refrained from announcing any monetary easing measures citing that the country's economy is picking up moderately.

The top after-market NYSE gainers Wednesday were Millennial Media, FleetCor Technologies, NQ Mobile, Dillard's, Orbitz Worldwide and MBIA, Inc. The top after-market NYSE losers were Medicis Pharmaceutical, Teekay Tankers, McEwen Mining, China Nepstar Chain Drugstore and ING Groep NV.