General Motors Still Owes US Government $15B, US Treasury Currently Expects To Recover $6.1B By Selling Its Remaining Shares In GM

[UPDATE 12:09 p.m. EDT]

GM’s board announced Friday it has approved paying a quarterly dividend of $0.59375 on its Series B convertible preferred stock payable on Dec. 2 for investors who buy this class of stock though Nov. 15. The dividend total is estimated to be $59.4 million.

Original story begins here:

The U.S. Treasury Department says it’s on track to recover $6.1 billion through its ongoing selloff of General Motors Co. (NYSE:GM) shares, but the U.S. taxpayer is currently owed $15 billion, leaving a gap that would end up being a write-off -- proving the point that some companies are so big that they expect and receive government support when they incur disastrous losses.

And as the Treasury sells off its GM shares gradually, so as to not cause the share price to plummet by dumping hundreds of millions of shares on the market at once, it has to play the market and choose carefully when and how much to sell. The issue underscores the problem of corporations taking public welfare and then paying back the taxpayer in what amounts to stock options rather than cash.

“During September, Treasury received total net proceeds of approximately $570.1 million from the sales of GM common stock,” the Treasury said in its monthly report to Congress on the 2009 Troubled Asset Relief Program. As of Sept. 30, Treasury has recovered approximately $36.0 billion of its investment in GM through repayments, sales of stock, dividends, interest and other income.”

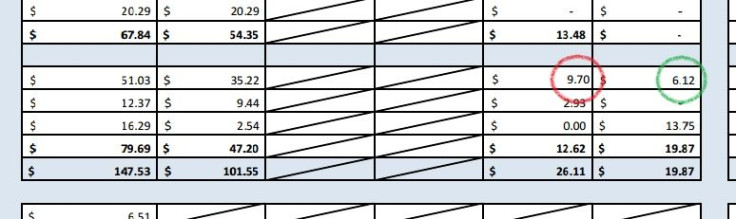

The U.S. government disbursed $51 billion to rescue GM, and according to Thursday’s Daily TARP Update the Treasury Department has recovered nearly $36 billion, including interest. In August, GM owed $15.6 billion. Sales of GM stock sold by the government in September reduced that burden to $15 billion.

However, the government saw its estimated write-off (the amount of money it will still be owed from TARP after it sells all of its remaining shares in GM) rise from $9.6 billion to $9.7 billion between Sept. 18 and Thursday.

The reason is simple: GM’s ongoing stock value determines how much the government will have to write off after it sells its last share. The government entered September owning 101 million shares of GM.

The Treasury doesn’t say directly how many shares it sold last month, since the number changes practically daily, but by dividing the average share price of GM in September ($36.43) by the amount of revenue generated by the sale of the stock last month ($570.1 million), you can conclude that the Treasury reduced its stake in GM by roughly 16 million shares in September, for a rough estimated balance of about 85 million shares.

The U.S. Treasury estimates it can recover an additional $6.1 billion shares. But Friday's value of 85 million shares of GM stock is less than $3 billion. As of June 30, GM has $60 billion in short-term liabilities and $26 billion in cash, a financial position that makes it difficult for the company to pay back what it owes in cash anytime soon.

General Motors will release its third-quarter earnings report on Oct. 30.

© Copyright IBTimes 2025. All rights reserved.