India Overtakes US In Q3 2017, Becomes Second Largest Smartphone Market: Report

In the third quarter of 2017, the United States grabs the third spot in the global smartphone market with India overtaking it terms of smartphone shipments, according to a new report by analyst firm Canalys. Smartphone shipments to India grew to 40 million units surpassing the U.S. in the third quarter of fiscal year 2017 — a growth of almost 23 percent.

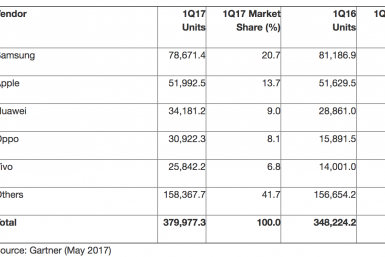

While American companies such as Apple have only in recent years woken up to potential of the smartphone market in the South Asian country, several other brands have been in the country's market for long.

Samsung and Xiaomi are currently at the top of the charts in India. Samsung has been offering phones in India for more than a decade, while Chinese company Xiaomi moved into the country in 2014 and has seen stupendous growth since then. Both brands account for the sales of close to 10 million devices each in the Indian market, reveals the data collected by Canalys, Singapore-based firm specializing in research on smartphone markets. Its quarterly estimate is based on forecast data collected by the Canalys' smartphone analysis division.

How the Indian smartphone market works is actually entirely in contrast with the U.S. market. According to research firm ComScore’s report in August, Apple still has the lion’s share of the U.S. market — 1 in 2 smartphones sold in the U.S. is an iPhone. The nearest competitor has 14 percent less market share.

While markets in developing countries such as India seem to be highly dynamic — owing to a large consumer base and the demand for affordable smartphones — the U.S. market has been mostly stable with the same brands ruling the roost for long. Consumers in the U.S. actually go for succeeding generations of the same devices, like switching from iPhone 7 to iPhone 8, but customers in countries such as India seem to vying for a better deal when they go for a new smartphone. This is why brands such as Xiaomi have made inroads into the country and grabbed to the top spot in just three years.

“This growth comes as a relief to the smartphone industry. Doubts about India’s market potential are clearly dispelled by this result. There are close to 100 mobile device brands sold in India, with more vendors arriving every quarter. In addition, India has one of the most complex channel landscapes, but with low barriers to entry. Growth will continue. Low smartphone penetration and the explosion of LTE are the main drivers,” Canalys Research Analyst Ishan Dutt stated in the press release.

The top five brands in India — Samsung, Xiaomi, Vivo, Oppo and Lenovo — account for more than 75 percent of the smartphone sales. With the exception of Samsung, most of the other smartphone market players here are based out of China. Samsung is the only one that has held its ground despite the onslaught of Chinese brands in the country in the past five years, but it is expected to lose the top spot to Xiaomi in the country.

“Xiaomi’s growth is a clear example of how a successful online brand can effectively enter the offline market while maintaining low overheads. But Xiaomi focuses on the low end. It struggles in the mid-range (devices priced between INR15,000 and INR20,000 [US$230 and US$310], where Samsung, Oppo and Vivo are particularly strong. Nevertheless, we predict Xiaomi’s continued go-to-market innovations will allow it to overtake Samsung within a couple of quarters,” Canalys Analyst Rushabh Dosh stated in the press release.

This kind for demand and diversity in the market spaces forces even premium global brands such as Apple to come out with affordable device such as the iPhone SE. Apple has also been working on increasing its shipments in the country and its production in the country has doubled in the country in Q3 to 900,000 units. The company has also set up a production unit in the South Indian State of Karnataka to make iPhones for the country.

© Copyright IBTimes 2025. All rights reserved.