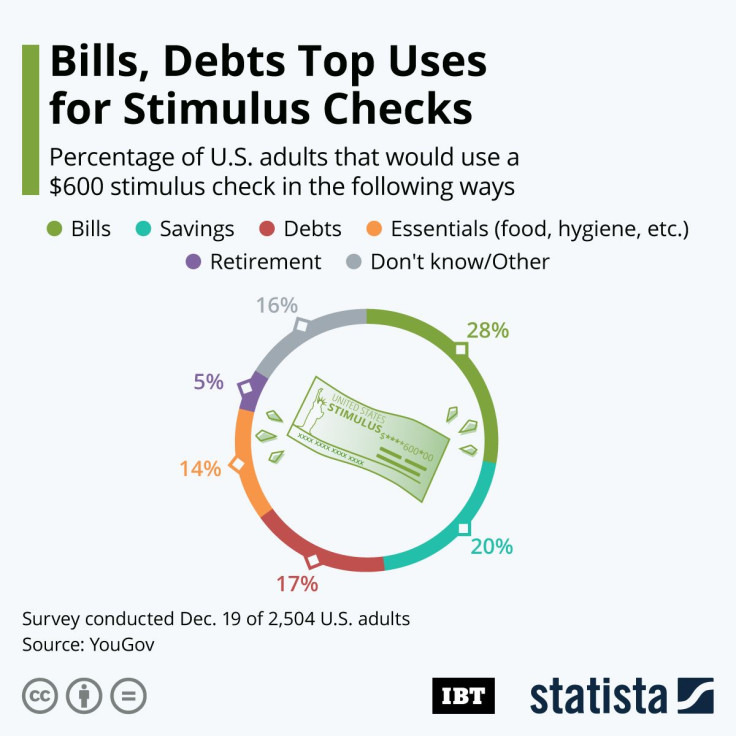

Infographic: Bills, Debts Top Uses For Stimulus Checks

Another round of checks are set to be distributed to Americans soon, as a new $900 billion stimulus is nearing the final stages of approval in Congress. The amount sent to those earning less than $75,000 annually will be $600 – half the amount that was sent back at the beginning of the pandemic in April. While the money will scale based on how many dependents are in a household, survey data shows how many Americans feel the stimulus money is still too little for many basic needs to be met.

According to a recent YouGov survey, 70 percent of Americans said $600 is too little to meet basic needs like rent and essentials. Still, 28 percent of respondents said they’ll use the money to pay off bills, with another 17 percent saying they’ll put most of the money toward paying off debts they owe. A fourth of respondents said they’ll put much of the new stimulus check in savings or retirement plans, while 14 percent said they’ll spend much of the money on essentials like food, hygiene, and other necessary products.

Two stimulus checks from the U.S. government in one year is unprecedented, evident by the long time it took Congress to finally agree on sending more support to millions of Americans hit hard by the virus. Some in Washington were hoping to send another $1,200 but were beat out by those insisting on more relief for corporations and small business owners. Overall, the agreed-upon sum of relief is less than half of the $2 trillion distributed in April.

The U.S. Treasury has stated the checks could begin going out as soon as Dec. 28, with direct-deposit payments arriving the fastest. Other forms of payment could take a month or longer, and some checks from the first round of stimulus have still not reached their intended targets.